Patrick (PATK) to Buy Sportech, Expand Outdoor Enthusiast Space

Patrick Industries, Inc. PATK, a prominent component solutions provider, is set to expand its Outdoor Enthusiast portfolio with the $315 million acquisition of Sportech, LLC. The deal, slated to conclude by Jan 24, 2024, positions Patrick as a dominant force in the powersports market, enhancing its innovative capabilities and fueling future growth.

Key Takeaways

In a strategic move, Patrick has solidified its standing in the Outdoor Enthusiast market with the acquisition of Sportech, LLC for $315 million. Sportech, headquartered in Elk River, MN, specializes in high-value component solutions for powersports OEMs, adjacent market OEMs and the aftermarket. The acquisition aligns seamlessly with Patrick's vision and reinforces its brand-forward strategy in the outdoor sector.

Sportech's focus on premium components, particularly in the utility vehicle segment, complements Patrick's existing strengths in the RV and marine markets. The company's robust revenue performance, with an estimated $255 million in 2023 and a five-year compound annual growth rate of 17%, underscores its prowess in the powersports industry. The acquisition is projected to immediately enhance profit margins and net income per share for Patrick Industries.

Sportech's history of innovation and customer service aligns well with Patrick's values, making it an ideal addition to the company's growing portfolio. The acquisition not only expands Patrick's footprint in powersports but also strengthens relationships with OEMs, leveraging synergies across RV, marine and existing powersports businesses.

The deal is structured as an all-cash transaction, funded through a combination of borrowings under Patrick's existing credit facility and available cash.

Post-acquisition, Sportech will operate as a wholly owned subsidiary of Patrick, maintaining its identity and operations within existing facilities. The move is poised to reduce the proforma net leverage ratio, ensuring a swift return to pre-acquisition levels within the next two to three quarters.

In summary, Patrick’s acquisition of Sportech marks a strategic milestone, enhancing its position in the powersports market and paving the way for sustained growth in the Outdoor Enthusiast space.

Share Price Performance

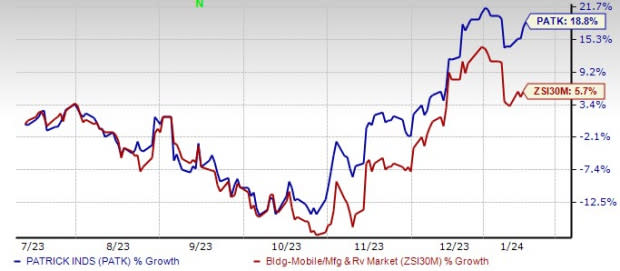

PATK shares have surged 18.8% in the past six months, outperforming the Zacks Building Products - Mobile Homes and RV Builders industry’s 5.7% rise.

Image Source: Zacks Investment Research

Patrick pivots around strategies that ensure operational excellence, an increase in customer reach and long-term growth. Its primary focus comprises accretive acquisitions, strategic diversification and efficient capital allocation.

Patrick’s focus on strategic diversification, primarily across leisure lifestyle and housing markets, has positioned it to deliver growth in the gross margin in this challenging economic scenario. Also, the company’s disciplined capital allocation strategy allows it to maintain a stable balance between offering shareholder value and strategic business growth.

Zacks Rank & Key Picks

Patrick currently carries a Zacks Rank #3 (Hold).

Here are some better-ranked stocks from the Construction sector.

Martin Marietta Materials, Inc. MLM sports a Zacks Rank #1 (Strong Buy). It has a trailing four-quarter earnings surprise of 37.3%, on average. Shares of MLM have increased 39.9% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for MLM’s 2024 sales and earnings per share (EPS) suggests growth of 9.2% and 13.8%, respectively, from the year-ago period’s levels.

Armstrong World Industries, Inc. AWI currently sports a Zacks Rank of 1. AWI delivered a trailing four-quarter earnings surprise of 7.9%, on average. The stock has surged 32.7% in the past year.

The Zacks Consensus Estimate for AWI’s 2024 sales and EPS indicates growth of 1.3% and 6.8%, respectively, from the previous year’s levels.

AECOM ACM carries a Zacks Rank of #2 (Buy). It has a trailing four-quarter earnings surprise of 2.1%, on average. Shares of ACM have increased 3.7% in the past year.

The Zacks Consensus Estimate for ACM’s 2024 sales and EPS indicates an increase of 4.5% and 17.5%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AECOM (ACM) : Free Stock Analysis Report

Martin Marietta Materials, Inc. (MLM) : Free Stock Analysis Report

Armstrong World Industries, Inc. (AWI) : Free Stock Analysis Report

Patrick Industries, Inc. (PATK) : Free Stock Analysis Report