Paychex (PAYX) Q2 Earnings Beat on Solid Segmental Performance

Paychex, Inc. PAYX reported adjusted earnings of $1.08 per share, which beat the Zacks Consensus Estimate by a slight margin and increased 9.1% on a year-over-year basis. Strong performance in Professional Employer Organization (“PEO”), mid-market HCM and retirement contributed to earnings growth.

Elevated compensation costs due to rising wage rates, higher PEO insurance expenses from the increased workforce and ongoing investments in technology, sales and marketing were offset by the strong pipeline for HCM, PEO and Insurance solutions and record-level client retention rate.

EBITDA reached $551 million, marking a 6% year-over-year increase but falling short of our anticipated $554.4 million. Operating income rose 7% year over year to $506.2 million, slightly below our estimate. The operating margin was 40.2%, indicating a 50-basis point improvement from the reported figure of the previous year.

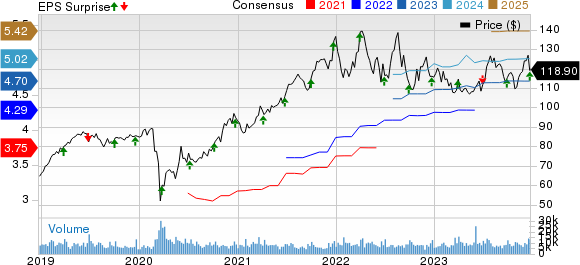

Paychex, Inc. Price, Consensus and EPS Surprise

Paychex, Inc. price-consensus-eps-surprise-chart | Paychex, Inc. Quote

The demand for HR technology and advisory solutions remains robust, reflecting the ongoing challenges that business leaders in the small and mid-sized sectors continue to grapple with. Revenues in the Management Solutions segment rose 4% year over year to $930.7 million, slightly below our estimate. The growth is attributed to an expanded clientele utilizing the company's human capital management solutions, increased revenue per client through improved pricing and broader product penetration, including HR Solutions and retirement offerings, as well as an expansion in ancillary services.

Revenues from PEO and Insurance Solutions reached $295.7 million, an 8% increase from the previous year and surpassing our estimate by 1.8%. Factors driving this growth include an expansion in the average number of employees at PEO worksites, increased PEO insurance revenues and higher income from ancillary services. Interest on funds held for clients saw a 44% year-over-year increase to $31.5 million, slightly below our anticipated $32.8 million.

Paychex has a Zacks Rank #3 (Hold) currently. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Releases

Here are a few stocks from the broader Business Services sector that have performed well in their recent earnings releases:

ABM Industries Inc. ABM reported impressive fourth-quarter fiscal 2023 results wherein earnings and revenues beat the Zacks Consensus Estimate.

Adjusted earnings (considering 5 cents from non-recurring items) were $1.01 per share, which beat the consensus estimate by 8.6% and increased 13.5% from last fiscal year’s quarterly figure.

Total revenues of $2.09 billion beat the consensus mark by 2.8% and improved 4.1% from the last fiscal year’s quarterly figure. The upside was backed by solid segmental performance, strength from new accounts that came online late last year and the acquisition of RavenVolt. Quarterly revenue growth included 3.8% organic growth and a 0.3% upside from acquisitions.

S&P Global Inc. SPGI reported impressive third-quarter results wherein earnings and revenues beat the Zacks Consensus Estimate.

SPGI’s adjusted earnings per share (excluding 88 cents from non-recurring items) of $3.21 rose 9.6% year over year and beat the consensus estimate by 5.3%. Revenues of $3.08 billion surpassed the consensus estimate by 2% and improved 8% year over year, backed by strong performance in each of its divisions.

Verisk Analytics Inc.VRSK reported impressive third-quarter 2023 results wherein earnings and revenues beat the Zacks Consensus Estimate.

VRSK’s adjusted earnings (excluding 23 cents from non-recurring items) were $1.52 per share, beating the consensus estimate and increasing 4.1% from the year-ago reported figure. Such a beat was supported by strong growth in Underwriting Data Solutions, Life Insurance and Extreme Events Solutions.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Paychex, Inc. (PAYX) : Free Stock Analysis Report

ABM Industries Incorporated (ABM) : Free Stock Analysis Report

Verisk Analytics, Inc. (VRSK) : Free Stock Analysis Report

S&P Global Inc. (SPGI) : Free Stock Analysis Report