The past three years for XBiotech (NASDAQ:XBIT) investors has not been profitable

It is a pleasure to report that the XBiotech Inc. (NASDAQ:XBIT) is up 60% in the last quarter. But that doesn't change the fact that the returns over the last three years have been disappointing. Indeed, the share price is down a tragic 66% in the last three years. So it's good to see it climbing back up. After all, could be that the fall was overdone.

Since shareholders are down over the longer term, lets look at the underlying fundamentals over the that time and see if they've been consistent with returns.

Check out our latest analysis for XBiotech

Because XBiotech made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years XBiotech saw its revenue shrink by 49% per year. That means its revenue trend is very weak compared to other loss making companies. With no profits and falling revenue it is no surprise that investors have been dumping the stock, pushing the price down by 18% per year over that time. Bagholders or 'baggies' are people who buy more of a stock as the price collapses. They are then left 'holding the bag' if the shares turn out to be worthless. After losing money on a declining business with falling stock price, we always consider whether eager bagholders are still offering us a reasonable exit price.

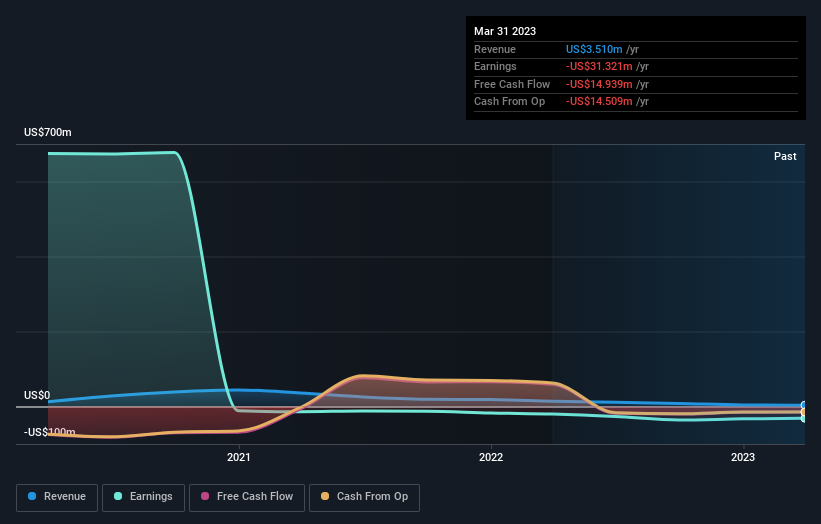

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at XBiotech's financial health with this free report on its balance sheet.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between XBiotech's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. We note that XBiotech's TSR, at -60% is higher than its share price return of -66%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

XBiotech shareholders are up 3.7% for the year. Unfortunately this falls short of the market return. On the bright side, the longer term returns (running at about 7% a year, over half a decade) look better. It's quite possible the business continues to execute with prowess, even as the share price gains are slowing. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with XBiotech (at least 1 which is potentially serious) , and understanding them should be part of your investment process.

Of course XBiotech may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here