Patterson-UTI (PTEN) Earnings & Sales Beat Estimates in Q2

Patterson-UTI Energy PTEN reported a second-quarter 2022 adjusted net profit of 5 cents per share, beating the Zacks Consensus Estimate of a loss of 1 cent. This outperformance can be attributed to second-quarter revenues beating the consensus mark.

Moreover, the profit beat the year-ago quarter's loss of 54 cents per share on accelerated rig activity and much higher energy prices.

The company’s total quarterly revenues of $622 million outperformed the Zacks Consensus Estimate of $576 million. Moreover, the top line improved by an impressive 113.3% on a year-over-year basis.

Patterson-UTI will pay out its quarterly dividend of 4 cents per share (or 16 cents per share annualized) on Sep 15, 2022 to shareholders of record as of Sep 1, 2022. The dividend of 4 cents marks 100% year-over-year growth from the last year’s second-quarter payout of 2 cents per share.

Segmental Performances

Contract Drilling: Revenues totaled $304.6 million, up by 114.9% from the last year’s second-quarter figure of $141.7 million, due to further increased activity and pricing strength. The unit posted an operating profit $21.7 million in the second quarter, outperforming the year-ago loss of $58.2 million, due to continued day rate pricing momentum.

Pressure Pumping: Revenues of $238.4 million rose about 112.8% from the year-ago figure of $111.9 million due to better pricing. Moreover, the segment posted an operating profit of $20 million compared to a loss of $23.9 million in the second quarter of 2021. The profit is attributable to better pricing, higher utilization and more favorable contract terms in the reported quarter.

Directional Drilling: Revenues summed at $54.8 million, up 120.4% year over year from the last year’s figure of $24.9 million, due to higher activity and more favorable pricing. Moreover, the segment posted an operating profit of $4 million against a loss of $5.1 million reported in the corresponding quarter of 2021.

Other Operations: Revenues were $24.4 million, about 85.5% more than the year-ago quarter’s $13.2 million, as activity levels improved. The unit also posted a quarterly profit of $3.3 million compared to a loss of $3.2 million recorded in the year-ago quarter.

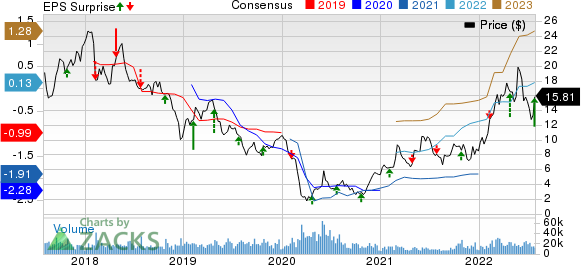

PattersonUTI Energy, Inc. Price, Consensus and EPS Surprise

PattersonUTI Energy, Inc. price-consensus-eps-surprise-chart | PattersonUTI Energy, Inc. Quote

Capital Expenditure & Financial Position

In the second quarter of 2022, PTEN spent $96.4 million on capital programs (compared with $38 million in the second quarter of 2021). As of Jun 30, 2022, the company had $19.6 million of cash and cash equivalents and $877.7 million as long-term debt.

Outlook

Patterson-UTI believes that the increasing demand and the tight supply of rigs should drive better pricing and longer-term contracts and increase the contract backlog in contract drilling moving forward.

Based on contracts currently in place, Patterson-UTI expects its third-quarter 2022 rig count to average 71 rigs under term contracts. As the onshore driller foresees a ramp-up in drilling activity, the company expects the third-quarter rig count to be 128 rigs, on average.

For 2022, PTEN anticipates its adjusted EBITDA to be more than $600 million from the earlier guidance of $500 million. The company also increased its Capex forecast from $350 million to $390 million.

Zacks Rank & Key Picks

Patterson-UTI currently has a Zacks Rank #2 (Buy). Some other top-ranked players from the energy space are Marathon Petroleum MPC, Cenovus Energy CVE and PBF Energy PBF, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Marathon Petroleum beat the Zacks Consensus Estimate for earnings in all the trailing four quarters, the average being around 65%.

The Zacks Consensus Estimate for MPC’s 2022 earnings is pegged at $19 per share, up approximately 675.5% from the year-ago earnings of $2.45.

The Zacks Consensus Estimate for Cenovus Energy’s 2022 earnings is pegged at $3.02 per share, up 272.8% from the year-ago earnings of 81 cents.

The Zacks Consensus Estimate for CVE’s 2022 earnings has been revised approximately 9.8% upward over the past 60 days.

The Zacks Consensus Estimate for PBF Energy’s 2022 earnings has been revised upward by about 164% over the past 60 days from $4.82 to $12.73 per share.

The Zacks Consensus Estimate for PBF’s 2022 earnings stands at $12.73 per share, up about 609.2% from the year-ago loss of $2.50.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PattersonUTI Energy, Inc. (PTEN) : Free Stock Analysis Report

Cenovus Energy Inc (CVE) : Free Stock Analysis Report

Marathon Petroleum Corporation (MPC) : Free Stock Analysis Report

PBF Energy Inc. (PBF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research