The past year for Veru (NASDAQ:VERU) investors has not been profitable

The art and science of stock market investing requires a tolerance for losing money on some of the shares you buy. But serious investors should think long and hard about avoiding extreme losses. We wouldn't blame Veru Inc. (NASDAQ:VERU) shareholders if they were still in shock after the stock dropped like a lead balloon, down 87% in just one year. A loss like this is a stark reminder that portfolio diversification is important. We note that it has not been easy for shareholders over three years, either; the share price is down 67% in that time. Shareholders have had an even rougher run lately, with the share price down 20% in the last 90 days. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

It's worthwhile assessing if the company's economics have been moving in lockstep with these underwhelming shareholder returns, or if there is some disparity between the two. So let's do just that.

See our latest analysis for Veru

Given that Veru didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In just one year Veru saw its revenue fall by 71%. If you think that's a particularly bad result, you're statistically on the money The market didn't mess around, sending shares down the garbage shute. (Or down 87% to be specific). This kind of performance makes us wary, and usually gives us reason to forget about a stock. While some losers redeem themselves, most remain losers and we prefer winners anyway.

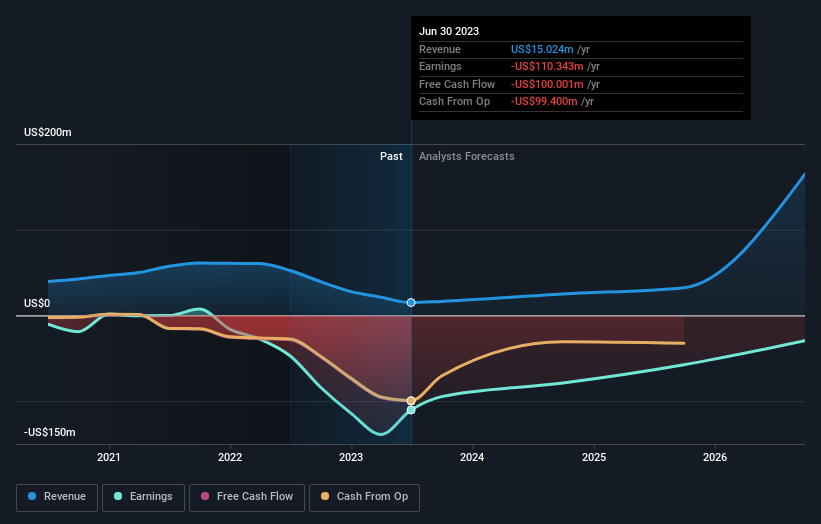

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at Veru's financial health with this free report on its balance sheet.

A Different Perspective

While the broader market gained around 9.8% in the last year, Veru shareholders lost 87%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 6% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 5 warning signs for Veru (of which 1 is significant!) you should know about.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.