Penumbra (PEN): A Modestly Undervalued Gem in the Medical Device Market?

Penumbra Inc (NYSE:PEN), a prominent player in the neurovascular and peripheral vascular markets, has seen a day's loss of 3.51% and a 3-month loss of 20.14%. Despite these numbers, the company's Earnings Per Share (EPS) sits at 0.74, raising the question: Is Penumbra (NYSE:PEN) modestly undervalued? This article presents a comprehensive valuation analysis of Penumbra, encouraging readers to delve into the financial intricacies of the company.

A Snapshot of Penumbra Inc (NYSE:PEN)

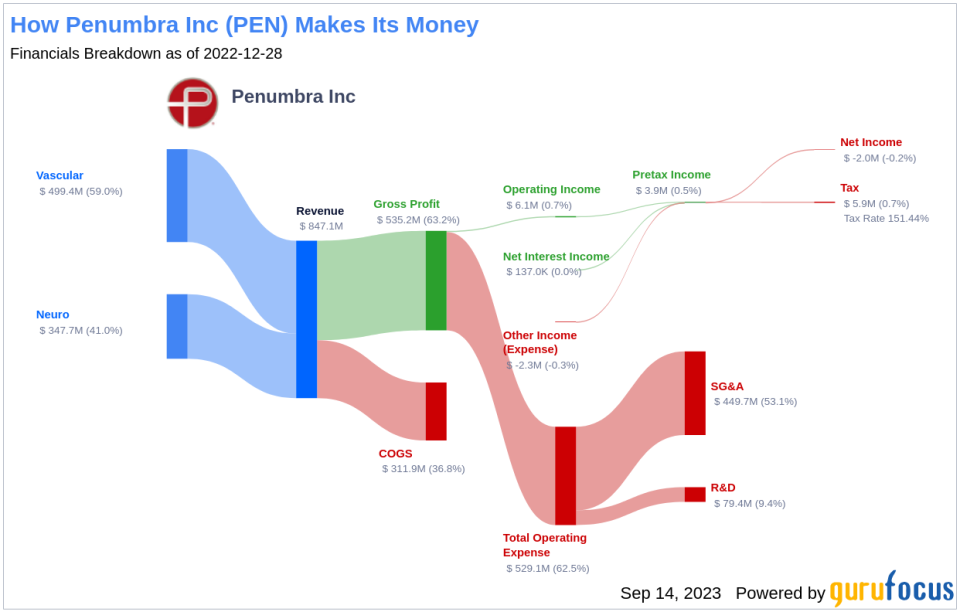

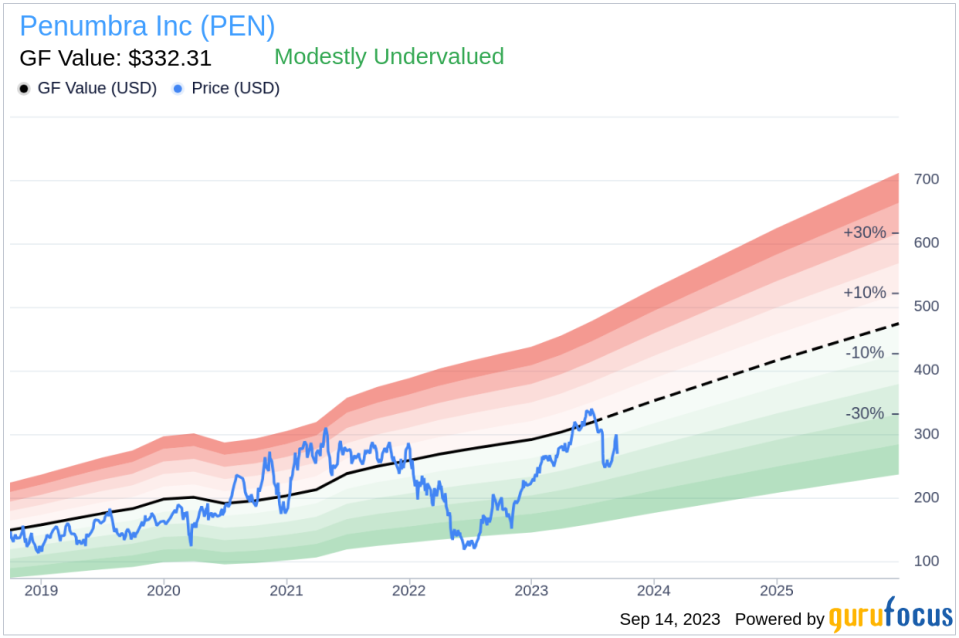

Penumbra develops and manufactures medical devices primarily for hospitals, with a focus on neurovascular and peripheral vascular markets. The neurovascular product category contributes to the majority of the company's revenue. Penumbra's current stock price is $269.46, with a market cap of $10.40 billion. Comparing this with the GuruFocus Fair Value (GF Value) of $332.31, Penumbra appears to be modestly undervalued.

Understanding the GF Value

The GF Value is a proprietary measure of a stock's intrinsic value, calculated based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. The GF Value Line represents the fair value at which the stock should be traded.

According to GuruFocus' estimation, Penumbra (NYSE:PEN) appears to be modestly undervalued. This is based on the stock's historical trading multiples, past business growth, and analyst estimates of future business performance. Given this valuation, Penumbra's long-term return is likely to be higher than its business growth.

Penumbra's Financial Strength

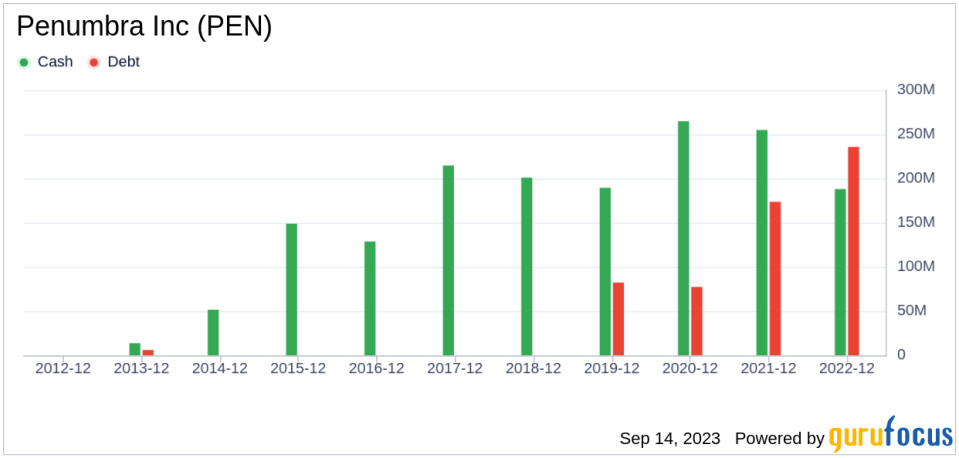

Companies with poor financial strength pose a high risk of permanent capital loss. To avoid this, it's crucial to review a company's financial strength before purchasing shares. Penumbra's cash-to-debt ratio of 0.96 ranks lower than 66.9% of 840 companies in the Medical Devices & Instruments industry. However, with an overall financial strength score of 8 out of 10, Penumbra's financial health remains strong.

Profitability and Growth

Consistent profitability over the long term offers less risk for investors. Penumbra has been profitable 8 out of the past 10 years, with a revenue of $937.80 million over the past twelve months and an operating margin of 3.86%, ranking better than 54.7% of 830 companies in the industry. Despite this, the company's growth ranks lower than 83.72% of 737 companies in the Medical Devices & Instruments industry, with an average annual revenue growth of 14% and a 3-year average EBITDA growth of -19.4%.

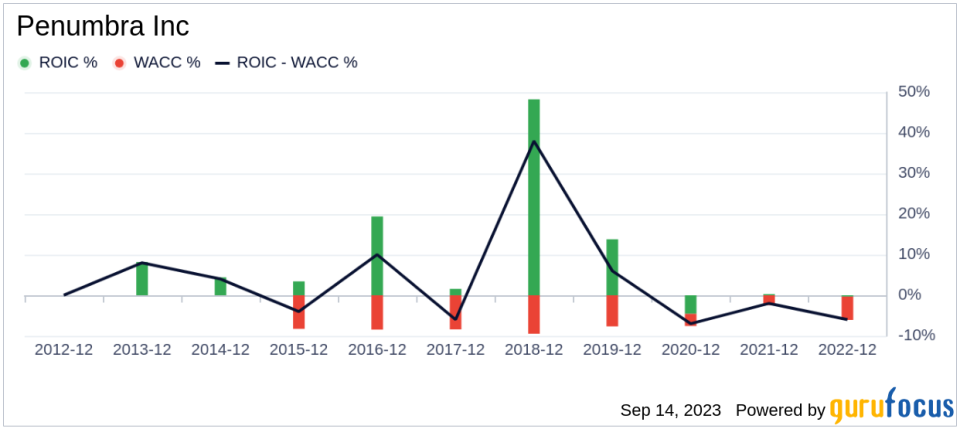

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to its weighted average cost of capital (WACC) is a useful way to evaluate profitability. ROIC measures how well a company generates cash flow relative to the capital it has invested in its business, while WACC is the rate that a company is expected to pay on average to all its security holders to finance its assets. Over the past 12 months, Penumbra's ROIC has been 2.62, while its WACC has been 6.04.

Conclusion

In conclusion, Penumbra (NYSE:PEN) appears to be modestly undervalued. Despite its strong financial condition and fair profitability, the company's growth ranks lower than most in the Medical Devices & Instruments industry. For more detailed information on Penumbra's financials, check out its 30-Year Financials here.

For a list of high-quality companies that may deliver above-average returns, visit the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.