Peloton Interactive (NASDAQ:PTON) is in a Race Against the Cash Burn

This article first appeared on Simply Wall St News.

An old proverb says that when one door closes, another one opens. Although many more were closed, the lockdowns in 2020 opened the doors wide open for Peloton Interactive (NASDAQ: PTON), an exercise & media company focused on home training.

Yet, lockdowns don't last forever, and the company is still looking for stability after the latest earnings and guidance disappointment.

See our latest analysis for Peloton Interactive

First-quarter 2022 results

US$1.25 loss per share (down from US$0.24 profit in 1Q 2021)

Revenue: US$805.1m (up 6.2% from 1Q 2021)

Net loss: US$376.0m (down US$445.3m from profit in 1Q 2021)

Revenue was in line with analyst estimates. Earnings per share (EPS) surpassed analyst estimates by 16%. Earnings per share (EPS) surpassed analyst estimates by 16%. Over the next year, revenue is forecast to grow 20%, compared to a 13% growth forecast for the industry in the US.

Even though the management blamed supply chain issues (which is the most popular scapegoat these days), it is unquestionable that the demand is slowing down. The company is trying to compensate for this with price reductions, but this is a questionable tactic and a sure way to lower the margins.

When Might Peloton Interactive Run Out Of Money?

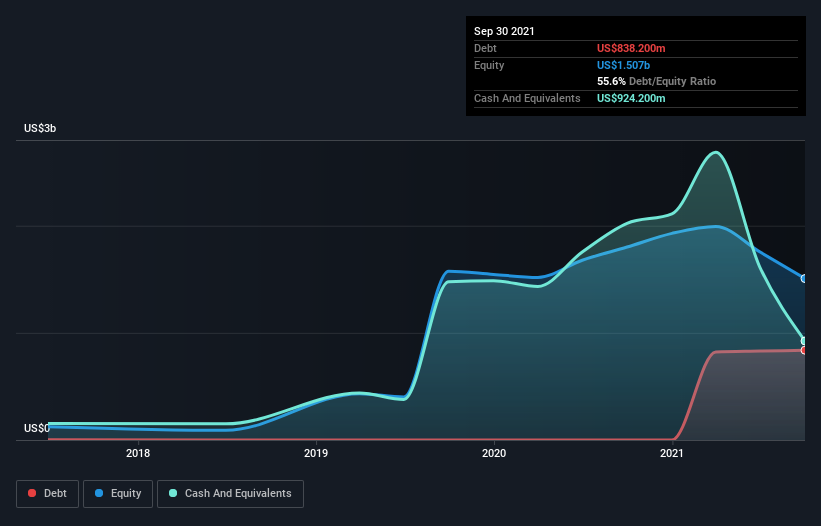

A company's cash runway is calculated by dividing its cash hoard by its cash burn. Peloton Interactive has such a small amount of debt that we'll set it aside and focus on the US$924m in cash it held in September 2021. Importantly, its cash burn was US$1.5b over the trailing twelve months. So it had a cash runway of approximately 8 months from September 2021.

Thus, it was not surprising to hear that the company raised US$1.07b via equity offering just last week. The offering represented approx. 8% of the market cap, priced at US$46 per share.

The image below shows how its cash balance has been changing over the last few years.

Is Peloton Interactive's Revenue Growing?

Given that Peloton Interactive had positive free cash flow last year, before burning cash this year, we'll focus on its operating revenue to get a measure of the business trajectory. Notably, its strong revenue growth of 73% over the last year is genuinely causing optimism.

The crucial factor is whether the company will grow its business from now on. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

How Hard Would It Be For Peloton Interactive To Raise More Cash For Growth?

There's no doubt Peloton Interactive's revenue growth is impressive, but even if it's only hypothetical, it's always worth asking how easily it could raise more money to fund further growth. Companies can raise capital through either debt or equity. Commonly, a business will sell new shares in itself to raise cash and drive growth. We can compare a company's cash burn to its market capitalization to see how many new shares a company would have to issue to fund one year's operations.

Since it has a market capitalization of US$16b, Peloton Interactive's US$1.5b in cash burn equates to about 9.5% of its market value. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a bit of dilution (12.9% in the last year), or even to borrow some money.

Is Peloton Interactive's Cash Burn A Worry?

Even though its cash runway makes us a little nervous, the company bought enough time to deal with the short-term issues. Yet after considering the range of factors in this article, we believe shareholders should be monitoring how it changes over time.

From our view, there are two main problems with Peloton – a massive short-term skew caused by the global Pandemic that is distorting the outlook and negative associations with that period pose a risk from the brand management perspective.

Readers need to be aware of the risks that can affect the company's operations. We've picked out 4 warning signs for Peloton Interactive that investors should know when investing in the stock.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com