Paylocity (NASDAQ:PCTY) Reports Q2 In Line With Expectations But Stock Drops

Payroll and human resources software provider, Paylocity (NASDAQ:PCTY) reported results in line with analysts' expectations in Q2 FY2024, with revenue up 19.5% year on year to $326.4 million. On the other hand, the company expects next quarter's revenue to be around $397 million, slightly below analysts' estimates. It made a non-GAAP profit of $1.49 per share, improving from its profit of $1.12 per share in the same quarter last year.

Is now the time to buy Paylocity? Find out by accessing our full research report, it's free.

Paylocity (PCTY) Q2 FY2024 Highlights:

Revenue: $326.4 million vs analyst estimates of $324.4 million (small beat)

EPS (non-GAAP): $1.49 vs analyst estimates of $1.28 (16.9% beat)

Revenue Guidance for Q3 2024 is $397 million at the midpoint, below analyst estimates of $401 million

The company dropped its revenue guidance for the full year from $1.41 billion to $1.39 billion at the midpoint, a 1.5% decrease

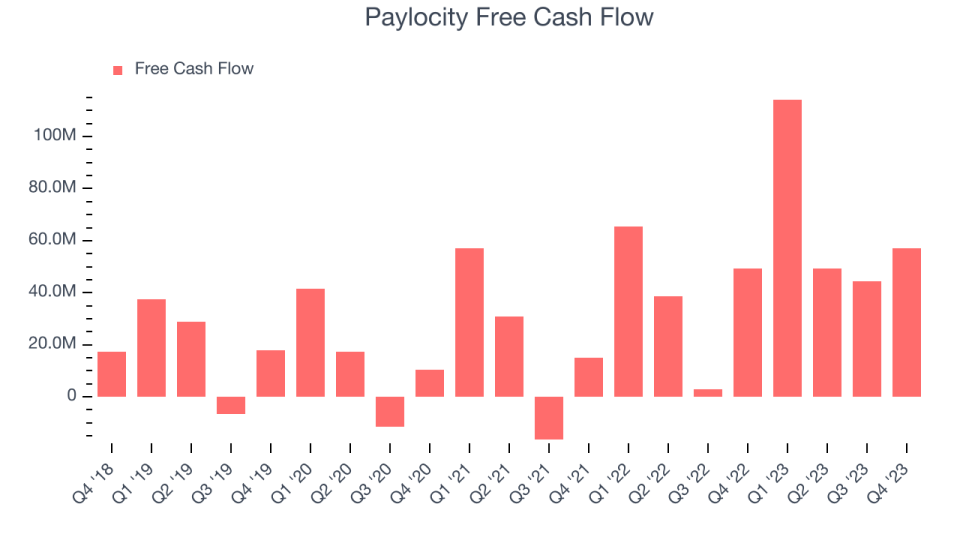

Free Cash Flow of $57.09 million, up 28.3% from the previous quarter

Gross Margin (GAAP): 67.1%, in line with the same quarter last year

Market Capitalization: $9.45 billion

“Our differentiated value proposition of providing the most modern software in the industry continues to resonate in the marketplace as we saw total revenue growth of 20% and recurring revenue growth of 16% in Q2 of fiscal 24. We continue to receive positive client feedback on our modern product suite, including newer products such as Advanced Scheduling, Learning Management, Rewards & Recognition, and Employee Voice. We also extended our AI leadership in the HCM industry with the launch of AI-driven personalized learning plans,” said Steve Beauchamp, Co-Chief Executive Officer of Paylocity.

Founded by payroll software veteran Steve Sarowitz in 1997, Paylocity (NASDAQ:PCTY) is a provider of payroll and HR software for small and medium-sized enterprises.

HR Software

Modern HR software has two powerful benefits: cost savings and ease of use. For cost savings, businesses large and small much prefer the flexibility of cloud-based, web-browser-delivered software paid for on a subscription basis rather than the hassle and complexity of purchasing and managing on-premise enterprise software. On the usability side, the consumerization of business software creates seamless experiences whereby multiple standalone processes like payroll processing and compliance are aggregated into a single, easy-to-use platform.

Sales Growth

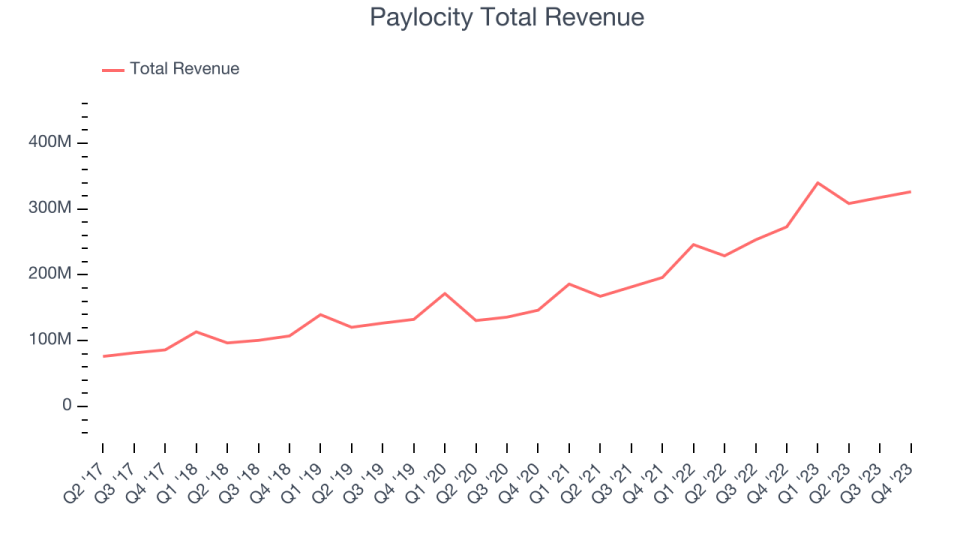

As you can see below, Paylocity's revenue growth has been very strong over the last two years, growing from $196 million in Q2 FY2022 to $326.4 million this quarter.

This quarter, Paylocity's quarterly revenue was once again up 19.5% year on year. We can see that Paylocity's revenue increased by $8.78 million in Q2, which was roughly the same growth rate observed in Q1 2024. This steady quarter-on-quarter growth shows that the company can maintain its paced growth trajectory.

Next quarter's guidance suggests that Paylocity is expecting revenue to grow 16.8% year on year to $397 million, slowing down from the 38.2% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 17.7% over the next 12 months before the earnings results announcement.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Paylocity's free cash flow came in at $57.09 million in Q2, up 15.6% year on year.

Paylocity has generated $265 million in free cash flow over the last 12 months, an impressive 20.3% of revenue. This high FCF margin stems from its asset-lite business model and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a cash cushion.

Key Takeaways from Paylocity's Q2 Results

It was good to see Paylocity exceed analysts' earnings estimates but otherwise we struggled to find many strong positives in these results. On the other hand, Paylocity's full-year revenue guidance was below expectations and market took that seriously. The company is down 8.6% on the results and currently trades at $157.55 per share.

Paylocity may not have had the best quarter, but does that create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.