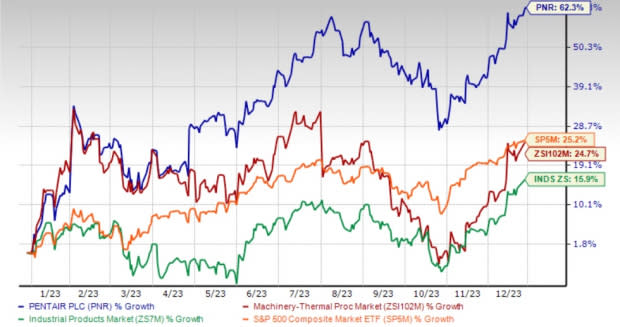

Pentair (PNR) Gains 62% in a Year: Will the Rally Hold in 2024?

Pentair PNR has gained 62.3% in a year, faring way better than the industry’s 24.7% growth. The Industrial Products sector has risen 15.9% while the Zacks S&P 500 composite has moved up 25.2% in the same time frame.

PNR has a market capitalization of around $12.1 billion. The average volume of shares traded in the last three months was 1.43M.

Pentair currently carries a Zacks Rank #3 (Hold).

Image Source: Zacks Investment Research

Momentum in IFT & Water Solutions to Aid Growth

Pentair has been witnessing year-over-year growth in revenues in the Industrial and Flow Technologies and Water Solutions segments over the past 11 quarters. This has helped offset the impact of weak pool volumes over the past few quarters. Despite this setback, Pentair’s sales have remained more than the $1 billion level over the past six quarters.

The company has also delivered margin expansion across each of its segments this year, primarily driven by pricing, cost-cutting initiatives and progress on its Transformation initiatives.

Focus on product introductions, acquisitions and investments, which are in sync with its strategy to expand in the areas of pool, and residential and commercial water treatment, will continue to aid growth.

Upbeat Prospects for the Pool Business

Even though the pool business is currently bearing the brunt of weak demand and ongoing inventory correction, it is expected to eventually pick up. The company expects the channel inventory correction in the Pool business to be completed this year.

The pool industry in North America is catering to a large installed base of approximately 5.4 million pools, with the average age of these pools being 20-25 years. Around 60% of the industrial demand is for repairing, 20% for major remodeling and 20% for new pools. Pentair is well-poised to gain from these demand trends in the long term. Also, given that half of the installed pools lack any form of automation, the growing preference for more autonomous and energy-efficient pools will benefit the company as well.

Strategic Initiatives to Aid Growth

Pentair is focused on expanding digital transformation, innovation, technology and brand building. The company has a strong product pipeline. It is also expanding in the areas of pool and residential and commercial water treatment through acquisitions. To this end, Pentair has completed the acquisition of Manitowoc Ice, a leading provider of commercial ice makers.

Pentair has embarked on a Transformation program to accelerate growth and drive margin expansion. The program is structured in multiple phases and is expected to drive operational efficiency, streamline processes and reduce complexity while meeting financial objectives. The company is targeting its return on sales to be around 23% by 2025, through the program, from the 18.6% return on sales in 2022. It will also be using automation to increase productivity.

Solid Balance Sheet Bodes Well

Over the past five years, the company has generated a cumulative free cash flow of more than $2 billion. The company has a long-term target to consistently generate free cash flow, which is greater than the 100% conversion of its net income.

Its total debt-to-total capital ratio was 0.40 at the end of third-quarter 2023. It has no significant long-term debt maturing in the next five years. Pentair's times interest earned was 5.9.

Stocks to Consider

Some better-ranked stocks from the Industrial Products sector are Resideo Technologies, Inc. REZI, Applied Industrial Technologies AIT and A. O. Smith Corporation AOS.

REZI currently sports a Zacks Rank #1 (Strong Buy), and AIT and AOS carry a Zacks Rank #2 (Buy), at present. You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Resideo Technologies’ 2023 earnings per share is pegged at $1.48. The consensus estimate for 2023 earnings has been unchanged in the past 60 days. The company has a trailing four-quarter average earnings surprise of 5.7%. REZI shares have rallied 15% in a year.

Applied Industrial has an average trailing four-quarter earnings surprise of 15%. The Zacks Consensus Estimate for AIT’s 2023 earnings is pinned at $9.43 per share, which indicates year-over-year growth of 7.8%. Estimates have moved up 4% in the past 60 days. The company’s shares have gained 38% in a year.

The Zacks Consensus Estimate for A. O. Smith’s 2023 earnings is pegged at $3.77 per share. The consensus estimate for 2023 earnings has moved 5% north in the past 60 days and suggests year-over-year growth of 20.1%. The company has a trailing four-quarter average earnings surprise of 14%. AOS shares have gained 44% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Pentair plc (PNR) : Free Stock Analysis Report

Resideo Technologies, Inc. (REZI) : Free Stock Analysis Report