Pediatrix Medical Group Inc (MD) Reports Q4 Loss and Revenue Decline Amid Operational Challenges

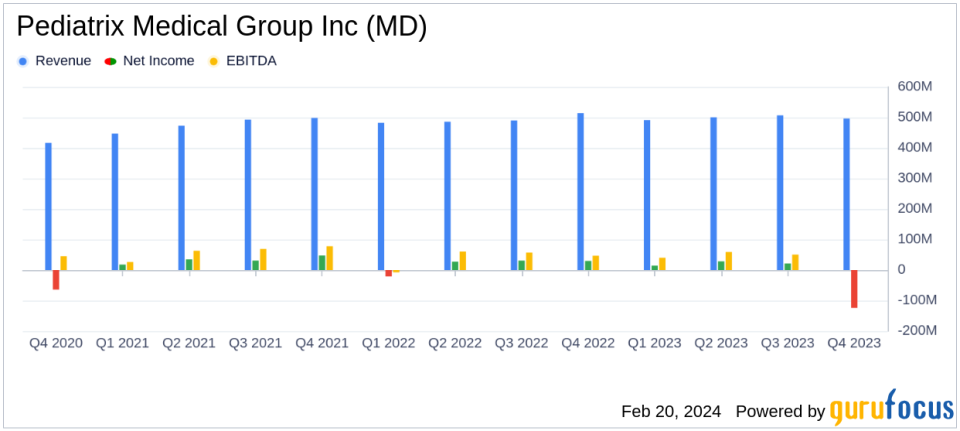

Net Revenue: Decreased to $496 million in Q4 2023 from $513.8 million in Q4 2022.

Loss from Continuing Operations: Reported a loss of $124 million, or $1.50 per share, in Q4 2023.

Adjusted EBITDA: Declined to $51 million in Q4 2023 from $66.5 million in Q4 2022.

Adjusted EPS: From continuing operations decreased to $0.32 in Q4 2023 from $0.47 in Q4 2022.

Cash and Cash Equivalents: Increased to $73.3 million at the end of 2023, up from $9.8 million at the end of 2022.

Total Debt: Stood at $628 million at the end of 2023, with no borrowings against the $450 million revolving line of credit.

2024 Outlook: Preliminary Adjusted EBITDA expected to be in the range of $200 million to $220 million.

On February 20, 2024, Pediatrix Medical Group Inc (NYSE:MD) released its 8-K filing, revealing a challenging fourth quarter with a loss from continuing operations of $1.50 per share. The company, a leading provider of specialized healthcare services for women, children, and babies, reported a net revenue of $496 million for the quarter, a decrease from the previous year's $513.8 million. Adjusted EBITDA also saw a decline, coming in at $51 million compared to $66.5 million in the prior-year period.

Pediatrix Medical Group Inc operates under one segment, providing physician services that include maternal care, intensive care for premature babies, cardiology care for infants, and anesthesia care during surgeries. The company generates approximately half of its revenue from women's and children's services, with a significant portion of its total revenue earned in the United States.

The decrease in net revenue was attributed to a decline in same-unit revenue and non-same unit activity. Specifically, same-unit revenue attributable to patient volume decreased by 1.0 percent for the fourth quarter of 2023 compared to the prior-year period. The company also faced a reduction in funds received under the CARES Act, which impacted same-unit revenue from net reimbursement-related factors by 0.4 percent.

Despite the decline in revenue, Pediatrix Medical Group Inc's cash and cash equivalents showed a significant increase to $73.3 million at the end of 2023, up from $9.8 million at the end of 2022. The company's total debt stood at $628 million, with no borrowings against its $450 million revolving line of credit.

For the full year of 2023, Pediatrix generated revenue from continuing operations of $1.99 billion, slightly up from $1.97 billion for the previous year. However, the company reported a loss from continuing operations of $60.4 million, or $0.73 per share, for the year ended December 31, 2023, compared to income from continuing operations of $62.6 million, or $0.74 per share, for the prior year.

Looking ahead, Pediatrix anticipates that its 2024 Adjusted EBITDA will be in the range of $200 million to $220 million. The company's CEO, James D. Swift, M.D., expressed confidence in the operating plans for 2024, which are expected to build on progress in both the hybrid revenue-cycle management structure and increased in-network status, positioning the company for reliable cash flow and a foundation for future growth.

As Pediatrix Medical Group Inc navigates through its operational challenges, investors and stakeholders will be closely monitoring the company's performance and strategic initiatives aimed at improving its financial health and positioning in the highly specialized healthcare services industry.

For more detailed financial information and to join the earnings conference call, investors are encouraged to visit the company's website at www.pediatrix.com.

Explore the complete 8-K earnings release (here) from Pediatrix Medical Group Inc for further details.

This article first appeared on GuruFocus.