Paychex's (PAYX) Q1 Earnings & Revenues Beat Estimates, Rise Y/Y

Paychex, Inc. PAYX reported impressive first-quarter fiscal 2024 results wherein earnings and revenues beat the Zacks Consensus Estimate.

Adjusted earnings of $1.14 per share beat the consensus estimate by 1.8% and increased 10.7% on a year-over-year basis. Total revenues of $1.29 billion beat the consensus mark by a slight margin and increased 6.6% year over year.

Service revenues of $1.3 billion were up 5% year over year, beating our estimate by 4%.

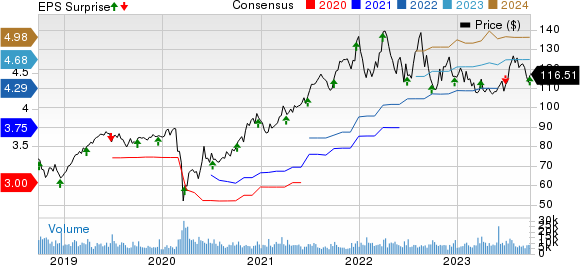

Paychex, Inc. Price, Consensus and EPS Surprise

Paychex, Inc. price-consensus-eps-surprise-chart | Paychex, Inc. Quote

Quarter Details

Revenues from the Management Solutions segment increased 6% year over year to $955.5 million and beat our estimate by slight margin. The segment benefited from growth in the number of clients and client’s employees served for human capital management (HCM) and additional worksite employees for HR Solutions. Also, strong demand for HR Solutions, retirement and time and attendance solutions, price realization, higher product penetration, and expansion of HCM ancillary services acted as tailwinds to the segment.

Professional employer organization (PEO) and Insurance Solutions’ revenues were $297.8 million, up 5% from the year-ago quarter’s level but lagged our estimated $299.3 million. The uptick was due to growth in the number of average worksite employees, a rise in average wages per worksite employee, and an increase in state unemployment insurance revenues. Interest on funds held for clients increased 83% year over year to $32.7 million.

EBITDA of $578.2 million increased 7% year over year but lagged our estimated $579.5 million. Operating income increased 8% year over year to $536.3 million, which beat our estimate by 1.1%. Operating margin came in at 41.7%, which was 60 basis points more than the prior-year reported figure.

Paychex exited the quarter with cash and cash equivalents of $1.65 billion compared with $1.2 billion reported at the end of the prior quarter. Long-term debt was $798.3 million compared with $798.2 million in the prior quarter.

The company generated $655.8 million of cash from operating activities while capital expenditures were $38.7 million.

Updated Fiscal 2024 Outlook

Paychex provided its fiscal 2024 outlook wherein adjusted earnings per share (EPS) is expected to register 9-11% growth, which is updated from the 9-10% growth expected earlier. PAYX reaffirmed its expectation of total revenues to register 6-7% growth.

Management Solutions’ revenues are expected to grow around 5-6%. PEO and Insurance Solutions’ revenues are expected to grow 6-9%. Interest on funds held for clients is anticipated to be in the range of $140-$150 million. The company expects operating margin to be in the range of 41-42%.

Currently, Paychex carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Stocks to Consider

Here are a few other stocks from the broader Business Services sector, which have performed well in their recent earnings releases:

Automatic Data ADP reported better-than-expected fourth-quarter fiscal 2023 results. Adjusted EPS of $1.89 (excluding 1 cent from non-recurring items) beat the Zacks Consensus Estimate by 3.3% and grew 26% from the year-ago fiscal quarter’s figure. Total revenues of $4.47 billion beat the consensus estimate by 1.8% and improved 8.5% from the year-ago fiscal quarter’s reading on a reported basis and 9% on an organic constant-currency basis.

TransUnion TRU reported impressive second-quarter 2023 results, wherein earnings and revenues beat the Zacks Consensus Estimate. Quarterly adjusted earnings of 86 cents per share (adjusting 58 cents from non-recurring items) surpassed the consensus mark by 3.6% but decreased 12.2% year over year. Total revenues of $968 million beat the consensus mark by 1% and increased 2.1% year over year on a reported basis. Revenues were up 3% on a constant-currency basis, mainly driven by strength in international markets.

Gartner IT reported better-than-expected second-quarter 2023 results. Adjusted EPS (excluding 37 cents from non-recurring items) of $2.85 beat the Zacks Consensus Estimate by 14.9% and matched the year-ago reported figure. Revenues of $1.5 billion beat the consensus estimate by 1% and improved 9.2% year over year on a reported basis and 10% on a foreign currency-neutral basis. The total contract value was $4.6 billion, up 8.9% year over year on a foreign currency-neutral basis.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Paychex, Inc. (PAYX) : Free Stock Analysis Report

Automatic Data Processing, Inc. (ADP) : Free Stock Analysis Report

Gartner, Inc. (IT) : Free Stock Analysis Report

TransUnion (TRU) : Free Stock Analysis Report