PC Connection Inc (CNXN) Reports Mixed 2023 Financial Results; Dividend Increased by 25%

Net Sales: Q4 net sales decreased by 4.9% year-over-year, while full-year net sales were down by 8.8%.

Gross Profit: Q4 gross profit increased by 4.4% year-over-year, with a full-year decrease of 2.7%.

Net Income: Q4 net income rose by 26.3% year-over-year, but there was a 6.7% decrease for the full year.

Diluted EPS: Q4 diluted EPS increased by 26.3% year-over-year, with a full-year decrease of 6.6%.

Dividend: Quarterly dividend increased by 25% to $0.10 per share.

Cash Position: Cash and cash equivalents and short-term investments totaled $297.2 million at the end of 2023.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

On February 14, 2024, PC Connection Inc (NASDAQ:CNXN), a leading provider of information technology solutions, released its 8-K filing, detailing the financial results for the fourth quarter and full year of 2023. The company, which operates through Business Solutions, Enterprise Solutions, and Public Sector Solutions segments, reported a decrease in annual net sales but an increase in net income and gross profit for the fourth quarter.

Financial Performance Overview

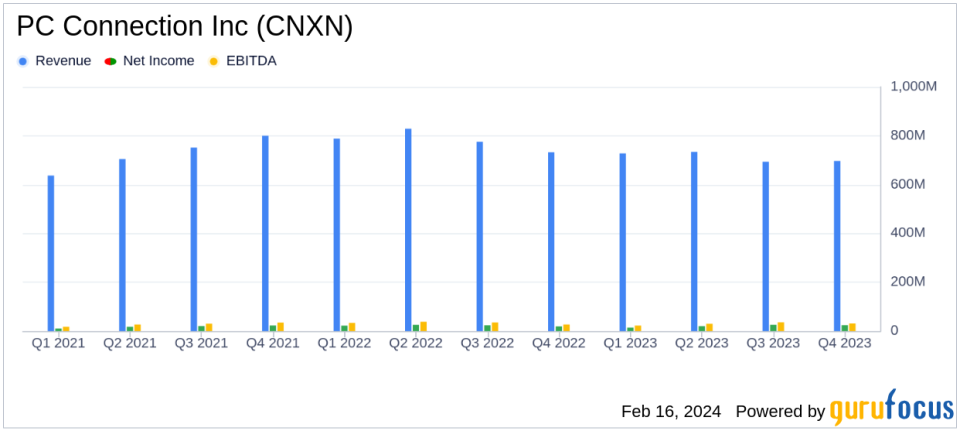

For the fourth quarter of 2023, PC Connection Inc reported net sales of $696.5 million, a 4.9% decrease from the previous year. However, gross profit for the same period rose by 4.4% to $129.8 million, with a notable expansion in gross margin by 166 basis points to 18.6%. The company's net income for the quarter increased significantly by 26.3% to $23.8 million, or $0.90 per diluted share.

Despite the positive quarterly results, the full-year figures showed a decline, with net sales dropping by 8.8% to $2.9 billion and gross profit decreasing by 2.7% to $511.7 million. Net income for the year was down by 6.7% to $83.3 million, with diluted EPS falling by 6.6% to $3.15.

Segment Performance and Product Mix

The company's Business Solutions segment saw a 2.9% decrease in net sales for Q4, while the Public Sector Solutions segment experienced a more significant 14.2% drop. The Enterprise Solutions segment's net sales decreased by 3.3%. Despite these declines, gross profit increased across all segments, attributed to a higher mix of integrated solutions, advanced technologies, and services.

In terms of product mix, notebook/mobility sales decreased by 17%, while software sales surged by 42%, and networking sales grew by 36%. Accessories sales, however, fell by 24%.

Operational Highlights and Challenges

PC Connection Inc's SG&A expenses increased slightly in Q4 to $101.8 million, mainly due to investments in the solutions business and marketing expenses. Interest income saw a substantial increase to $4.1 million in Q4. The company's cash position strengthened significantly, with cash and cash equivalents and short-term investments at $297.2 million at the end of 2023, up from $122.9 million the previous year.

President and CEO Timothy McGrath commented on the company's resilience and progress, stating:

Throughout the year we have made significant progress growing the sale of advanced technologies and improving our profitability with record gross margins and record cash flow. The market for end-point devices remains soft, however we continue to prepare for the gradual recovery in endpoints and improvements in demand driven by A-I for modern infrastructure and multi-cloud solutions.

Investor and Market Implications

The mixed financial results reflect the challenges PC Connection Inc faces in a competitive and evolving IT landscape. While the company has demonstrated an ability to grow its profitability in the face of declining sales, investors will be watching closely to see if these trends continue and how the company adapts to market demands, particularly in the sale of advanced technologies.

The increase in the quarterly dividend may appeal to value investors looking for steady income streams, and the company's strong cash position provides a solid foundation for future investments and operational flexibility.

For more detailed information, including financial tables and the full earnings report, investors are encouraged to review the full 8-K filing from PC Connection Inc.

Investors interested in the latest financial trends and insights can find more articles and resources on GuruFocus.com.

Explore the complete 8-K earnings release (here) from PC Connection Inc for further details.

This article first appeared on GuruFocus.