PENN Entertainment (PENN) Completes Barstool Sportsbook Migration

PENN Entertainment, Inc. PENN recently announced the migration of Barstool Sportsbook & Casino to its proprietary technology platform named PENN Interactive Gaming Platform, followed by the launch of the former’s improved version.

The full-scale migration of Barstool Sportsbook & Casino to PENN’s state-of-the-art technology platform was initiated simultaneously across all 16 jurisdictions in the U.S. where it operates during the MLB All-Star Break. The vertically integrated technology stack is custom built to meet the North American market requirements. This custom technology stack is designed to ensure platform stability, extendible into new markets, as well as meet evolving regulatory requirements.

This migration is a prime achievement of PENN Entertainment as it brings all the components of the company’s online gaming operation under the in-house umbrella as well as amplifies Barstool Sportsbook’s product offerings.

Barstool Sportsbook a Major Growth Driver

Since partnering with Barstool Sports in 2020, PENN has developed an omnichannel approach that is bolstered by the “mychoice” loyalty program, which rewards and recognizes more than 20 million members for their loyalty to both retail and online gaming and sports betting products.

During the first quarter of 2023, the company reported solid revenues and engagement results across Barstool Sports. In the quarter, the company reported increased its 2023 revenue guidance to range between $6.37 billion and $6.81 billion, compared to the previously expected range of $6.2-$6.6 billion, to reflect the Barstool Sportsbook buyout.

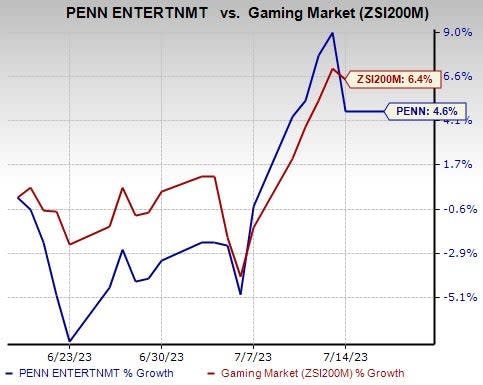

Image Source: Zacks Investment Research

Shares of PENN have gained 4.6% in the past month compared with the Zacks Gaming industry’s 6.4% growth. Although the shares of the company have underperformed the industry, its omnichannel strength, technological investments and improvement in marketing capabilities will aid it to gain traction in the forthcoming quarters.

Zacks Rank & Key Picks

PENN Entertainment currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the Consumer Discretionary sector are Mohawk Industries, Inc. MHK, Caesars Entertainment, Inc. CZR and Marriott International, Inc. MAR.

Mohawk presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

MHK has a negative trailing four-quarter earnings surprise of 10.1%, on average. The stock has gained 9.9% in the year-to-date period. The Zacks Consensus Estimate for MHK’s 2023 sales and earnings per share (EPS) indicates a decline of 4.9% and 26.2%, respectively, from the year-ago period’s levels.

Caesars Entertainment presently carries a Zacks Rank #2 (Buy). CZR has a trailing four-quarter earnings surprise of 28.2%, on average. The stock has gained 26.7% in the year-to-date period.

The Zacks Consensus Estimate for CZR’s 2023 sales and EPS indicates a rise of 7.1% and 110.3%, respectively, from the year-ago period’s levels.

Marriott currently carries a Zacks Rank of 2. MAR has a trailing four-quarter earnings surprise of 8%, on average. Shares of the company have increased 27.2% in the year-to-date period.

The Zacks Consensus Estimate for MAR’s 2023 sales and EPS indicates a rise of 13.1% and 25.7%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Marriott International, Inc. (MAR) : Free Stock Analysis Report

PENN Entertainment, Inc. (PENN) : Free Stock Analysis Report

Mohawk Industries, Inc. (MHK) : Free Stock Analysis Report

Caesars Entertainment, Inc. (CZR) : Free Stock Analysis Report