The past five years for International Consolidated Airlines Group (LON:IAG) investors has not been profitable

Generally speaking long term investing is the way to go. But unfortunately, some companies simply don't succeed. For example the International Consolidated Airlines Group S.A. (LON:IAG) share price dropped 77% over five years. That's an unpleasant experience for long term holders.

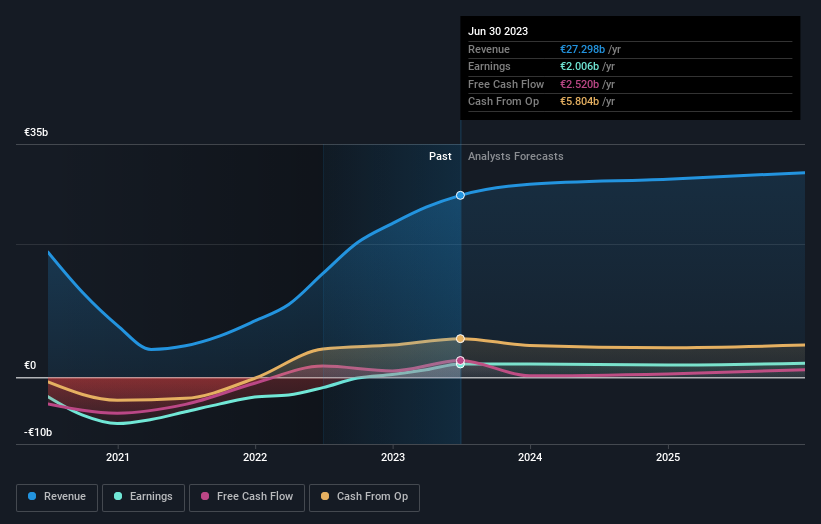

Now let's have a look at the company's fundamentals, and see if the long term shareholder return has matched the performance of the underlying business.

Check out our latest analysis for International Consolidated Airlines Group

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During five years of share price growth, International Consolidated Airlines Group moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics may better explain the share price move.

Arguably, the revenue drop of 7.8% a year for half a decade suggests that the company can't grow in the long term. This has probably encouraged some shareholders to sell down the stock.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

International Consolidated Airlines Group is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So it makes a lot of sense to check out what analysts think International Consolidated Airlines Group will earn in the future (free analyst consensus estimates)

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between International Consolidated Airlines Group's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that International Consolidated Airlines Group's TSR, which was a 60% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

We're pleased to report that International Consolidated Airlines Group shareholders have received a total shareholder return of 19% over one year. That certainly beats the loss of about 10% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

We will like International Consolidated Airlines Group better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.