Patterson Companies (PDCO) Hits 52-Week High: What's Aiding It?

Shares of Patterson Companies, Inc. PDCO scaled a new 52-week high of $34.46 on Aug 15, before closing the session slightly lower at $33.83.

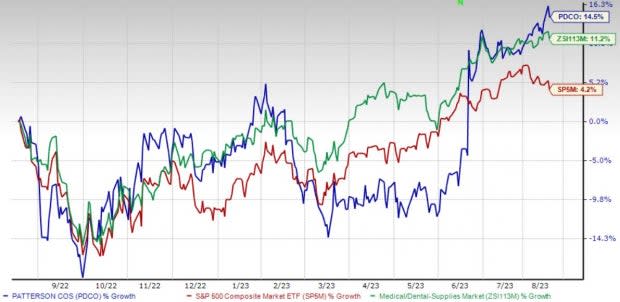

Over the past year, this Zacks Rank #1 (Strong Buy) stock has gained 14.5% compared with the 11.2% rise of the industry and the S&P 500’s 4.2% growth.

Over the past five years, the company registered earnings growth of 6% compared with the industry’s 8.8% rise. The company’s long-term expected growth rate of 9.2% compares with the industry’s growth projection of 12.2%. Patterson Companies’ earnings surpassed the Zacks Consensus Estimate in three of the trailing four quarters and missed once, the average surprise being 4.5%.

Patterson Companies is witnessing an upward trend in its stock price, prompted by its broad product line. The optimism led by a solid third-quarter fiscal 2023 performance and a few notable acquisitions are expected to contribute further. Integration risks and stiff competitive forces persist.

Image Source: Zacks Investment Research

Let’s delve deeper.

Key Growth Drivers

Broad Product Spectrum: We are optimistic about Patterson Companies’ wide range of consumable supplies, equipment and software, and value-added services. A notable offering from the company is a private-label brand named Pivotal, while it continues adding stock-keeping units to its broader private-label portfolio. Patterson Companies’ NaVetor is an integrated cloud-based veterinary practice management software for its Animal Health segment.

Acquisitions: We are upbeat about Patterson Companies’ strategy of expanding its business via strategic acquisitions. In January, it announced that it had, through subsidiaries, completed the previously-announced acquisition of substantially all the assets of Relief Services for Veterinary Practitioners and Animal Care Technologies.

In December 2022, Patterson Companies announced that it had, through a subsidiary, closed the previously announced acquisition of substantially all the assets of Dairy Tech, Inc.

Strong Q3 Results: Patterson Companies’ better-than-expected earnings in third-quarter fiscal 2023 results buoy optimism. Strength in the overall top line, value-added Services and Other business of the Dental segment and the overall Animal Health segment was witnessed. The gross margin expansion bodes well for the company. Prudent cost-saving initiatives and solid sales execution continue to favor Patterson Companies.

Downsides

Stiff Competition: The U.S. dental products distribution industry is highly competitive and consists chiefly of national, regional and local full-service and mail-order distributors. Patterson Companies needs to continue to introduce newer products in the market to withstand competitive pressures. Failure to do so can dilute the company’s market share.

Integration Risks: Patterson Companies has been on an acquisition spree which is improving its revenue opportunities, but aggravating integration risks. Regular acquisitions are also a distraction for management, which is likely to impact organic growth. This may limit Patterson Companies’ future expansion and worsen the company’s risk profile, going forward.

Other Key Picks

A few other top-ranked stocks in the broader medical space are Cardinal Health, Inc. CAH, HealthEquity, Inc. HQY and McKesson Corporation MCK.

Cardinal Health, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 13.5%. CAH’s earnings surpassed estimates in all the trailing four quarters, with an average surprise of 16%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Cardinal Health has gained 31.1% compared with the industry’s 11.2% rise over the past year.

HealthEquity, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 22%. HQY’s earnings surpassed estimates in three of the trailing four quarters and missed once, with an average of 9.1%.

HealthEquity has gained 13.3% against the industry’s 15.2% decline over the past year.

McKesson, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 10.7%. MCK’s earnings surpassed estimates in three of the trailing four quarters and missed once, the average surprise being 8.1%.

McKesson has gained 17.3% compared with the industry’s 11.2% rise over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

McKesson Corporation (MCK) : Free Stock Analysis Report

Patterson Companies, Inc. (PDCO) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report