PaySign Inc (PAYS) Posts Strong Full-Year Growth, Beats Analyst Revenue Estimates

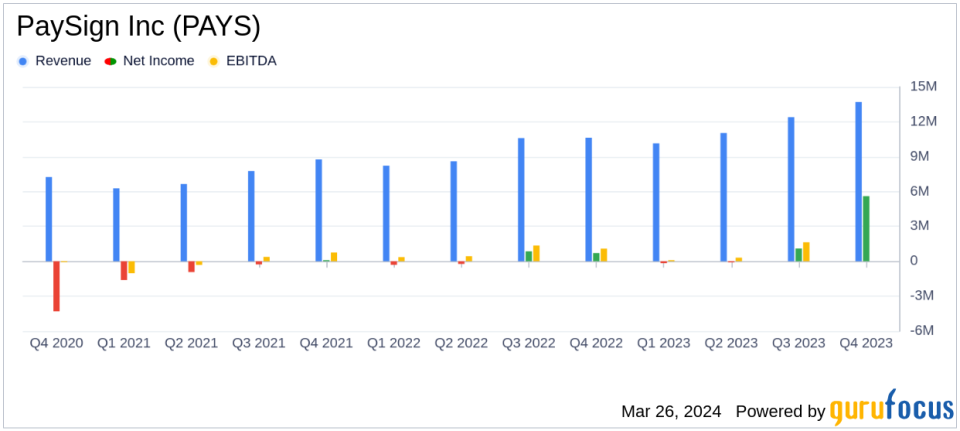

Full-Year Revenue: $47.3 million, a 24% increase from the previous year, surpassing analyst estimates.

Net Income: Full-year net income reached $6.5 million, significantly higher than the estimated net loss of $0.0815 million.

Earnings Per Share (EPS): Diluted EPS for the full year stood at $0.12, showcasing robust profitability.

Plasma and Pharma Growth: Plasma revenue grew by 21%, while pharma patient affordability revenue surged by 172%.

Adjusted EBITDA: Increased by 21% to $6.7 million, indicating strong operational performance.

Unrestricted Cash: Ended the year with $17.0 million in unrestricted cash and zero debt, emphasizing a solid financial position.

Stock Repurchase: Repurchased 394,558 shares of common stock, reflecting confidence in the company's value.

On March 26, 2024, PaySign Inc (NASDAQ:PAYS) released its 8-K filing, announcing its financial results for the fourth quarter and full-year 2023. The company, a prominent provider of prepaid card programs and integrated payment processing, reported a significant increase in full-year revenue to $47.3 million, marking a 24% rise from the previous year and outperforming analyst revenue estimates of $11.695 million for the quarter.

Company Overview

PaySign Inc is a leading innovator in the financial services sector, offering prepaid card solutions, patient affordability programs, digital banking, and integrated payment processing. The company caters to a diverse range of industries, including pharmaceuticals, healthcare, and retail, generating revenue through various fees associated with cardholder transactions and program management.

Financial Performance and Challenges

The company's performance in 2023 was marked by substantial growth in key areas. Notably, plasma revenue increased by 21%, supported by an expansion to 464 plasma centers. The pharma patient affordability sector also saw a remarkable 172% revenue increase, driven by the launch of 24 new programs throughout the year. However, these achievements come with challenges, such as navigating a highly regulated environment and managing the costs associated with increased cardholder activity.

Financial Achievements

PaySign Inc's financial achievements in 2023, particularly the growth in net income to $6.5 million and a diluted EPS of $0.12, are critical for the company's sustainability and investor confidence. These results reflect the company's ability to capitalize on market opportunities and effectively manage its operational costs.

Key Financial Metrics

The company's income statement reveals a robust gross profit increase of $3.2 million, or 15%, with a gross profit margin of 51.1%. Selling, general, and administrative expenses rose by 15%, reflecting investments in the company's growth. The balance sheet shows a healthy unrestricted cash position of $17.0 million, with no debt, underscoring a strong liquidity status.

2024 Outlook

Looking ahead, PaySign Inc expects continued growth across all business units in 2024. The company anticipates total revenues to be in the range of $54.5 million to $56.7 million, with plasma revenue comprising a significant portion and pharma revenue projected to double. Adjusted EBITDA is forecasted to be between $8.0 million and $9.0 million, reflecting the company's operational efficiency.

PaySign Inc's strategic investments and growth in the plasma and pharma sectors have positioned the company for sustained success. The company's commitment to innovation and customer service excellence remains a cornerstone of its business model, as it continues to navigate the dynamic financial services landscape.

For more detailed information and to join the discussion on PaySign Inc's financial results, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from PaySign Inc for further details.

This article first appeared on GuruFocus.