Paychex (PAYX): A Modestly Undervalued Gem in the Business Services Industry?

Paychex Inc (NASDAQ:PAYX) recently saw a daily gain of 2.94%, marking a 4.39% increase over the last three months. With an Earnings Per Share (EPS) of 4.3, this article aims to answer the question: Is Paychex modestly undervalued? Through a comprehensive valuation analysis, we hope to provide valuable insights for potential investors.

Company Overview

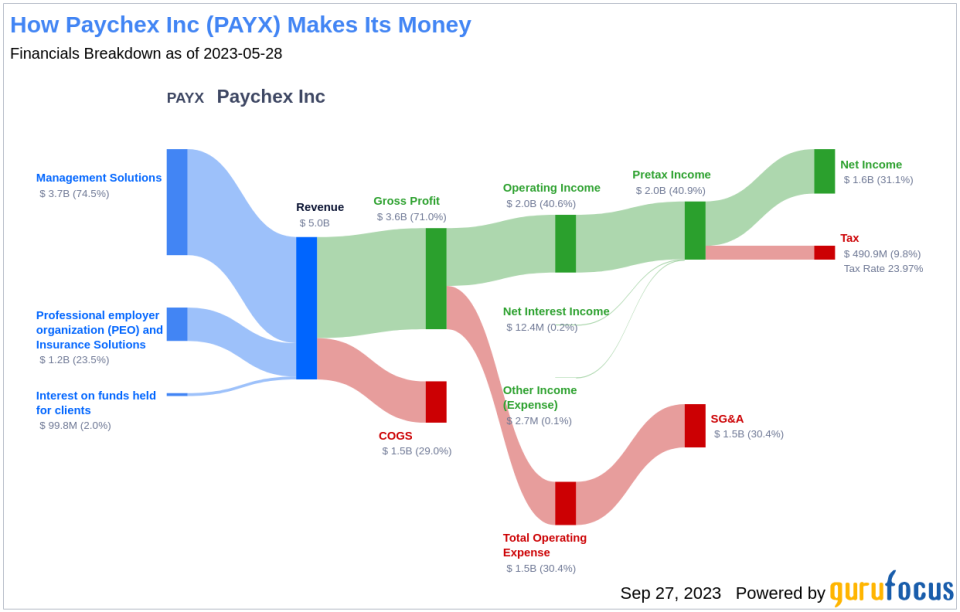

Established in 1979, Paychex is a leading provider of payroll, human capital management, and insurance solutions. The company primarily services small to midsize clients in the United States. With over 740,000 clients, Paychex pays over 1 in 12 U.S. private-sector workers. Besides its traditional payroll services, Paychex offers benefits administration, time and attendance software, human resources outsourcing, and insurance agency services.

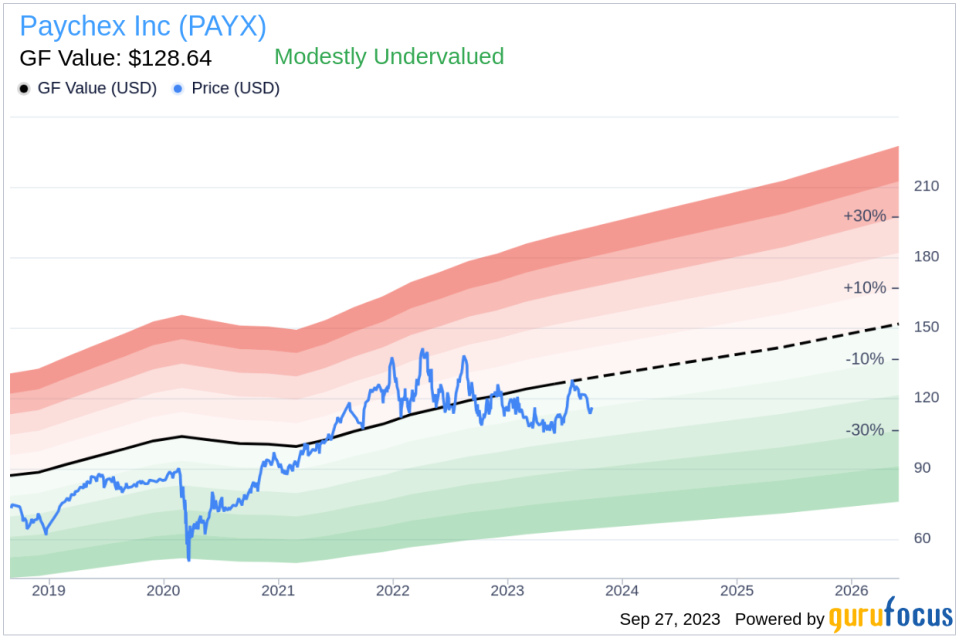

Currently trading at $116.03 per share, Paychex has a market cap of $41.90 billion. When compared to the GF Value of $128.64, it appears that the stock might be modestly undervalued. This comparison forms the basis for a deeper exploration of the company's intrinsic value.

Understanding the GF Value

The GF Value is an estimate of a stock's fair value based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. If the stock price is significantly above the GF Value Line, it is overvalued, and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher.

Given Paychex's current price and market cap, the stock appears to be modestly undervalued. This suggests that the long-term return of its stock is likely to be higher than its business growth.

Link: These companies may deliever higher future returns at reduced risk.

Financial Strength

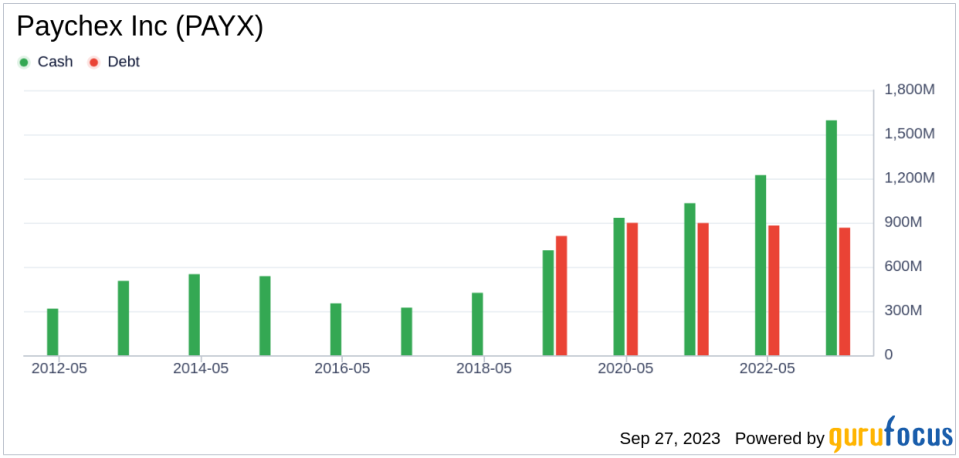

Investing in companies with low financial strength could result in permanent capital loss. Therefore, it's crucial to review a company's financial strength before deciding to buy shares. Paychex has a cash-to-debt ratio of 1.84, ranking better than 58.9% of 1051 companies in the Business Services industry. Based on this, GuruFocus ranks Paychex's financial strength as 8 out of 10, suggesting a strong balance sheet.

Profitability and Growth

Consistent profitability over the long term offers less risk for investors. Paychex has been profitable 10 over the past 10 years. Over the past twelve months, the company had a revenue of $5 billion and an Earnings Per Share (EPS) of $4.3. Its operating margin is 40.6%, ranking better than 96.71% of 1064 companies in the Business Services industry. Overall, Paychex's profitability is ranked 10 out of 10, indicating strong profitability.

Growth is a crucial factor in a company's valuation. The 3-year average annual revenue growth rate of Paychex is 7.3%, which ranks better than 59.27% of 982 companies in the Business Services industry. The 3-year average EBITDA growth rate is 10.2%, ranking better than 51.35% of 851 companies in the same industry.

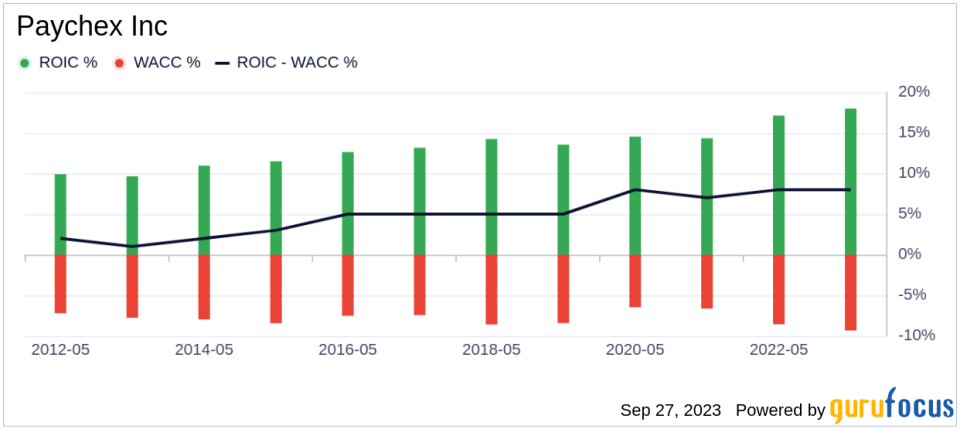

ROIC vs WACC

Comparing a company's Return on Invested Capital (ROIC) to the Weighted Average Cost of Capital (WACC) is another method of determining its profitability. When the ROIC is higher than the WACC, it implies the company is creating value for shareholders. For the past 12 months, Paychex's ROIC is 18.52, and its WACC is 10.66.

Conclusion

Overall, Paychex (NASDAQ:PAYX) stock appears to be modestly undervalued. The company's financial condition is strong, and its profitability is robust. Its growth ranks better than 51.35% of 851 companies in the Business Services industry. To learn more about Paychex stock, you can check out its 30-Year Financials here.

To find out the high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.