Penske's (PAG) Q3 Earnings Snap Beat Streak, Decline Y/Y

Penske Automotive Group’s PAG 13 consecutive quarter-long beat streak snapped as it reported lower-than-expected earnings for the third quarter of 2023. The auto retailer reported adjusted earnings of $3.90 per share, which decreased 15.4% year over year and also missed the Zacks Consensus Estimate of $4.04. The company registered net sales of $7,447.8 million, marginally missing the Zacks Consensus Estimate of $7,449 million. The top line rose 7.6% from the year-ago quarter.

Penske’s gross profit in the reported quarter increased 2.8% on a year-over-year basis to $1,220 million. The operating income contracted 8.6% to $331.5 million. Foreign currency transactions positively impacted revenues by $172.4 million, net income by $1.3 million and earnings per share by 2 cents.

In the reported quarter, same-store retail units rose 10.3% year over year to 119,921. Within the Retail Automotive segment, same-store new-vehicle revenues were up 14.9% to $2,726.5 million. Same-store used-vehicle revenues increased 3.7% to $2,263.4 million.

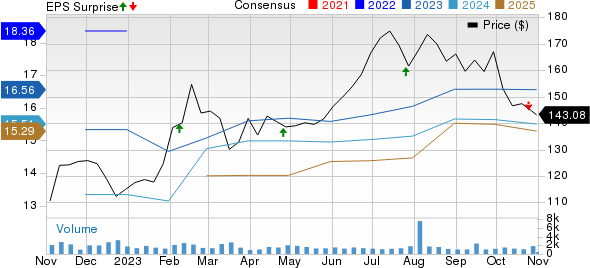

Penske Automotive Group, Inc. Price, Consensus and EPS Surprise

Penske Automotive Group, Inc. price-consensus-eps-surprise-chart | Penske Automotive Group, Inc. Quote

Segmental Performance

In the reported period, revenues in the Retail Automotive segment came in at $6,325.4 million, up 10% from a year ago and topping our estimate of $5,458 million. The outperformance resulted from higher-than-expected revenues from new and used vehicles. Gross profit of $1,025.3 inched up 1.8% year over year and came ahead of our estimate of $935 million.

Revenues in the Retail Commercial Truck segment decreased 5% to $964.7 million and fell short of our estimate of $981 million. Gross profit in the segment was $155.4 million, rising from $139.7 million in the year-earlier quarter figure and topping our expectation of $128.4 million.

The Commercial Vehicle Distribution and Other segment’s revenues in the reported quarter increased 9.9% to $157.7 million and topped our estimate of $152.7 million. Gross profit came in at $39.7 million, down from $40.3 million in the year-ago period but higher than our estimate of $35.8 million.

Financial Tidbits

In the quarter under review, SG&A costs totaled $853.5 million, up 7.7% year over year. As of Sep 30, 2023, Penske had cash and cash equivalents of $104.4 million, down from $106.5 million on Dec 31, 2022. The long-term debt amounted to $1,537.3 million, down from $1,547 million as of Dec 31, 2022.

During the quarter under discussion, PAG repurchased 0.1 million shares of common stock for $14.1 million. As of Sep 30, 2023, $233.1 million of stock repurchase authorization remained outstanding.

Zacks Rank & Key Picks

PAG currently carries a Zacks Rank #3 (Hold).

A few top-ranked players in the auto space include Toyota TM, Honda HMC and Nissan NSANY. While TM and HMC sport a Zacks Rank #1 (Strong Buy) each, NSANY carries a Zacks Rank #2 (Buy) currently. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for TM’s fiscal 2024 sales and EPS implies year-over-year growth of 10.5% and 27.5%, respectively. The earnings estimate for fiscal 2024 and 2025 has been revised upward by 4 cents and 21 cents, respectively, in the past 30 days.

The Zacks Consensus Estimate for HMC’s fiscal 2024 sales and EPS implies year-over-year growth of 7.7% and 29.4%, respectively. The earnings estimate for fiscal 2024 and 2025 has been revised upward by 1 cent and 18 cents, respectively, in the past 30 days.

The Zacks Consensus Estimate for NSANY’s fiscal 2024 EPS implies year-over-year growth of 12.6%. The earnings estimate for fiscal 2024 and 2025 has been revised upward by 10 cents and 3 cents, respectively, in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Toyota Motor Corporation (TM) : Free Stock Analysis Report

Penske Automotive Group, Inc. (PAG) : Free Stock Analysis Report

Honda Motor Co., Ltd. (HMC) : Free Stock Analysis Report

Nissan Motor Co. (NSANY) : Free Stock Analysis Report