Pennant Investors Trims Johnson & Johnson, Microsoft

- By Tiziano Frateschi

Alan Fournier (Trades, Portfolio)'s Pennant Investors manages a $237 million equity portfolio composed of 19 stocks as of the quarter's end. The firm sold shares of the following stocks during the second quarter.

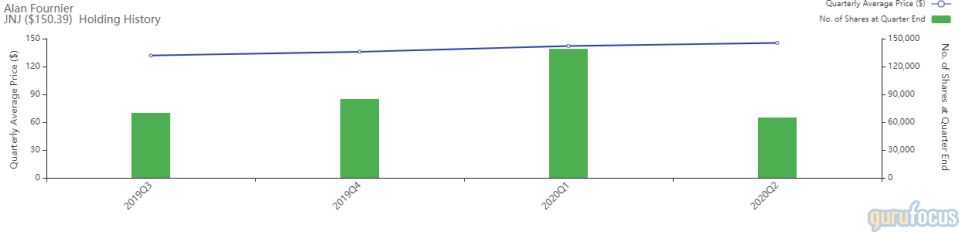

Johnson & Johnson

The fund trimmed its position in Johnson & Johnson (JNJ) by 53.24%. The trade had an impact of -3.49% on the portfolio.

The healthcare giant has a market cap of $395.95 billion and an enterprise value of $407.21 billion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity of 25.08% and return on assets of 9.71% are outperforming 83% of companies in the drug manufacturers industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 0.63 is below the industry median of 0.87.

The largest guru shareholder of the company is Pioneer Investments (Trades, Portfolio) with 0.23% of outstanding shares, followed by Jeremy Grantham (Trades, Portfolio) with 0.09% and Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.09%.

Microsoft

The fund's Microsoft Corp. (MSFT) position was reduced by 49.58%. The portfolio was impacted by -4%.

The hardware and software producer has a market cap of $1.59 trillion and an enterprise value of $1.53 trillion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity of 40.16% and return on assets of 15.43% are outperforming 92% of companies in the software industry. Its financial strength is rated 7 out of 10. The cash-debt ratio of 1.92 is below the industry median of 2.2.

The largest guru shareholder of the company is PRIMECAP Management (Trades, Portfolio) with 0.32% of outstanding shares, followed by Ken Fisher (Trades, Portfolio) with 0.29% and Dodge & Cox with 0.26%.

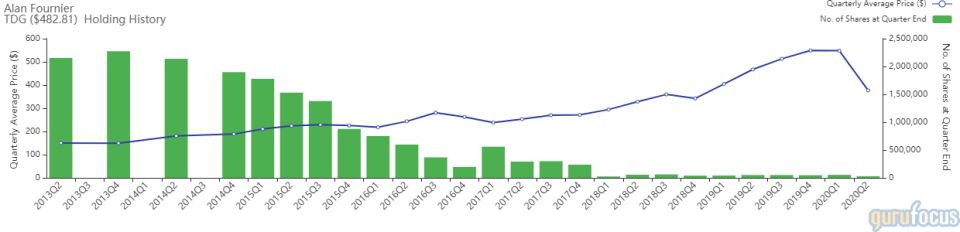

TransDigm

The fund reduced its position in TransDigm Group Inc. (TDG) by 45.66% The portfolio was impacted by -2.85%.

The company, which provides products for electronic, power, fluid and mechanical motion control, has a market cap of $26.17 billion and an enterprise value of $41.67 billion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on assets of 5.54% is outperforming 72% of companies in the aerospace and defense industry. Its financial strength is rated 3 out of 10. The cash-debt ratio of 0.23 is below the industry median of 0.52.

The largest guru shareholder is Chase Coleman (Trades, Portfolio)'s Tiger Global Management with 3.24% of outstanding shares, followed by Steve Mandel (Trades, Portfolio)'s Lone Pine Capital with 3.23%.

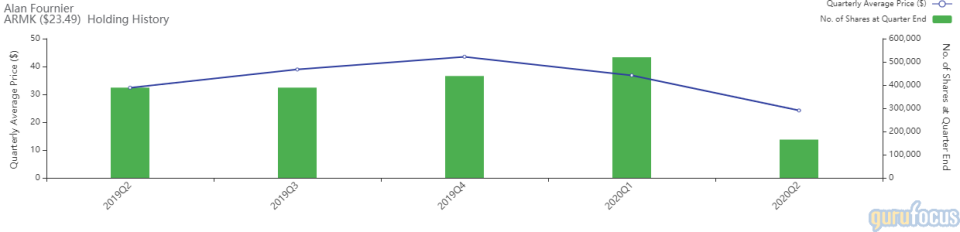

Aramark

The fund curbed its Aramark (ARMK) holding by 68.27%, impacting the portfolio by -2.55%.

The company, which provides food, facilities and uniform services, has a market cap of $5.94 billion and an enterprise value of $13.20 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on equity of -7.05% and return on assets of -1.57% are outperforming 55% of companies in the restaurants industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.25 is below the industry median of 0.36.

The largest guru shareholder is Barrow, Hanley, Mewhinney & Strauss with 7.02% of outstanding shares, followed by George Soros (Trades, Portfolio) with 0.65%.

Charter Communications

The investment fund closed its holding of Charter Communications Inc. (CHTR) by 26.55%. The portfolio was impacted by -2.35%.

The communications company has a market cap of $125.33 billion and an enterprise value of $208.87 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of 7.13% and return on assets of 1.55% are outperforming 56% of companies in the media, diversified industry. Its financial strength is rated 3 out of 10. The cash-debt ratio of 0.03 is far below the industry median of 0.84.

The largest guru shareholder is Dodge & Cox with 2.58% of outstanding shares, followed by Warren Buffett (Trades, Portfolio)'s Berkshire Hathaway with 2.54% and Frank Sands (Trades, Portfolio) with 0.49%.

CAE

The investment fund closed its CAE Inc. (CAE) position. The trade had an impact of -2.04% on the portfolio.

The company has a market cap of $3.99 billion and an enterprise value of $5.89 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. While the return on equity of 5.97% is outperforming the sector, return on assets of 1.82% is underperforming 50% of companies in the aerospace and defense industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.13 is below the industry median of 0.52.

The largest guru shareholder of the company is Simons with 0.15% of outstanding shares, followed by Pioneer Investments (Trades, Portfolio) with 0.04% and Chuck Royce (Trades, Portfolio) with 0.02%.

Amazon.com

The investment fund reduced its holding in Amazon.com Inc. (AMZN) by 26.97%. The portfolio was impacted by -1.69%.

The e-commerce giant has a market cap of $1.63 trillion and an enterprise value of $1.64 trillion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 21.22% and return on assets of 6.02% are outperforming 80% of companies in the retail, cyclical industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 0.29 is above the industry median of 0.41.

The largest guru shareholder of the company is Fisher with 0.33% of outstanding shares, followed by Pioneer Investments (Trades, Portfolio) with 0.25% and Sands with 0.22%.

Disclosure: I do not own any stocks mentioned.

Read more here:

Fairfax Financial Exits Six Flags, WABCO

The Baupost Group Exits Cheniere, Cuts Facebook

Gotham Asset Management Exits TJX Companies, Raytheon

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.