Pebblebrook Hotel Trust (PEB) Reports Mixed 2023 Results and Issues 2024 Guidance

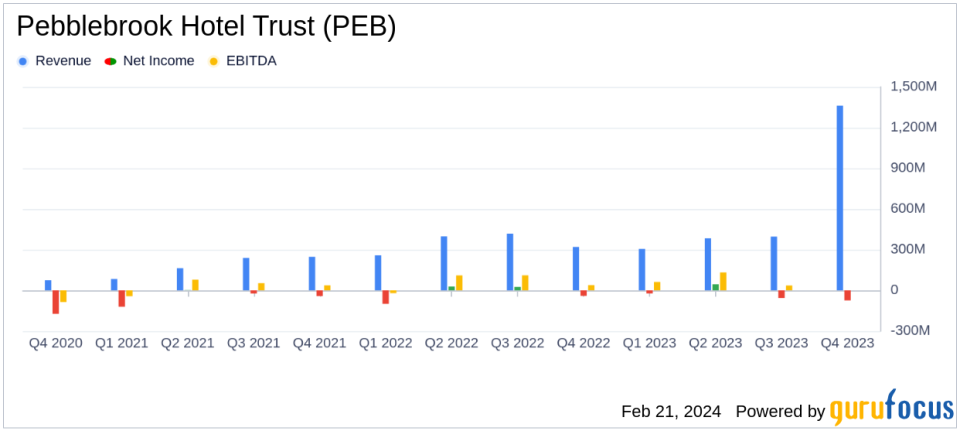

Net Loss: Reported a net loss of $74.3 million in 2023, improving from a net loss of $85.0 million in 2022.

Revenue Performance: Same-Property Total RevPAR increased by 5.9% compared to 2022.

EBITDA and FFO: Same-Property Hotel EBITDA reached $350.9 million, slightly below 2022's $360.4 million. Adjusted FFO per diluted share was $1.60, down from $1.69 in 2022.

Debt Management: Addressed all significant 2024 debt maturities and extended a $357 million term loan to 2028.

Capital Reinvestments: Completed $152.3 million of capital investments in 2023, with a multi-year total exceeding $540 million.

2024 Outlook: Projects a net loss between $62.0 to $47.0 million and Adjusted FFO per diluted share between $1.49 to $1.61.

Portfolio Sales: Sold 7 properties in 2023, generating approximately $331 million in gross proceeds.

Pebblebrook Hotel Trust (NYSE:PEB) released its 8-K filing on February 21, 2024, disclosing its financial results for the year ended December 31, 2023, and providing an outlook for 2024. PEB, which owns upper-upscale and luxury hotels across the United States, reported a net loss of $74.3 million for 2023, an improvement from the $85.0 million net loss in 2022. The company's Same-Property Total Revenue per Available Room (RevPAR) saw a 5.9% increase over the previous year, indicating a recovery in urban demand, particularly in key markets such as San Francisco, Washington, D.C., and Chicago.

Financial Performance and Challenges

Despite the uptick in Same-Property Total RevPAR, Same-Property Hotel EBITDA was slightly down by 2.6% compared to 2022, standing at $350.9 million. Adjusted EBITDAre was nearly flat at $356.4 million versus $356.7 million in the prior year. Adjusted Funds from Operations (FFO) per diluted share decreased to $1.60 from $1.69 in 2022. These figures reflect the challenges faced by the hospitality industry, including inflationary pressures and a competitive market environment.

The importance of these performance metrics lies in their ability to measure the company's operational efficiency and profitability, which are critical for real estate investment trusts (REITs) like PEB that rely on income-generating properties. The challenges, particularly the softening overall industry demand in lower to middle segments, could pose problems for PEB as it navigates the economic landscape shaped by the Federal Reserve's anti-inflation measures.

Strategic Financial Management

PEB's financial achievements in 2023 included the successful sale of seven properties, generating significant gross proceeds that were used to reduce outstanding debt and repurchase shares. This strategic financial management is crucial for PEB as it enhances the company's balance sheet strength and shareholder value. Additionally, the company's proactive approach to addressing its 2024 debt maturities by extending a substantial term loan to 2028 and paying down existing debt underscores its commitment to long-term financial stability.

In terms of capital investments, PEB completed $152.3 million in 2023, part of an extensive capital reinvestment and redevelopment program totaling over $540 million. These investments are expected to yield significant returns and increase market share and cash flow in the coming years, which is particularly important for a company in the REIT sector that must continuously invest in its properties to maintain and grow its asset base.

Key Financial Metrics and Commentary

PEB's income statement reflects a nuanced picture, with Same-Property Room Revenues increasing by 4.3% year-over-year to $884.6 million. However, Same-Property Total Expenses also rose by 9.3%, highlighting the cost pressures the company faces. The balance sheet shows a strong liquidity position with $830.0 million available, including cash and undrawn credit facilities. The cash flow statement details the use of proceeds from property sales for debt reduction and share repurchases, illustrating PEB's focus on capital allocation efficiency.

Our fourth quarter results surpassed expectations, driven by healthy urban demand and favorable short-term pickup, notably at our San Francisco, Boston, Los Angeles, and Washington, D.C. hotels, said Jon E. Bortz, Chairman and Chief Executive Officer of Pebblebrook Hotel Trust. This momentum underscores strong urban recovery trends, which we anticipate will continue in 2024, barring any major negative movement in the economy."

2024 Outlook and Analysis

Looking ahead to 2024, PEB expects a net loss ranging from $62.0 to $47.0 million and Adjusted FFO per diluted share between $1.49 and $1.61. The company plans to target capital investments of $85 to $90 million, a significant reduction from the previous year's levels. This forecast reflects PEB's cautious optimism about the ongoing recovery in its urban markets and the upper upscale segment, despite potential headwinds from broader economic factors.

PEB's performance in 2023 and its strategic initiatives, particularly in capital reinvestment and debt management, position it to navigate the uncertain economic environment of 2024. The company's focus on urban markets and luxury properties, combined with its prudent financial management, suggest a potential for resilience and growth in the coming year.

For more detailed information on Pebblebrook Hotel Trust's financial results and 2024 outlook, investors and interested parties can access the full earnings release and join the upcoming earnings call scheduled for February 22, 2024.

For additional insights and analysis on Pebblebrook Hotel Trust (NYSE:PEB) and other investment opportunities, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Pebblebrook Hotel Trust for further details.

This article first appeared on GuruFocus.