Payoneer Global Inc (PAYO) Reports Robust Revenue Growth and Profitability Expansion for FY 2023

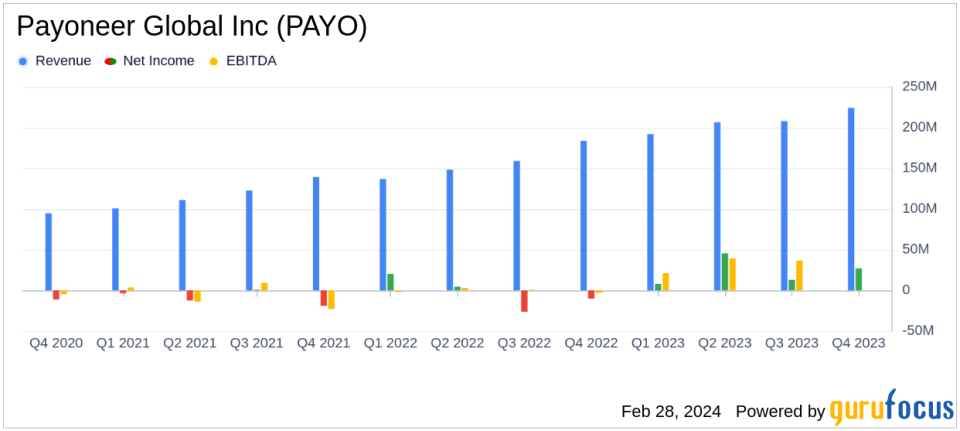

Revenue Growth: Payoneer Global Inc (NASDAQ:PAYO) achieved a 32% increase in annual revenue, reaching $831.1 million in 2023.

Profitability: Net income turned positive with over $90 million, a significant improvement from a net loss in the previous year.

Adjusted EBITDA: A remarkable year-over-year growth of 323%, with adjusted EBITDA reaching $205.1 million.

Transaction Costs: Reduced to 14.7% of revenue in 2023, down from 17.6% in 2022.

Active Customer Profiles: Growth of 6% in Ideal Customer Profiles (ICPs), indicating a broader customer base.

2024 Guidance: Revenue is projected to be between $875 million and $885 million, with adjusted EBITDA forecasted at $185 million to $195 million.

On February 28, 2024, Payoneer Global Inc (NASDAQ:PAYO), a leading financial technology company that empowers small and medium-sized businesses to grow globally, released its 8-K filing, announcing its financial results for the fourth quarter and full year ended December 31, 2023. The company reported a third consecutive year of over 30% revenue growth since going public in 2021 and a significant expansion in profitability for the year 2023.

Payoneer's mission is to enable entrepreneurs and businesses from all over the world to participate and succeed in the digital global economy. Founded in 2005, Payoneer has developed a comprehensive financial stack that simplifies cross-border commerce, helping millions of SMBs, especially in emerging markets, to connect with the global economy, manage funds, and grow their businesses.

Financial Performance and Challenges

Payoneer's financial achievements in 2023 are a testament to the company's robust growth strategy and operational efficiency. The 32% increase in revenue to $831.1 million and the turnaround to a net income of over $90 million from a net loss in the previous year highlight the company's ability to scale profitably. The adjusted EBITDA, which soared by 323% to $205.1 million, underscores Payoneer's improved operational leverage and cost management.

However, challenges remain as transaction costs, while reduced, still represent a significant portion of revenue at 14.7%. The company's focus on acquiring and retaining active ICPs, increasing customer adoption of multiple products, and driving growth in B2B and Merchant Services will be crucial to maintaining momentum and managing costs effectively.

Key Financial Metrics

Payoneer's performance is reflected in several key financial metrics that are important to the company's success:

Revenue less transaction costs grew by 37% year-over-year, indicating strong top-line growth and improved cost efficiency.

The company's "Take Rate," or revenue as a percentage of volume, improved by 21 basis points, suggesting enhanced monetization of transaction volumes.

Active ICPs increased by 6%, and the company saw a 36% expansion in ARPU (Average Revenue Per User), signaling a growing and more profitable customer base.

"We made meaningful progress in 2023 to expand access for small and medium-sized businesses (SMBs) to the digital, global economy... Our strategy is working, and we drove 6% year-over-year growth in our ideal customer profiles (ICPs) and 36% ARPU expansion," said John Caplan, Chief Executive Officer of Payoneer.

"Payoneer began 2023 with a focus on profitable growth and we have delivered. In 2023, we generated 32% revenue growth, over $90 million of net income, and quadrupled adjusted EBITDA to over $200 million," said Bea Ordonez, Chief Financial Officer.

Analysis of Performance

Payoneer's impressive financial results are indicative of the company's strategic focus on profitable growth and its ability to capitalize on the expanding digital economy. The company's growth engines, B2B and Merchant Services, are expected to continue driving performance, supported by ongoing innovation and improvements in customer experience.

The company's guidance for 2024 suggests confidence in its ability to sustain growth and profitability. With a revenue forecast of $875 million to $885 million and adjusted EBITDA of $185 million to $195 million, Payoneer is positioning itself for another year of strong performance.

Value investors may find Payoneer's consistent revenue growth, expanding profitability, and strategic focus on high-growth areas appealing. The company's financial results demonstrate its potential for long-term growth and its commitment to delivering value to customers, employees, and shareholders alike.

For more detailed financial information and to access the webcast of Payoneer's earnings conference call, investors and interested parties can visit the investor relations section of the company's website at https://investor.payoneer.com.

Explore the complete 8-K earnings release (here) from Payoneer Global Inc for further details.

This article first appeared on GuruFocus.