Peapack Gladstone Financial Corp (PGC) Reports Fourth Quarter Earnings Amid Economic Challenges

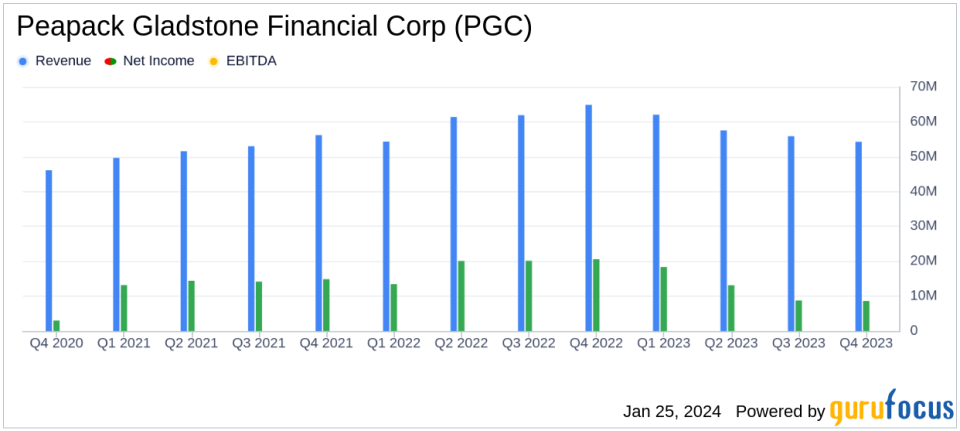

Net Income: $8.6 million, a 58% decrease from Q4 2022.

Revenue: $54.3 million, down 16% from the same quarter last year.

Diluted EPS: $0.48, compared to $1.12 in Q4 2022.

Net Interest Margin: Stabilized at 2.29% for Q4 2023.

Loan Growth: Increased by $135.2 million to $5.4 billion as of December 31, 2023.

Deposits: Rose by $69.0 million to $5.3 billion year over year.

Wealth Management: AUM/AUA increased by 10% year over year to $10.9 billion.

On January 25, 2024, Peapack Gladstone Financial Corp (NASDAQ:PGC) released its 8-K filing, detailing the financial results for the fourth quarter of 2023. The company, which operates through its Banking segment and Peapack Private Division, faced significant headwinds over the past year, reflective of broader industry challenges.

Company Overview

Peapack Gladstone Financial Corp provides comprehensive banking services, including loans and deposits, as well as asset management services through its Peapack Private Division. The company's banking segment focuses on commercial real estate, multifamily, residential, and consumer lending, while Peapack Private offers asset management for individuals and institutions, personal trust services, and financial planning.

Financial Performance and Challenges

The company reported a net income of $8.6 million for Q4 2023, a significant decrease from the $20.6 million reported in the same quarter of the previous year. Revenue also saw a downturn, coming in at $54.3 million compared to $64.9 million in Q4 2022. The diluted earnings per share (EPS) was $0.48, down from $1.12 year over year.

Despite these challenges, the net interest margin showed signs of stabilization at 2.29% for the quarter, and the company experienced growth in loans and deposits. The wealth management division also reported a 10% increase in assets under management/administration (AUM/AUA) to $10.9 billion, highlighting a strong performance in this area.

Key Financial Metrics

Important metrics for Peapack Gladstone Financial Corp include the return on average assets (0.53%), return on average equity (6.13%), and return on average tangible equity (6.68%). The company's liquidity position remains stable, with balance sheet liquidity at $782.4 million, representing 12.08% of total assets.

"The fourth quarter brings an end to an incredibly challenging year for the financial services industry," said Douglas L. Kennedy, President and CEO. "Our net interest margin stabilized during the fourth quarter which provides an encouraging sign as we turn the calendar to 2024. We continue to generate a consistent stream of noninterest income led by our Wealth Management Team."

However, the company also faced elevated provisions for credit losses, primarily due to reserves required for two credits within the freight industry, which is currently experiencing a downturn.

Analysis of Performance

Peapack Gladstone Financial Corp's performance in the fourth quarter reflects the broader economic pressures faced by the financial services industry, including interest rate hikes and liquidity concerns. While the company has demonstrated resilience in its wealth management division and maintained a stable net interest margin, the significant declines in net income and revenue underscore the ongoing challenges.

The company's strategic focus on diversifying its loan portfolio and upholding strong underwriting standards is intended to safeguard its long-term stability. The growth in loans and deposits, coupled with the increase in AUM/AUA, indicates potential areas of strength as the company moves into the new year.

For a detailed breakdown of Peapack Gladstone Financial Corp's financial results and to gain further insights into the company's performance, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Peapack Gladstone Financial Corp for further details.

This article first appeared on GuruFocus.