Penske Automotive Group Inc Reports Mixed Results Amidst Market Challenges

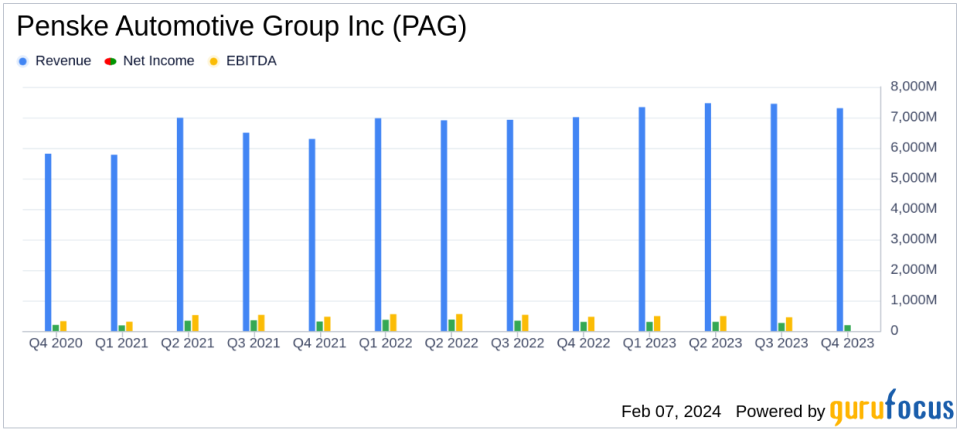

Revenue Growth: Fourth quarter revenue increased by 4% to $7.3 billion.

Profit Decline: Income from continuing operations attributable to common stockholders decreased by 36% to $190.7 million in Q4.

Adjusted Earnings: Excluding a goodwill impairment charge, adjusted income from continuing operations decreased by 22% to $231.4 million in Q4.

Full Year Performance: Full year revenue increased by 6% to $29.5 billion, while adjusted income from continuing operations decreased by 21% to $1.09 billion.

Dividend Increase: The Board of Directors approved a 10% increase in the quarterly dividend to $0.87 per share.

Stock Repurchase: During 2023, 2.6 million shares were repurchased for approximately $358.7 million.

Acquisition: In January 2024, PAG completed the acquisition of Rybrook Group Limited, estimated to bring in annualized revenues of approximately $1 billion.

Penske Automotive Group Inc (NYSE:PAG) released its 8-K filing on February 7, 2024, revealing a mixed financial performance for the fourth quarter and full year of 2023. The company, a diversified international transportation services company and one of the world's premier automotive and commercial truck retailers, reported a 4% increase in fourth-quarter revenue to $7.3 billion. However, income from continuing operations attributable to common stockholders saw a significant decrease of 36% to $190.7 million in the fourth quarter compared to the same period in 2022. Earnings per share also decreased by 33% to $2.84.

The fourth-quarter results were impacted by a non-cash goodwill impairment charge of $40.7 million, lower equity earnings from Penske Transportation Solutions (PTS), and higher interest expenses. Excluding the goodwill impairment charge, adjusted income from continuing operations decreased by 22% to $231.4 million, and adjusted earnings per share decreased by 18% to $3.45. Foreign currency exchange had a positive impact on revenue by $130.0 million but a negligible effect on income and earnings per share.

Operational Highlights and Financial Performance

PAG operates approximately 150 U.S. light-vehicle stores, including in Puerto Rico, and 189 franchised dealerships overseas, primarily in the United Kingdom. The company sells more than 35 brands, with a significant portion of its retail automotive revenue coming from luxury and import names. PAG also owns 44 truck dealerships and 20 CarShop used-vehicle stores in the U.S. and U.K.

For the full year of 2023, PAG's revenue increased by 6% to $29.5 billion. However, income attributable to common stockholders decreased by 24% to $1.05 billion, and earnings per share decreased by 16% to $15.50. Adjusted for the goodwill impairment charge, income from continuing operations attributable to common stockholders decreased by 21% to $1.09 billion, and adjusted earnings per share decreased by 13% to $16.10. Foreign currency exchange had a slightly negative impact on full-year revenue, income, and earnings per share.

Retail automotive same-store revenue increased by 5%, with a notable 9% increase in service and parts. However, same-store gross profit decreased slightly by 0.4%. Retail commercial truck same-store revenue and gross profit saw modest increases of 1% and 3%, respectively. PAG's investment in PTS recorded a decrease in earnings due to higher interest and maintenance costs, lower gains on sales of used trucks, and lower rental revenue and utilization.

Chair and CEO Roger Penske commented on the results, stating, "Demand for new vehicles remains strong while used vehicle supply and affordability remains challenging. I am pleased with the continued growth in service and parts gross profit and our continued focus on controlling costs. Also, I was particularly pleased with the sequential performance of retail automotive new and used vehicle gross profit per unit retailed which only declined marginally from the third to fourth quarter of 2023." He also noted that PAG achieved the third-best year of profitability of all time.

Our diversified business achieved the third best year of profitability of all-time," said Roger Penske, Chair and CEO of Penske Automotive Group.

In terms of corporate development and capital allocation, PAG's Board of Directors approved a 10% increase in the quarterly dividend to $0.87 per share. The company also repurchased 2.6 million shares of common stock for approximately $358.7 million and acquired additional shares from employees in connection with employee equity awards. PAG completed the acquisition of Rybrook Group Limited in January 2024, which is expected to contribute an estimated annualized revenue of approximately $1 billion.

The company's performance reflects the resilience of its diversified business model amidst market challenges, including supply constraints and shifting consumer preferences. The increase in dividend and share repurchases demonstrate PAG's commitment to delivering shareholder value, while strategic acquisitions like Rybrook Group Limited signal continued growth prospects.

For more detailed financial information and to listen to the conference call discussing these results, investors and interested parties can visit the Investors section of Penske Automotive Group's website at www.penskeautomotive.com.

Explore the complete 8-K earnings release (here) from Penske Automotive Group Inc for further details.

This article first appeared on GuruFocus.