PDF Solutions (PDFS): A Hidden Gem or a Mirage? Unveiling Its True Market Value

PDF Solutions Inc (NASDAQ:PDFS) recently experienced a daily loss of 6.05%, with a 3-month loss of 28.84%. Despite these numbers, the company posted an Earnings Per Share (EPS) (EPS) of $0.23. The question now is: Is the stock modestly undervalued? This article aims to provide an in-depth valuation analysis of PDF Solutions (NASDAQ:PDFS) to answer this question. Keep reading to uncover the intrinsic value of this company.

Company Snapshot

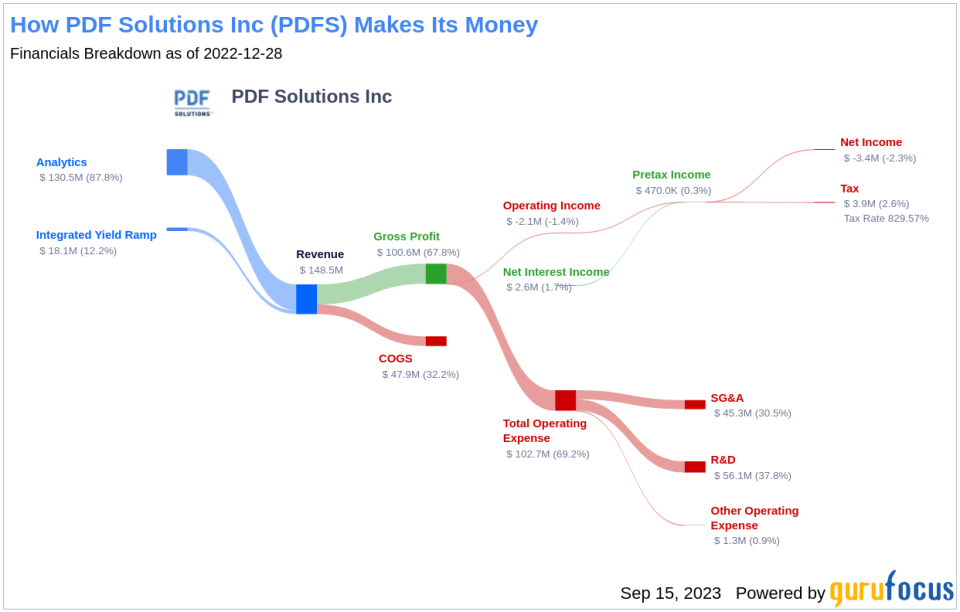

PDF Solutions Inc offers products and services aimed at empowering engineers and data scientists across the semiconductor ecosystem to improve yield, quality, and profitability. Their solutions combine proprietary software, physical intellectual property (IP) for integrated circuit (IC) designs, electrical measurement hardware tools, methodologies, and professional services. The company's products and services are sold to integrated device manufacturers (IDMs), fabless semiconductor companies, foundries, outsourced semiconductor assembly and test (OSATs), and system houses.

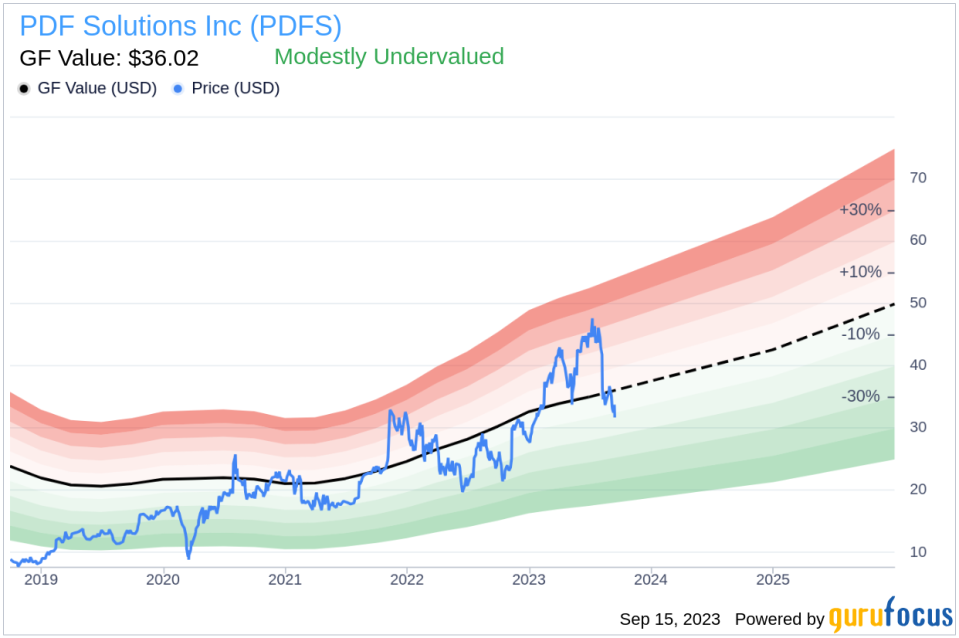

With a current stock price of $31.67 and a GuruFocus Fair Value (GF Value) of $36.02, PDF Solutions appears to be modestly undervalued. This comparison sets the stage for a deeper exploration into the company's value.

Understanding GF Value

The GF Value is a unique measure of a stock's intrinsic value, computed based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. The GF Value Line provides a visual representation of a stock's ideal fair trading value.

According to GuruFocus Value calculation, the stock of PDF Solutions (NASDAQ:PDFS) is estimated to be modestly undervalued. At its current price of $31.67 per share and a market cap of $1.20 billion, the stock is estimated to be modestly undervalued. This suggests that the long-term return of its stock is likely to be higher than its business growth.

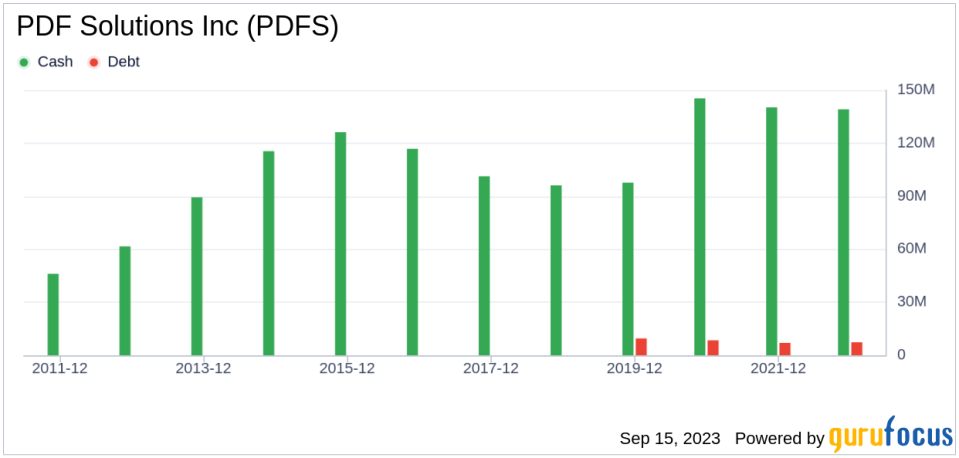

Financial Strength

Investing in companies with low financial strength could result in permanent capital loss. Hence, it's crucial to review a company's financial strength before deciding to buy shares. Looking at the cash-to-debt ratio and interest coverage can provide an initial perspective on the company's financial strength. PDF Solutions has a cash-to-debt ratio of 18.25, ranking better than 71.58% of 2752 companies in the Software industry. Based on this, GuruFocus ranks PDF Solutions's financial strength as 9 out of 10, suggesting a strong balance sheet.

Profitability and Growth

Investing in profitable companies, especially those with consistent profitability over the long term, is less risky. PDF Solutions has been profitable 4 times over the past 10 years. Over the past twelve months, the company had a revenue of $162.70 million and an EPS of $0.23. Its operating margin is 2.29%, ranking worse than 50.79% of 2731 companies in the Software industry. Overall, the profitability of PDF Solutions is ranked 5 out of 10, indicating fair profitability.

Growth is one of the most critical factors in the valuation of a company. PDF Solutions's 3-year average revenue growth rate is better than 64.94% of 2413 companies in the Software industry. However, its 3-year average EBITDA growth rate is 0%, ranking worse than 0% of 2009 companies in the Software industry.

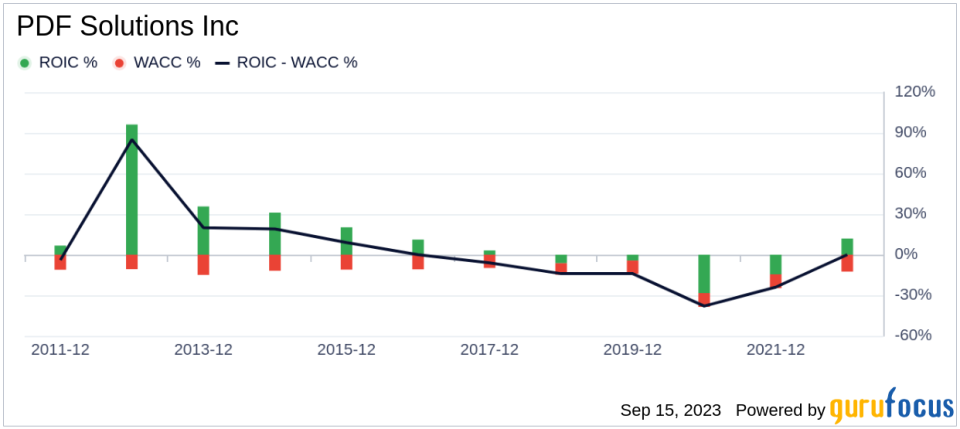

ROIC vs WACC

Another way to look at the profitability of a company is to compare its return on invested capital (ROIC) and the weighted average cost of capital (WACC). For the past 12 months, PDF Solutions's ROIC is 3.54, and its cost of capital is 11.77.

Conclusion

In conclusion, the stock of PDF Solutions (NASDAQ:PDFS) is estimated to be modestly undervalued. The company's financial condition is strong, and its profitability is fair. However, its growth ranks worse than 0% of 2009 companies in the Software industry. To learn more about PDF Solutions stock, you can check out its 30-Year Financials here.

To find out high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.