Penn National (PENN) Drop on Q3 Earnings Miss, Margin Fall

Penn National Gaming, Inc. PENN reported tepid third-quarter 2021 results wherein earnings lagged the Zacks Consensus Estimate while revenues marginally beat the same. On a year-over-year basis, earnings fell significantly despite revenue growth. Following the results, shares of the company declined 21.1% during the trading hours on Nov 4.

Jay Snowden, president and CEO, said “While July was a record month, the second half of August and September was impacted by Hurricane Ida and regional flare-ups of the Delta variant, which reduced property Adjusted EBITDAR and Adjusted EBITDAR margins by an estimated $30 million and 85 basis points, respectively. As the operating environment has normalized, we have seen improved results in October. Further, Other Segment results included a $12.5 million lobbying expense to support the California sports betting initiative and $7.5 million in expenses related to new state launches of our Barstool Sportsbook app.”

Earnings & Revenue Discussion

Adjusted earnings of 52 cents per share missed the Zacks Consensus Estimate of 84 cents by 38.1% and declined 44.1% year over year. Net revenues totaled $1,511.8 million, which beat the consensus mark of $1,500 million and improved 33.8% from the year-ago quarter’s level.

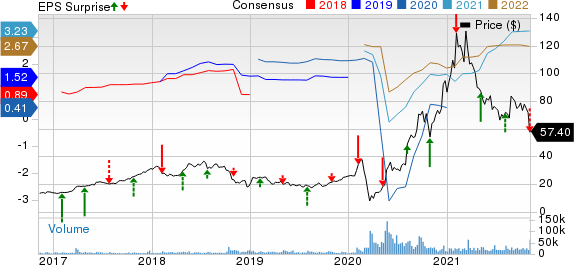

Penn National Gaming, Inc. Price, Consensus and EPS Surprise

Penn National Gaming, Inc. price-consensus-eps-surprise-chart | Penn National Gaming, Inc. Quote

The Northeast segment reported revenues of $672.4 million, up 23.4% year over year. The South, West, Midwest and Other segments’ revenues were $318.2 million, $145.7 million, $285.7 million and $96.5 million, up 24.5%, 85.1%, 24.7% and 307.2% year over year, respectively.

Operating Headlines

Adjusted EBITDAR rose 6.1% from the year-ago quarter’s level to $480.3 million. Adjusted EBITDAR margin, however, contracted 830 basis points to 31.89% from 40.1% a year ago.

Other Financial Information

At the third quarter-end, cash and cash equivalents increased to $2.73 billion from $1.85 billion as of Dec 31, 2020. Bank debt as of Sep 30, 2021 was $1.58 billion, down from $1.63 billion at 2020 end.

Zacks Rank & Key Picks

Penn National carries a Zacks Rank #3 (Hold), currently. You can the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

A few better-ranked stocks in the Zacks Gaming industry are Churchill Downs Incorporated CHDN, Golden Entertainment, Inc. GDEN and Accel Entertainment, Inc. ACEL. While Churchill Downs and Golden Entertainment sport a Zacks Rank #1, Accel Entertainment carries a Zacks Rank #2 (Buy) at present.

Earnings of Churchill Downs, Golden Entertainment and Accel Entertainment for 2021 are expected to rise 673.5%, 232.1% and 957.1%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Penn National Gaming, Inc. (PENN) : Free Stock Analysis Report

Churchill Downs, Incorporated (CHDN) : Free Stock Analysis Report

Golden Entertainment, Inc. (GDEN) : Free Stock Analysis Report

Accel Entertainment, Inc. (ACEL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research