Penumbra Inc (PEN) Reports Robust Revenue Growth and Profitability in Q4 and Full Year 2023

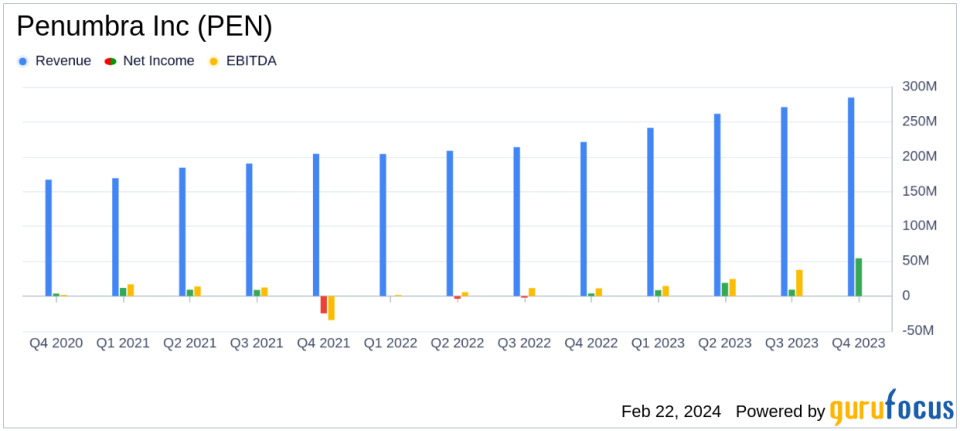

Revenue Growth: Q4 revenue jumped 28.7% to $284.7 million; full-year revenue climbed 25.0% to $1,058.5 million.

Thrombectomy Products: Q4 sales soared by 42.4%; full-year sales up 32.5%.

Operating Income: Q4 GAAP income from operations reached $35.0 million; full-year income from operations stood at $73.6 million.

Net Income and EBITDA: Q4 net income was $54.2 million with an adjusted EBITDA margin of 18.8%; full-year net income totaled $91.0 million with an adjusted EBITDA margin of 16.1%.

Financial Position: Cash and marketable investments increased by $40.3 million in Q4.

2024 Outlook: Projected total revenue growth of 16% to 20%, with U.S. thrombectomy growth of 27% to 30%.

On February 22, 2024, Penumbra Inc (NYSE:PEN), a leading developer and manufacturer of medical devices, released its 8-K filing, disclosing its financial results for the fourth quarter and full year ended December 31, 2023. The company, which primarily serves the neurovascular and peripheral vascular markets, has reported significant growth in revenue and profitability, particularly in its thrombectomy product line.

Company Overview

Penumbra Inc's portfolio includes devices for neurovascular access, ischemic stroke, neurovascular embolization, and neurosurgical tools, as well as peripheral embolization and thrombectomy products. With the majority of its revenue generated in the United States, Penumbra's innovative therapies have positioned it as a key player in the medical device industry.

Financial Performance and Challenges

The company's financial performance in the fourth quarter and full year of 2023 was marked by robust revenue growth. Q4 revenue surged by 28.7% to $284.7 million, while full-year revenue saw a 25.0% increase to $1,058.5 million. This growth was driven by a 42.4% increase in Q4 sales of thrombectomy products, which reached $190.8 million. The full-year sales of these products also rose significantly by 32.5% to $677.3 million.

Penumbra's income from operations for Q4 was reported at $35.0 million, with non-GAAP income from operations at $37.4 million. For the full year, income from operations reached $73.6 million, with non-GAAP income from operations at $101.3 million. The company's net income for Q4 stood at $54.2 million, and for the full year, it was $91.0 million. Adjusted EBITDA for Q4 was $53.4 million, translating to an 18.8% margin, while the full-year adjusted EBITDA was $170.6 million, with a margin of 16.1%.

Despite these strong results, Penumbra faces challenges that could impact future performance, including intense competition, the need to continuously innovate, and potential regulatory changes. The company's ability to sustain growth, manage costs, and navigate the complex healthcare market will be critical in maintaining its upward trajectory.

Financial Achievements and Importance

The increase in cash and marketable investments by $40.3 million in Q4 is a testament to Penumbra's improved profitability and working capital management. The company's financial achievements are particularly important in the medical device industry, where research and development, as well as market expansion, require significant investment. Penumbra's strong financial position enables it to invest in innovation and pursue growth opportunities.

Analysis and Outlook

Looking ahead to 2024, Penumbra projects total revenue growth of 16% to 20%, with U.S. thrombectomy growth expected to be between 27% and 30%. The company also anticipates gross margin expansion of 100 to 150 basis points and non-GAAP operating margin expansion of 100 to 200 basis points compared to the full year 2023.

The company's strategic shift in reporting product revenues into new categoriesthrombectomy, embolization, and accessaims to provide investors with clearer insights into its business performance and direction. This change, along with the strong financial results and positive outlook, underscores Penumbra's commitment to transparency and growth.

For detailed financial tables and a full reconciliation of GAAP to non-GAAP financial measures, investors and interested parties are encouraged to review the full 8-K filing.

Penumbra's conference call to discuss the Q4 and full-year results will be accessible live over the phone or via webcast on the company's website, providing an opportunity for investors to delve deeper into the company's financials and strategies.

Value investors and potential GuruFocus.com members seeking to understand the implications of Penumbra's financial results can find comprehensive analysis and insights on GuruFocus.com, where the focus on long-term value creation aligns with the interests of prudent investors.

Explore the complete 8-K earnings release (here) from Penumbra Inc for further details.

This article first appeared on GuruFocus.