The past three years for El Pollo Loco Holdings (NASDAQ:LOCO) investors has not been profitable

For many investors, the main point of stock picking is to generate higher returns than the overall market. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. We regret to report that long term El Pollo Loco Holdings, Inc. (NASDAQ:LOCO) shareholders have had that experience, with the share price dropping 34% in three years, versus a market return of about 37%. On the other hand the share price has bounced 8.6% over the last week.

Since shareholders are down over the longer term, lets look at the underlying fundamentals over the that time and see if they've been consistent with returns.

View our latest analysis for El Pollo Loco Holdings

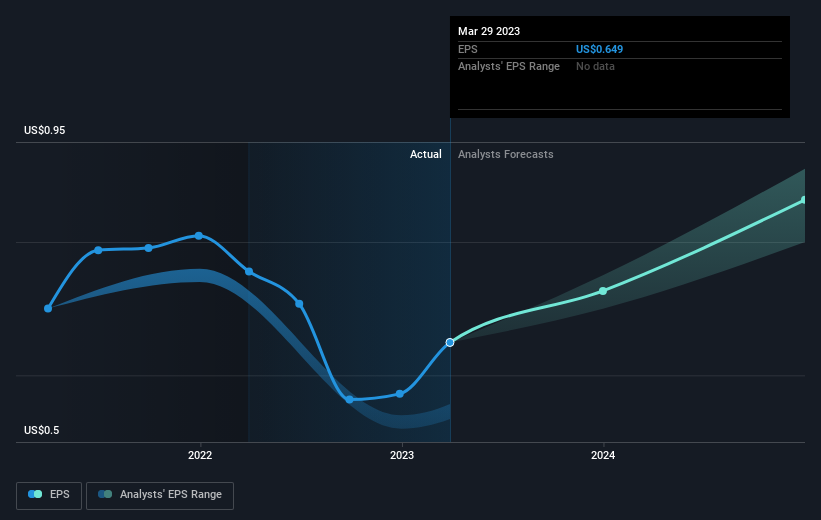

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the three years that the share price fell, El Pollo Loco Holdings' earnings per share (EPS) dropped by 5.3% each year. The share price decline of 13% is actually steeper than the EPS slippage. So it's likely that the EPS decline has disappointed the market, leaving investors hesitant to buy.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It might be well worthwhile taking a look at our free report on El Pollo Loco Holdings' earnings, revenue and cash flow.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between El Pollo Loco Holdings' total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. El Pollo Loco Holdings hasn't been paying dividends, but its TSR of -24% exceeds its share price return of -34%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

El Pollo Loco Holdings shareholders have received returns of 13% over twelve months, which isn't far from the general market return. The silver lining is that the share price is up in the short term, which flies in the face of the annualised loss of 1.0% over the last five years. While 'turnarounds seldom turn' there are green shoots for El Pollo Loco Holdings. Before deciding if you like the current share price, check how El Pollo Loco Holdings scores on these 3 valuation metrics.

Of course El Pollo Loco Holdings may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here