The past three years for Verrica Pharmaceuticals (NASDAQ:VRCA) investors has not been profitable

While it may not be enough for some shareholders, we think it is good to see the Verrica Pharmaceuticals Inc. (NASDAQ:VRCA) share price up 22% in a single quarter. But that doesn't help the fact that the three year return is less impressive. Truth be told the share price declined 39% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

It's worthwhile assessing if the company's economics have been moving in lockstep with these underwhelming shareholder returns, or if there is some disparity between the two. So let's do just that.

View our latest analysis for Verrica Pharmaceuticals

Verrica Pharmaceuticals wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

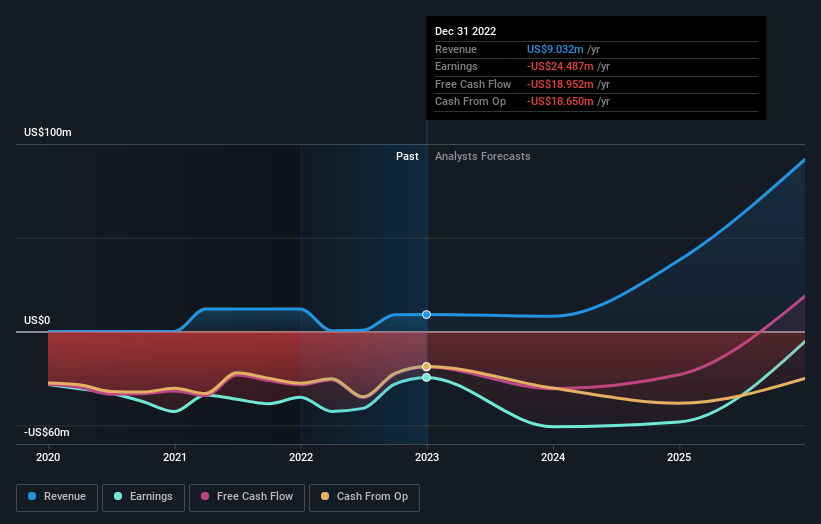

Over three years, Verrica Pharmaceuticals grew revenue at 54% per year. That is faster than most pre-profit companies. While its revenue increased, the share price dropped at a rate of 12% per year. That seems like an unlucky result for holders. It's possible that the prior share price assumed unrealistically high future growth. Still, with high hopes now tempered, now might prove to be an opportunity to buy.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. So it makes a lot of sense to check out what analysts think Verrica Pharmaceuticals will earn in the future (free profit forecasts).

A Different Perspective

We're pleased to report that Verrica Pharmaceuticals rewarded shareholders with a total shareholder return of 0.6% over the last year. This recent result is much better than the 12% drop suffered by shareholders each year (on average) over the last three. The optimist would say this is evidence that the stock has bottomed, and better days lie ahead. It's always interesting to track share price performance over the longer term. But to understand Verrica Pharmaceuticals better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Verrica Pharmaceuticals (at least 1 which is a bit unpleasant) , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here