Is PENN Entertainment (PENN) Too Good to Be True? A Comprehensive Analysis of a Potential Value Trap

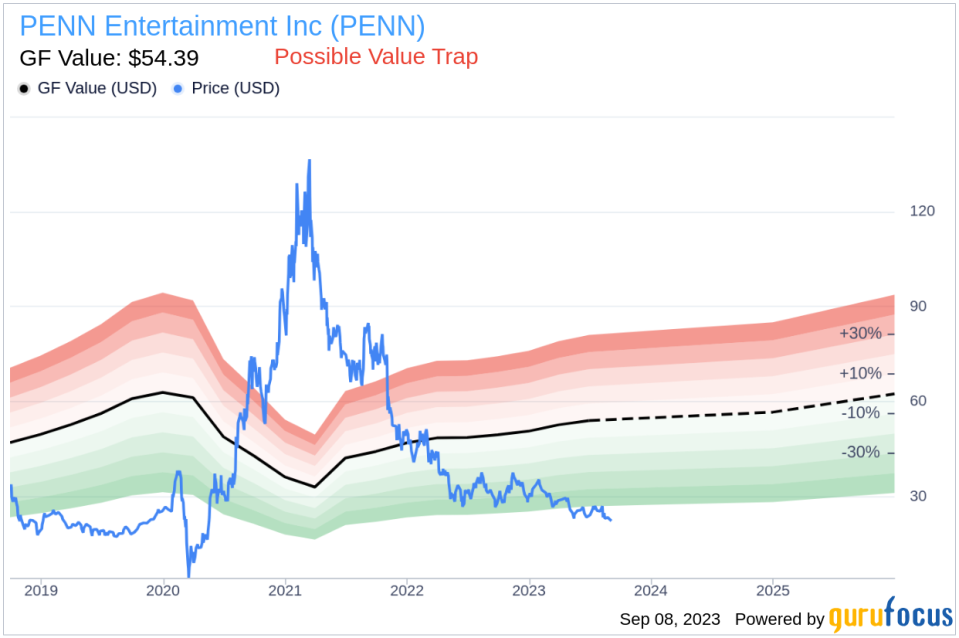

Value-focused investors constantly seek stocks priced below their intrinsic value. PENN Entertainment Inc (NASDAQ:PENN) is one such stock that warrants attention. Currently priced at 22.91, the stock recorded a 4.18% gain in a day and a 3-month decrease of 17.21%. Its fair valuation stands at $54.39, as indicated by its GF Value.

Understanding GF Value

The GF Value represents a stock's current intrinsic value derived from GuruFocus's exclusive method. It is calculated based on historical multiples, GuruFocus adjustment factor, and future business performance estimates. The GF Value Line on our summary page offers a snapshot of the stock's fair value, and the stock price is most likely to fluctuate around this line.

Delving Deeper: PENN Entertainment's Potential Value Trap

Despite PENN Entertainment's seemingly attractive valuation, it's crucial to consider certain risk factors associated with the company. These risks are primarily reflected through its low Altman Z-score of 0.91, indicating that PENN Entertainment might be a potential value trap. This complexity highlights the importance of thorough due diligence in investment decision-making.

Decoding the Altman Z-Score

The Altman Z-score is a financial model that predicts a company's probability of bankruptcy within two years. It combines five different financial ratios, each weighted to create a final score. A score below 1.8 suggests a high likelihood of financial distress, while a score above 3 indicates a low risk.

Inside PENN Entertainment

PENN Entertainment's origins date back to its 1972 racetrack opening in Pennsylvania. Today, it operates 43 properties across 20 states and 12 brands, with land-based casinos representing 90% of its total sales in 2022. The retail portfolio generates high-30% EBITDAR margins and helps position the company to obtain licenses for digital wagering markets. Additionally, PENN's media assets, theScore and ESPN, provide access to sports betting/iGaming technology and clientele, helping it form a leading digital position.

Breaking Down PENN Entertainment's Low Altman Z-Score

The EBIT to Total Assets ratio serves as a crucial barometer of a company's operational effectiveness. An analysis of PENN Entertainment's EBIT to Total Assets ratio from historical data (2021: 0.07; 2022: 0.06; 2023: 0.08) indicates a recent dip following an initial rise. This reduction suggests that PENN Entertainment might not be utilizing its assets to their full potential to generate operational profits, negatively affecting its overall Z-score.

Conclusion: Is PENN Entertainment a Value Trap?

Given PENN Entertainment's low Altman Z-score and the recent dip in its EBIT to Total Assets ratio, the company presents potential risks that could make it a value trap. Therefore, despite its seemingly undervalued status, investors should approach with caution and conduct thorough due diligence before making an investment decision.

GuruFocus Premium members can find stocks with high Altman Z-Score using the following Screener: Walter Schloss Screen .

This article first appeared on GuruFocus.