The past year for Integral Ad Science Holding (NASDAQ:IAS) investors has not been profitable

Integral Ad Science Holding Corp. (NASDAQ:IAS) shareholders should be happy to see the share price up 15% in the last quarter. But that's not enough to compensate for the decline over the last twelve months. Like an arid lake in a warming world, shareholder value has evaporated, with the share price down 54% in that time. The share price recovery is not so impressive when you consider the fall. Arguably, the fall was overdone.

So let's have a look and see if the longer term performance of the company has been in line with the underlying business' progress.

Check out our latest analysis for Integral Ad Science Holding

Because Integral Ad Science Holding made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last twelve months, Integral Ad Science Holding increased its revenue by 31%. We think that is pretty nice growth. Unfortunately it seems investors wanted more, because the share price is down 54% in that time. It may well be that the business remains approximately on track, but its revenue growth has simply been delayed. For us it's important to consider when you think a company will become profitable, if you're basing your valuation on revenue.

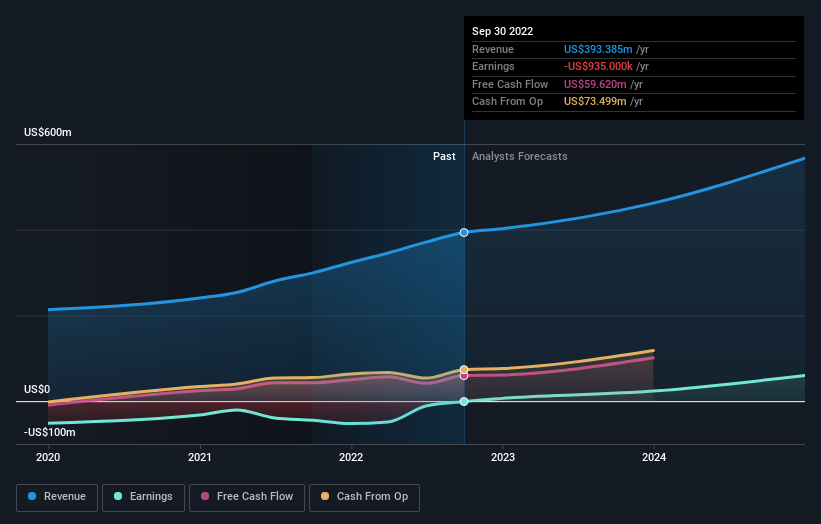

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

We doubt Integral Ad Science Holding shareholders are happy with the loss of 54% over twelve months. That falls short of the market, which lost 17%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. It's great to see a nice little 15% rebound in the last three months. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. Before spending more time on Integral Ad Science Holding it might be wise to click here to see if insiders have been buying or selling shares.

We will like Integral Ad Science Holding better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here