Paycom (PAYC) to Report Q4 Earnings: What's in the Cards?

Paycom Software PAYC is scheduled to report fourth-quarter 2023 results on Feb 7.

The company projects revenues between $420 million and $425 million for the fourth quarter. The Zacks Consensus Estimate for revenues is pegged at $422.6 million, indicating an increase of 14% year over year. The consensus mark for earnings is pegged at $1.78 per share, suggesting a 2.9% rise from the prior-year quarter.

Paycom estimates adjusted EBITDA in the range of $169-$174 million in the quarter to be reported.

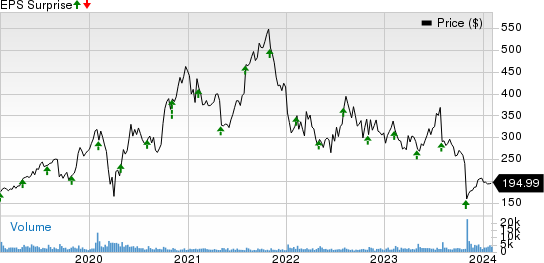

The company’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 8.4%.

Let’s see how things have shaped up for the upcoming announcement.

Paycom Software, Inc. Price and EPS Surprise

Paycom Software, Inc. price-eps-surprise | Paycom Software, Inc. Quote

Factors to Note

Paycom’s fourth-quarter performance is likely to have benefited from the strong demand for the latest products, new business wins and the high-margin recurring revenue business. Our estimates for the company’s Recurring revenues are pegged at $414.8 million, suggesting year-over-year growth of 13.9%.

Paycom’s employee usage strategy, sales efforts and investments might have contributed to sales growth in the quarter to be reported. Moreover, the cloud-based human capital management solution provider earlier announced its intention to aggressively drive advertising and marketing efforts to generate more demo leads, virtual meetings and increased close rates of deals. These are likely to have led to market share gains for Paycom.

The company expects the strong adoption of the BETI solution, the industry-first technology that empowers employees to do their payroll among clients, aiding them to avoid time-consuming manual checks. We anticipate new client additions to have driven the top line in the fourth quarter.

However, Paycom’s quarterly performance is expected to have been affected by macroeconomic uncertainty-triggered economic and business disruptions, which might have hurt the headcount across its client base. Enterprises are postponing their large IT spending plans due to the weakening global economy amid ongoing macroeconomic and geopolitical issues.

What Our Model Says

Our proven model does not conclusively predict an earnings beat for Paycom this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. However, that’s not the case here.

Though Paycom carries a Zacks Rank #3 at present, it has an Earnings ESP of -2.70%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks With the Favorable Combination

Per our model, Twilio TWLO, NVIDIA NVDA and Vertiv VRT have the right combination of elements to post an earnings beat in their upcoming releases.

Twilio carries a Zacks Rank #2 and has an Earnings ESP of +31.37%. The company is scheduled to report fourth-quarter 2023 results on Feb 14. Its earnings beat the Zacks Consensus Estimate in the preceding four quarters, with the average surprise being 157.8%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Twilio’s fourth-quarter earnings stands at 57 cents per share, indicating a year-over-year improvement of 159.1%. It is estimated to report revenues of $1.04 billion, which suggests an increase of approximately 1.5% from the year-ago quarter.

NVIDIA is slated to report fourth-quarter fiscal 2024 results on Feb 21. The company has a Zacks Rank #2 and an Earnings ESP of +3.68% at present. NVIDIA’s earnings beat the Zacks Consensus Estimate in the trailing four quarters, the average surprise being 19%.

The Zacks Consensus Estimate for fourth-quarter earnings is pegged at $4.49 per share, suggesting an increase of 410.2% from the year-ago quarter’s earnings of 88 cents. NVIDIA’s quarterly revenues are estimated to improve marginally to $20.1 billion from $6.05 billion in the year-ago quarter.

Vertiv carries a Zacks Rank #2 and has an Earnings ESP of +2.44%. The company is scheduled to report fourth-quarter 2023 results on Feb 21. Its earnings surpassed the Zacks Consensus Estimate thrice in the trailing four quarters while missing on one occasion, the average surprise being 27.8%.

The Zacks Consensus Estimate for Vertiv’s fourth-quarter earnings is pegged at 53 cents per share, indicating a year-over-year increase of 89.3%. The consensus mark for revenues stands at $1.89 billion, calling for a year-over-year rise of 14.1%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Paycom Software, Inc. (PAYC) : Free Stock Analysis Report

Twilio Inc. (TWLO) : Free Stock Analysis Report

Vertiv Holdings Co. (VRT) : Free Stock Analysis Report