Pentair (PNR) to Report Q3 Earnings: What's in the Offing?

Pentair plc PNR is scheduled to report third-quarter 2023 results on Oct 24, before the opening bell.

Q2 Results

Pentair’s revenues improved year over year in second-quarter 2023 and outpaced the Zacks Consensus Estimate. PNR’s earnings beat the Zacks Consensus Estimate and improved year over year in the last reported quarter.

The company has an impressive earnings surprise history. Pentair beat earnings estimates in each of the trailing four quarters, the average surprise being 8.8%.

Pentair plc Price and EPS Surprise

Pentair plc price-eps-surprise | Pentair plc Quote

Q3 Estimates

The Zacks Consensus Estimate for third-quarter revenues is pegged at $990 million, indicating a decline of 6.2% from the year-ago reported figure. Core revenues are expected to fall 8.8%.

The consensus estimate for earnings is pegged at 87 cents per share, suggesting a year-over-year decline of 12.1%. The Zacks Consensus Estimate for quarterly earnings has been unchanged over the past 60 days.

What the Zacks Model Unveils

Our proven model doesn’t conclusively predict an earnings beat for Pentair. this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. But that’s not the case here, as you can see below.

You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

Earnings ESP: Pentair has an Earnings ESP of -0.22%.

Zacks Rank: Pentair currently carries a Zacks Rank of 3.

Key Factors to Note

PNR has been clearing out its inventory. This ongoing optimization of inventory levels is expected to have impacted volumes in the third quarter. We, thus, expect volume to fall 10.1% year over year in the third quarter.

Pentair has been witnessing a tight supply of raw materials, such as metals, resins and electronics, along with rising logistics costs. While it has been implementing pricing actions and focusing on productivity improvements that may have negated these headwinds, supply-chain pressures and inflationary costs are likely to have weighed on the quarter’s performance.

However, PNR has been focusing on productivity improvements, which is likely to have contributed to earnings in the quarter. We expect the price to rise 3.4% year over year in the quarter.

Gains from the Manitowoc Ice acquisition and benefits from the Transformation program are expected to have helped offset the impacts of higher costs and low volumes in the second quarter. Our model predicts acquisitions to have a positive impact of 0.6% on third-quarter revenues.

The company has been witnessing weak demand in the pool business recently. Reflecting this, we expect the Pool segment’s sales to be $295 million, indicating a year-over-year decline of 24.5%. The downside is driven by the ongoing inventory reduction. The segment’s operating income is expected to fall 19.8% year over year to $87.6 million.

Our model predicts the Water Solutions segment’s net sales to increase 3.7% year over year to $285 million in the quarter. The operating income is expected to increase 30.9% to $64.5 million.

We expect Industrial & Flow Technologies’ revenues to be $401 million, indicating an improvement of 2.9% from the prior-year quarter’s reported figure. The consensus mark for this segment’s operating profit is expected to be $67.1 million, suggesting growth of 2.1% from the year-ago reported figure.

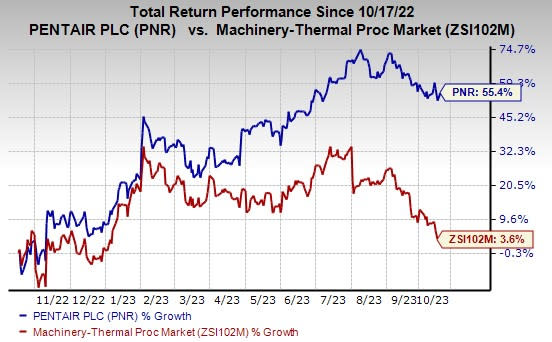

Price Performance

Shares of PNR have gained 55.4% in the past year compared with the industry’s growth of 3.6%.

Image Source: Zacks Investment Research

Stocks to Consider

Here are some stocks with the right combination of elements to post an earnings beat in their upcoming releases.

ESAB Corporation ESAB, scheduled to release earnings on Nov 1, has an Earnings ESP of +0.81% and sports a Zacks Rank of 1 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for ESAB’s third-quarter earnings is pegged at 92 cents per share. Earnings estimates have been unchanged in the past 60 days. It has an average trailing four-quarter earnings surprise of 13.6%.

H&E Equipment Services, Inc. HEES, expected to release earnings on Oct 10, has an Earnings ESP of +14.79% and a Zacks Rank of 2 at present.

The Zacks Consensus Estimate for HEES’ earnings for the third quarter is pegged at $1.31 per share. The consensus estimate for 2023 earnings has moved 8% north in the past 60 days. It has an average trailing four-quarter earnings surprise of 24.1%.

Ingersoll Rand Inc. IR, expected to release earnings on Nov 1, has an Earnings ESP of +1.00%. IR currently carries a Zacks Rank of 3.

The consensus estimate for Ingersoll Rand’s earnings for the third quarter is pegged at 70 cents per share. Earnings estimates have been unchanged in the past 60 days. It has an average trailing four-quarter earnings surprise of 14.9%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ingersoll Rand Inc. (IR) : Free Stock Analysis Report

Pentair plc (PNR) : Free Stock Analysis Report

H&E Equipment Services, Inc. (HEES) : Free Stock Analysis Report

ESAB Corporation (ESAB) : Free Stock Analysis Report