Penumbra's (PEN) Expansion Moves, New Launches Aid Growth

Penumbra PEN is gaining traction in the international markets on strong customer uptake. Strategic innovation is an added positive. The stock carries a Zacks Rank #2 (Buy).

Penumbra is still in the early stages of its journey to bring its proprietary thrombectomy technologies to patients in the United States and around the world. The company’s consistent revenue growth momentum is being driven by the extraordinary outcomes witnessed in patients treated with Lightning Flash, Lightning Bolt 7 and RED 72 with SENDit technology.

Penumbra derives a significant portion of its revenues internationally (30.2% in 2022). It expects to materially increase both revenues and profitability in the company’s international business in the next three years and beyond. During this period, the company expects to bring its franchise products like RED catheters and CAT RX together with its most advanced products, Lightning Flash, Lightning Bolt 7 and Thunderbolt, to Penumbra global teams.

Internationally, the company projects early success with the launch of its first-generation computer-aided products in Europe. Penumbra has plans to expand access to its most advanced thrombectomy products to its international vascular teams over the next few years. In addition, the company’s international teams and partners believe in its enormous potential to expand its leadership in stroke intervention outside the United States with SENDit and Thunderbolt in the coming years. Among the recent developments, in 2023, the company launched the RED catheter for stroke and the first-generation computer-orchestrated thrombectomy products, Lightning 12 and 7 in Europe.

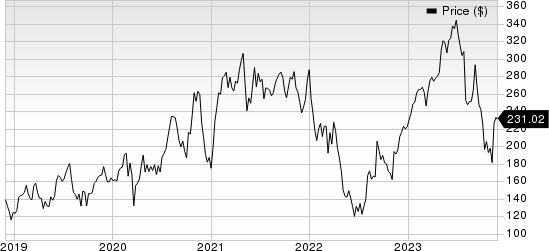

Penumbra, Inc. Price

Penumbra, Inc. price | Penumbra, Inc. Quote

In terms of pipeline, on the third-quarter earnings call, the company stated that over the next 18 months, it plans to launch four new computer-assisted vacuum thrombectomy (CAVT) products in the United States. Combined with Flash and Bolt 7, Penumbra expects its CAVT portfolio to drive market share and market growth in deep vein thrombosis, pulmonary embolism and arterial. In addition, the company has made significant advancements with next-generation technology that could expand both the scope and dominance of its CAVT platform over the long term.

Added to this, the company successfully launched the Lightning Bolt 7 arterial thrombectomy system in June following its FDA clearance in March 2023. Lightning Flash and Lightning Bolt are also driving an acceleration in Penumbra’s U.S. vascular thrombectomy franchise, which grew 42% year over year in the third quarter. The company expects to see a robust growth trajectory in the Vascular arm in the next five years and beyond.

On the flip side, though the pandemic is over, its impact on global supply chains and labor markets lingers. It resulted in cost inflation and raw material supply constraints, as well as an increase in employee turnover rates in certain jurisdictions. All these factors are putting significant pressure on Penumbra’s profitability.

In the third quarter of 2023, Penumbra reported an 18.9% rise in cost of revenues. Selling, general and administrative expenses rose 15.9%. Total operating expenses were up 13.1% year over year.

Further, a significant portion of Penumbra’s sales and costs are exposed to changes in foreign exchange rates. In 2022, approximately 30.2% of the company's consolidated revenues came from the non-U.S. markets. The company’s operations use multiple foreign currencies, including the euro and Japanese yen. Changes in those currencies relative to the U.S. dollar will impact its sales, cost of sales and expenses, and consequently, net income.

Key Picks

Other top-ranked stocks in the broader medical space are Insulet PODD, Haemonetics HAE and DexCom DXCM. While Insulet presently sports a Zacks Rank #1 (Strong Buy), Haemonetics and DexCom each carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Estimates for Insulet’s 2023 earnings per share have increased from $1.61 to $1.90 in the past 30 days. Shares of the company have decreased 40.9% in the past year compared with the industry’s decline of 7%.

PODD’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 105.1%. In the last reported quarter, it delivered an average earnings surprise of 77.4%.

Haemonetics’ stock has risen 11.6% in the past year. Estimates for Haemonetics’ 2023 earnings have increased from $3.82 to $3.86 and from $4.07 to $4.11 for 2024 in the past 30 days.

HAE’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 16.1%. In the last reported quarter, it posted an earnings surprise of 5.3%.

Estimates for DexCom’s 2023 earnings per share have increased from $1.23 to $1.41 in the past 30 days. Shares of the company have fallen 7.8% in the past year compared with the industry’s decline of 7.1%.

DXCM’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 36.4%. In the last reported quarter, it delivered an average earnings surprise of 47.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

Insulet Corporation (PODD) : Free Stock Analysis Report

Penumbra, Inc. (PEN) : Free Stock Analysis Report