Paylocity Holding Corp (PCTY) Reports Strong Revenue Growth in Q2 Fiscal Year 2024

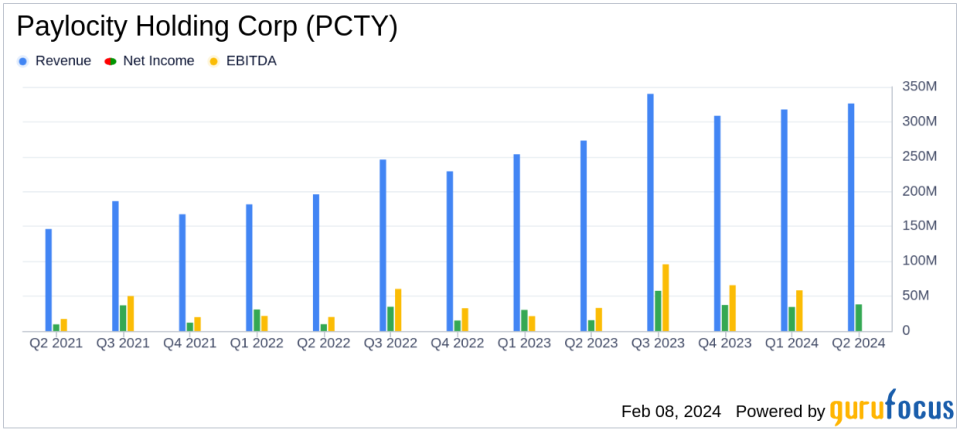

Total Revenue: $326.4 million, a 20% increase year-over-year.

Recurring & Other Revenue: $298.4 million, up 16% from the previous year.

GAAP Operating Income: Rose to $49.7 million, reflecting operational efficiency.

Net Income: GAAP net income reported at $38.1 million or $0.67 per share.

Adjusted EBITDA: Reached $112.6 million, showcasing strong profitability.

Cash Flow: Operating cash flow for the first half of fiscal year 2024 was $137.2 million, a significant increase from the prior year.

Balance Sheet Strength: Cash and cash equivalents stood at $366.9 million, with no long-term debt.

On February 8, 2024, Paylocity Holding Corp (NASDAQ:PCTY), a leading provider of cloud-based payroll and human capital management (HCM) solutions, released its 8-K filing, announcing its financial results for the second quarter of fiscal year 2024, which ended December 31, 2023. The company, founded in 1997, services approximately 36,000 clients, targeting small- to midsize businesses in the United States.

Financial Performance and Challenges

Paylocity's financial performance in Q2 FY 2024 was marked by a robust 20% year-over-year growth in total revenue, reaching $326.4 million. The recurring and other revenue streams also saw a healthy increase of 16%, amounting to $298.4 million. This growth is a testament to the company's strong market position and the increasing demand for its modern software solutions.

Despite these achievements, Paylocity faces challenges inherent in the rapidly evolving HCM and payroll software industry. The need to continuously innovate and integrate advanced technologies like AI into their offerings is crucial to maintain competitiveness. Additionally, as the company scales, it must manage the complexities of servicing a growing client base while maintaining high levels of customer satisfaction and operational efficiency.

Financial Achievements and Industry Significance

The company's financial achievements, particularly the increase in operating income to $49.7 million and net income to $38.1 million, underscore its operational efficiency and ability to translate revenue growth into profitability. In the software industry, where recurring revenue is a critical measure of stability and future growth, Paylocity's performance in this area highlights its strong customer retention and successful upselling strategies.

Key Financial Metrics

Key metrics from the income statement, such as the GAAP net income per share of $0.67, reflect the company's profitability on a per-share basis, which is important for investors. The balance sheet strength, with $366.9 million in cash and no long-term debt, demonstrates Paylocity's financial stability and ability to fund future growth initiatives. The cash flow statement reveals a substantial increase in operating cash flow to $137.2 million for the first half of FY 2024, indicating healthy cash generation from the company's core operations.

"Our differentiated value proposition of providing the most modern software in the industry continues to resonate in the marketplace as we saw total revenue growth of 20% and recurring revenue growth of 16% in Q2 of fiscal 24," said Steve Beauchamp, Co-Chief Executive Officer of Paylocity.

Analysis of Company Performance

Paylocity's performance in the second quarter of fiscal year 2024 reflects a strong trajectory in revenue growth and profitability. The company's strategic focus on product innovation and customer engagement has paid off, as evidenced by the recognition it has received in the industry. With no long-term debt and a solid cash position, Paylocity is well-equipped to navigate potential challenges and invest in opportunities that could further enhance its market position and financial performance.

The company's guidance for the third quarter and full fiscal year 2024 suggests confidence in its continued growth, projecting total revenue to increase by approximately 17% and 18%, respectively, and adjusted EBITDA to also see substantial growth. This forward-looking optimism, combined with the company's historical performance, positions Paylocity as a compelling entity within the software industry for value investors.

For more detailed financial information and future updates on Paylocity Holding Corp (NASDAQ:PCTY), investors and interested parties are encouraged to visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Paylocity Holding Corp for further details.

This article first appeared on GuruFocus.