Paychex: A Name for Both Growth and Income

Shares of Paychex Inc (NASDAQ:PAYX) havent done much in the near-term as the stock is up just 1% year-to-date and down slightly over the last twelve months. This compares unfavorably to the S&P 500 Index for both periods of time. While the stock may not have done much recently, there is still a lot to like about the company that should warrant the attention of both growth and income investors alike.

Recent Earnings Results

Paychex Inc (NASDAQ:PAYX) reported first-quarter earnings results on Sept. 27. Revenue grew 7% to $1.29 billion while adjusted earnings per share of $1.14 was an improvement from $1.03 in the prior year. Numbers came in ahead of estimates, with the top-line $20 million better than expected and the adjusted earnings per share beating by 2 cents.

Both segments of the company provided mid-single-digit growth. Management Solutions, the larger of the two segments, was up 6% to $955.5 million. This segment benefited from increased demand for HR Solutions. This, coupled with higher penetration of products amongst clients, led to gains in the number of clients and client employees. Better pricing also aided results.

PEO & Insurance Solutions improved 5% to $297.8 million as average number of worksite employees increased. Interest on funds held for clients surged 83% to $32.7 million thanks to higher interest rates.

On the strength of quarterly results, Paychex Inc (NASDAQ:PAYX) lifted its expected growth rate for adjusted earnings per share to 9% to 11% from 9% to 10%. Using fiscal year 2023 results, this equates to adjusted earnings per share of $4.70 for the new fiscal year. This is in-line with the companys historical annual earnings growth rate of nearly 11% over the last decade.

Strong Fundamentals

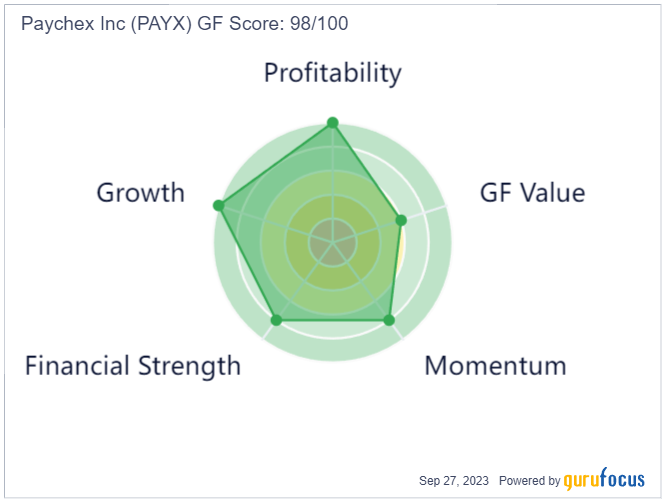

Paychex Inc (NASDAQ:PAYX) regularly turns out positive results from its two main businesses, which has helped the company to have some of the best fundamentals in its industry. As a result, Paychex Inc (NASDAQ:PAYX) has a GF Score of 98 out of 100, one of the highest in the market place. This score implies the potential for high returns moving forward. This score is derived from perfect scores for profitability and growth, high ratings for financial strength and momentum, and modest results for value.

Profitability and Efficiency

Profitability is where Paychex Inc (NASDAQ:PAYX) shines compared to its competition. The perfect score starts with the companys operating margin and net margin, which are both higher than more 95% of the nearly 1,100 companies in the Business Services industry. Return on equity and assets are equally impressive, with both showing better than 91% of the peer group.

The weakest metric within profitability is return on invested capital, but this is still above more than 84% of the competition. In addition, Paychex Inc (NASDAQ:PAYX)s ROIC 18.5% compares well to its weighted average cost of capital of 10.7%, proving that the company is very efficient at using capital to generate profits.

Nearly all of Paychex Inc (NASDAQ:PAYX)s current rankings for profitability are at the very high end of the companys 10-year history. The company has also been profitable each year during this period, which ranks ahead of 99.9% of the industry.

Financial Strength

Elsewhere, the numbers look just as good. For example, Paychex Inc (NASDAQ:PAYX) has very little debt on its balance sheet, with long-term borrowings totaling less than $800 million as of the most recent earnings result. This compares to cash and equivalents of $1.65 billion. This leads to good showings for the debt related metrics. The company also has ample interest coverage thanks to its large cash balance.

Dividend and Valuation Analysis

Paychex Inc (NASDAQ:PAYX) has raised its dividend for 12 consecutive years. This includes a 12.7% increase late last April. The dividend has compounded at a rate of close to 10% over the last 10 years.

The expected payout ratio for this fiscal year is 76%. This is high at face value, but would be one of the lowest ratios for the last decade. The average payout ratio over this period is 80%, so the projected payout ratio is likely in a safe range. And with earnings growth as high as it is, investors can likely expect dividend growth to continue. Shares of Paychex Inc (NASDAQ:PAYX) yield 3% presently, nearly twice the average yield of 1.6% for the S&P 500 Index.

Paychex Inc (NASDAQ:PAYX) is trading at 24.9 times forward earnings estimates, which is a slight discount to its historical average price-earnings ratio of 26.9.

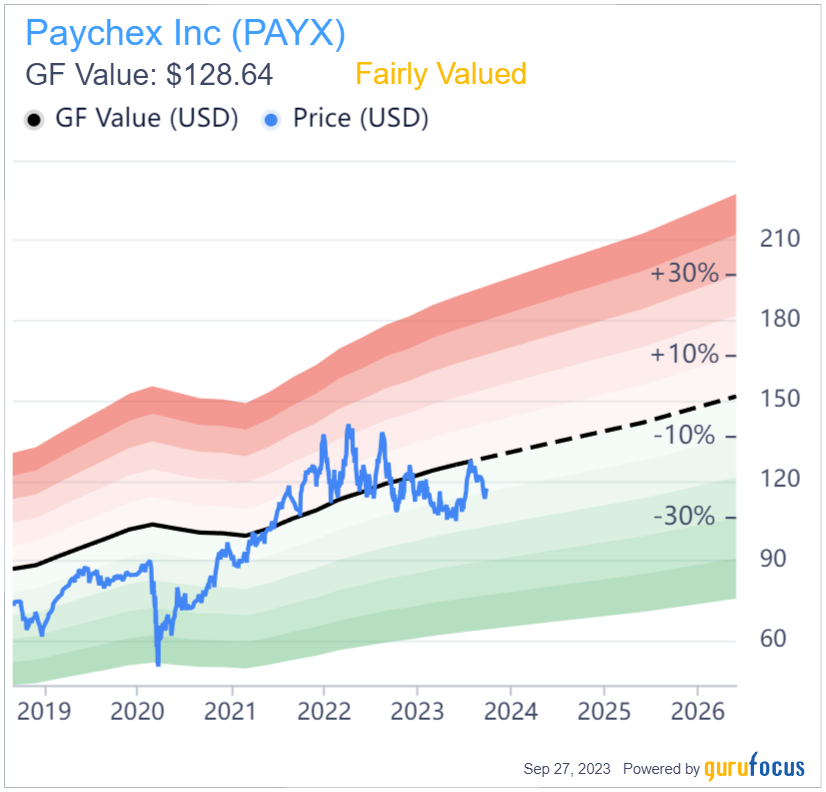

Paychex Inc (NASDAQ:PAYX)s GF Value Line suggests that the stock fairly valued, but trading below its intrinsic value and offering some upside potential. Investors could see a return of 9.7% from current levels if the stock were to reach its GF Value of $128.64. Add in the dividend yield, and total returns could stretch into the low double-digit figures.

Final Thoughts

Paychex Inc (NASDAQ:PAYX)s most recent quarter is more of the same for the company, with revenue and adjusted earnings per share growing compared to the prior year. Both were also better than the market had anticipated. The company also raised its earnings guidance for the year.

The fundamentals are in excellent shape as Paychex Inc (NASDAQ:PAYX) is one of the best run businesses in its industry. The dividend growth rate has been nearly double-digits for a long period of time, the yield is generous, and the payout ratio below the companys average.

The combination of growth and income should make Paychex Inc (NASDAQ:PAYX) an appealing investment option to investors both stripes.

This article first appeared on GuruFocus.