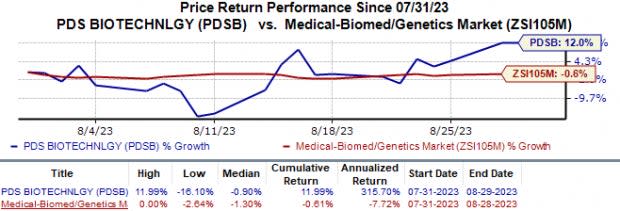

PDS Biotech's (PDSB) Shares Up 12% in a Month: Here's Why

Since the past month, PDS Biotechnology’s PDSB shares have gained 12.0% against the industry’s 0.6% fall.

Image Source: Zacks Investment Research

This rise is attributable to the company’s encouraging progress with its lead pipeline candidate PDS0101, a novel investigational human papillomavirus (“HPV”)-targeted immunotherapy, which is being evaluated across multiple oncology indications.

Currently, PDS Biotech is preparing to start the phase III VERSATILE-003 study to evaluate the combination of PDS0101 and Merck’s MRK blockbuster anti-PD-1 therapy, Keytruda (pembrolizumab) in HPV16-positive unresectable recurrent or metastatic head and neck cancer.

Earlier this month, PDS Biotech submitted the final phase III protocol and supporting chemistry, manufacturing and controls (CMC) information to the FDA to initiate the VERSATILE-003 study. Management expects to start the study before this year’s end.

The decision to initiate the VERSATILE-003 study is based on encouraging data from the ongoing phase II VERSATILE-002 study on PDS0101 combined with Merck’s Keytruda in HPV16-positive unresectable recurrent or metastatic head and neck cancer. The VERSATILE-002 study consists of two arms — Immune checkpoint inhibitor (ICI)-naïve patients (“ICI-naïve arm) and those with previously-failed treatments, including ICI therapy (“ICI-refractory arm”).

In May, PDSB reported promising interim data from the VERSATILE-002 wherein the PDS0101-Keytruda combo demonstrated an estimated 12-month overall survival rate of 87.1% in the ICI-naïve arm.

This June, management achieved the efficacy threshold in stage 2 of the VERSATILE-002 study. This threshold was achieved when 14 out of the 54 enrolled ICI-naïve patients achieved a confirmed objective response. A final data readout is expected next year.

Merck’s Keytruda is already approved for the treatment of many cancers globally. The drug is continuously growing and expanding into new indications and markets. In first-half 2023, Merck recorded $12.1 billion from Keytruda product sales.

Apart from the above studies, PDS Biotech is also evaluating its lead candidate in separate mid-stage studies for cervical cancer, oropharyngeal cancer and other HPV-positive oncology indications, as both monotherapy and in combination with other checkpoint inhibitors.

The company is also advancing the development of its second pipeline candidate PDS0301, a novel investigational tumor-targeting antibody-conjugated IL-12, designed to enhance anti-tumor response. This antibody is being developed across multiple mid-stage studies targeting prostate cancer and colon and bowel cancers.

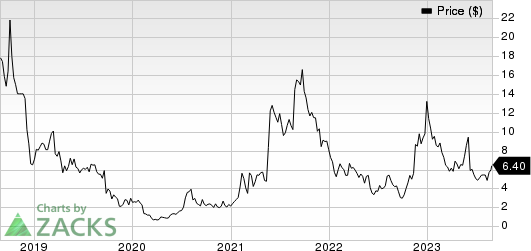

PDS Biotechnology Corporation Price

PDS Biotechnology Corporation price | PDS Biotechnology Corporation Quote

Zacks Rank & Stocks to Consider

PDS Biotech currently carries a Zacks Rank #4 (Sell). A couple of better-ranked stocks in the overall healthcare sector include ANI Pharmaceuticals ANIP and Annovis Bio ANVS, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 30 days, estimates for ANI Pharmaceuticals’ 2023 earnings per share have risen from $3.39 to $3.73. During the same period, the earnings estimates per share for 2024 have improved from $4.12 to $4.35. Year to date, shares of ANIP have surged 56.9%.

Earnings of ANI Pharmaceuticals beat estimates in each of the last four quarters, witnessing an earnings surprise of 91.56% on average. In the last reported quarter, ANI Pharmaceuticals’ earnings beat estimates by 100.00%.

In the past 30 days, estimates for Annovis Bio’s 2023 loss per share have narrowed from $4.89 to $4.38. During the same period, the loss estimates per share for 2024 have improved from $3.18 to $2.77. Year to date, shares of ANVS have lost 5.7%.

Earnings of Annovis Bio beat estimates in three of the last four quarters while missing the mark on one occasion, witnessing an earnings surprise of 13.40% on average. In the last reported quarter, Annovis’ earnings beat estimates by 6.14%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

ANI Pharmaceuticals, Inc. (ANIP) : Free Stock Analysis Report

PDS Biotechnology Corporation (PDSB) : Free Stock Analysis Report

Annovis Bio, Inc. (ANVS) : Free Stock Analysis Report