PennyMac Financial Services Inc Reports Q4 and Full-Year 2023 Results

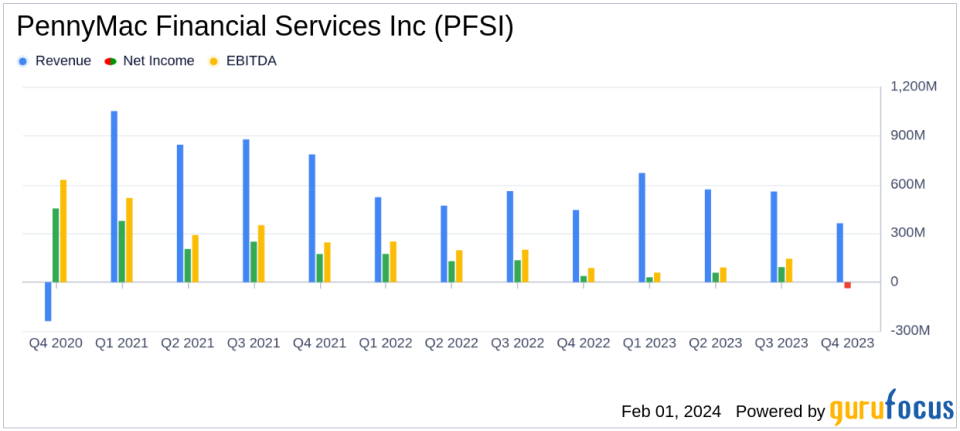

Net Loss: PennyMac Financial Services Inc (NYSE:PFSI) reported a net loss of $36.8 million for Q4 2023.

Revenue: Q4 revenue stood at $361.9 million.

Book Value: Book value per share decreased to $70.52 from $71.56 at the end of the previous quarter.

Dividend: A cash dividend of $0.20 per share has been declared for Q4.

Loan Production: Total loan production activity for the quarter was $26.7 billion in UPB.

Servicing Portfolio: The total servicing portfolio grew to $607.2 billion in UPB, a 10% increase from the previous year.

PennyMac Financial Services Inc (NYSE:PFSI) released its 8-K filing on February 1, 2024, detailing a challenging fourth quarter and full-year 2023 performance. The company, a leading entity in the mortgage lending and servicing industry, operates through three segments: production, servicing, and investment management. Despite the hurdles faced in the mortgage market, PFSI's mortgage banking business, which includes mortgage loan origination, acquisition, and sale activities, remains a significant revenue generator.

The fourth quarter's net loss was primarily attributed to a one-time accrual related to an arbitration award with Black Knight, as explained by Chairman and CEO David Spector. He emphasized the strength of PFSI's balanced business model, which yielded an annualized operating return on equity of 15% in Q4. Despite a 40% industry-wide downturn in origination volumes compared to 2022, PennyMac's multi-channel production platform produced nearly $100 billion in UPB of mortgage loans, only a 9% decrease from the previous year.

The servicing portfolio's organic growth was a highlight, with a year-end total exceeding $600 billion in UPB, marking a 10% increase from the previous year. Spector expressed pride in the company's resilience and its well-positioned status in the industry, backed by proprietary technology, a robust balance sheet, and a growing customer base.

Financial Performance and Challenges

The Production segment reported a pretax income of $39.4 million, with revenue totaling $176.5 million, reflecting stability from the previous quarter and a 34% increase from Q4 2022. The Servicing segment, however, faced a pretax loss of $95.5 million, including a significant non-recurring arbitration accrual. The Investment Management segment saw a modest pretax income of $1.9 million.

Overall, PFSI's total expenses were $416.2 million, with the arbitration accrual accounting for a substantial portion. Excluding this one-time item, expenses would have been $257.8 million, showing a decrease from previous periods. The company also recorded a tax benefit of $17.4 million due to the pretax loss.

The detailed earnings report and management's commentary underscore the company's commitment to navigating the complex mortgage landscape and its focus on long-term growth and profitability.

For a more in-depth analysis and further details on PennyMac Financial Services Inc's Q4 and full-year 2023 performance, investors and interested parties can access the full earnings presentation and materials in the Investor Relations section of the company's website and join the conference call and live audio webcast.

For value investors seeking comprehensive insights into PennyMac Financial Services Inc's financials and strategic outlook, GuruFocus.com provides detailed analyses and up-to-date information to inform investment decisions.

Explore the complete 8-K earnings release (here) from PennyMac Financial Services Inc for further details.

This article first appeared on GuruFocus.