Patterson UTI (PTEN) Q1 Earnings & Sales Beat Estimates

Patterson-UTI Energy PTEN reported a first-quarter 2023 adjusted net profit of 46 cents per share, which beat the Zacks Consensus Estimate of 36 cents. This outperformance can be attributed to better-than-expected operating income in Contract Drilling and Pressure Pumping segments. Adjusted net profit improved from the year-ago quarter's loss of 13 cents per share.

Total revenues of $791.8 million outperformed the Zacks Consensus Estimate of $756 million. The top line also improved 55.4% on a year-over-year basis.

Patterson-UTI will pay its quarterly dividend of 8 cents per share on Jun 15, 2023, to shareholders of record as of Jun 1, 2023.

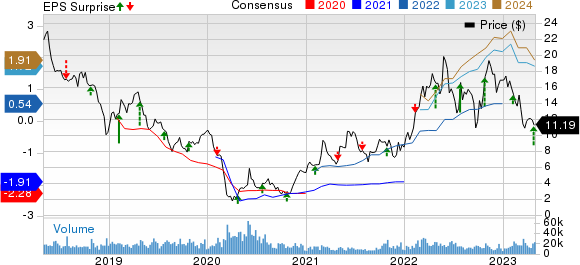

Patterson-UTI Energy, Inc. Price, Consensus and EPS Surprise

Patterson-UTI Energy, Inc. price-consensus-eps-surprise-chart | Patterson-UTI Energy, Inc. Quote

Segmental Performances

Contract Drilling: Revenues totaled $419 million, up 63.3% from the prior-year quarter’s figure of $256.6 million. This was due to continued renewal of drilling rig contracts at unchanged rates. Operating profit came in at $100.3 million against a loss of $3.2 million in the first quarter of 2022. The figure also beat the Zacks Consensus Estimate of $83 million.

Pressure Pumping: Revenues of $293.3 million rose about 54.7% from the year-ago quarter’s figure of $189.6 million due to better pricing. Operating profit was $44.4 million compared to a loss of $6.4 million in the first quarter of 2022. The figure beat the Zacks Consensus Estimate of $43.16 million. The surge in profit can be attributed to better pricing.

Directional Drilling: Revenues totaled $56.3 million, up 30% from the prior-year quarter’s figure of $43.3 million. Operating profit was $2.1 million compared with $1.8 million in the corresponding quarter of 2022. The figure missed the Zacks Consensus Estimate of $2.3 million. The year-over-year improvement can be attributed to higher activity and more favorable pricing.

Other Operations: Revenues were $23.2 million, 17.7% higher than the year-ago quarter’s figure of $19.8 million. This was mainly due to improved activity levels. The unit also reported a profit of $835,000 compared with $741,000 in the year-ago quarter.

Capital Expenditure & Financial Position

In the reported quarter, PTEN spent $117.6 million on capital programs compared with $94.8 million in the prior-year period. As of Mar 31, 2023, the company had $157.2 million worth cash and cash equivalents, and $822.2 million as long-term debt.

Outlook

For the second quarter of 2023, Patterson-UTI projects approximately 79 rigs to be in operation under term contracts in the United States.

The company expects to continue utilizing its Tier-1, super-spec rigs at a high level. However, it foresees a decrease of two to three rigs in the average rig count (of 131 rigs) for the second quarter, as the focus shifts toward oil activity instead of natural gas.

PTEN plans to reduce its capex estimate from $550 million to $510 million, Contract Drilling capex prediction from 320 million to $290 million and Pressure Pumping capex forecast to roughly $150 million for 2023.

Zacks Rank and Key Picks

Currently, Patterson-UTI Energy carries a Zacks Rank #4 (Sell).

Investors interested in the energy sector might look at some better-ranked stocks like Par Pacific PARR and Marathon Petroleum MPC, each sporting a Zacks Rank #1 (Strong Buy), and Ranger Energy Services RNGR, holding a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Par Pacific: PARR is worth approximately $1.63 billion. Its shares have risen 82.1% in the past year.

The company manages and maintains its interest in energy and infrastructure businesses. Its operating segment consists of refining, retail and logistics.

Marathon Petroleum: MPC is valued at around $58.02 billion. It delivered an average earnings surprise of 20.91% for the last four quarters and its current dividend yield is 2.30%.

The companycurrently has a forward P/E ratio of 6.36. In comparison, its industry has an average forward P/E of 9.10, which means MPC is trading at a discount to the group.

Ranger Energy Services: RNGR is valued at around $242.99 million. In the past year, its shares have gained 16.8%.

Ranger Energy Services currently has a forward P/E ratio of 5.30. In comparison, its industry has an average forward P/E of 11.60, which means RNGR is trading at a discount to the group.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Patterson-UTI Energy, Inc. (PTEN) : Free Stock Analysis Report

Marathon Petroleum Corporation (MPC) : Free Stock Analysis Report

Par Pacific Holdings, Inc. (PARR) : Free Stock Analysis Report

Ranger Energy Services, Inc. (RNGR) : Free Stock Analysis Report