Is Peoples Bancorp (PEBO) Worth a Watch for Solid Dividend?

Amid the ongoing regional banking crisis and probable recession in the near term, investors must keep an eye on high dividend-yielding stocks. One such stock is Peoples Bancorp PEBO.

This Marietta, OH-based company offers a complete line of banking, trust and investment, insurance, premium financing, and equipment leasing solutions through its subsidiaries. PEBO has been increasing its quarterly dividend on a regular basis. Over the past five years, the company increased the dividend six times, with an annualized dividend growth rate of 6.1%.

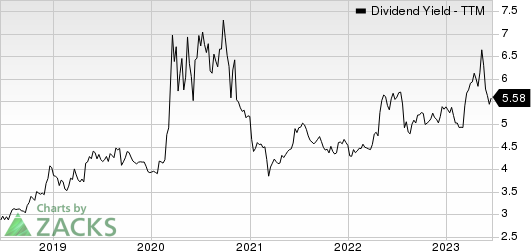

Considering the last day’s closing price of $27.98, Peoples Bancorp’s dividend yield currently stands at 5.58%. This is impressive compared with the industry average of 3.74% and attractive for income investors as it represents a steady income stream.

Peoples Bancorp Inc. Dividend Yield (TTM)

Peoples Bancorp Inc. dividend-yield-ttm | Peoples Bancorp Inc. Quote

Should you keep an eye on Peoples Bancorp stock to earn a high dividend yield? Let’s check out the company fundamentals to understand the risks and rewards. This will help us make a proper investment decision.

Peoples Bancorp has recorded a constant rise in revenues. Its total revenues witnessed a compound annual growth rate (CAGR) of 17.4% over the last three years (2019-2022). The upward momentum continued in the first quarter of 2023. The improvement was backed by a strong loan and deposit balance and high interest rates. The trend is likely to continue in the upcoming period due to higher rates, steady loan demand and solid deposits. Revenues are expected to rise 24.9% this year and 7.7% in 2024.

Peoples Bancorp stands solid from the balance-sheet perspective. Total loan and lease balance witnessed a three-year (2019-2022) CAGR of 17.9%. The rising trend continued in the first quarter of 2023. Its deposits recorded a CAGR of 20.2% over the same period, and the uptrend continued in the first quarter of 2023.

Hence, decent loan demand and modest deposit inflows are likely to keep the momentum going in the upcoming period. Management expects loan growth to be between 25% and 30%, including the new Limestone balances, and the annual organic growth without the acquired loans to be between 5% and 7% in 2023.

Peoples Bancorp has grown through a series of acquisitions over the years. It acquired Vantage Financial in the first quarter of 2022. It also acquired Premier Bancorp Financial, Inc. in the third quarter of 2021, and North Star Leasing in the second quarter of 2021. Additionally, it acquired Triumph Premium Finance, First Prestonsburg Bancshares Inc., and ASB Financial Corp.

These acquisitions have strengthened the company’s balance sheet and fee-based businesses. Moreover, it completed a merger with Limestone Bank in October 2022. Management expects fee-based income to grow low double digits in 2023.

On Apr 24, Peoples Bancorp announced a cash dividend of 39 cents per share, which reflected a hike of 2.6% from the previously announced dividend. The dividend was paid on May 22, 2023, to shareholders of record as of May 8, 2023.

As investors are always on the lookout for companies with a track record of consistent and incremental dividend payments to bet their money on, solid dividend payouts are therefore arguably the biggest enticement for income investors. Such strategic moves also boost investors’ confidence in the stock and will likely bump up the company’s shares in the upcoming period.

In the first quarter, Peoples Bancorp reported a Common Equity Tier 1 ratio of 12.22%. This offers room for enhanced capital deployment plans and is likely to enhance shareholder value in the long term.

Again, Peoples Bancorp’s trailing 12-month return on equity (ROE) indicates its growth potential. The company’s ROE of 13.75% compares favorably with 13.63% for the industry. Thus, this reflects that it is more efficient in using shareholder funds.

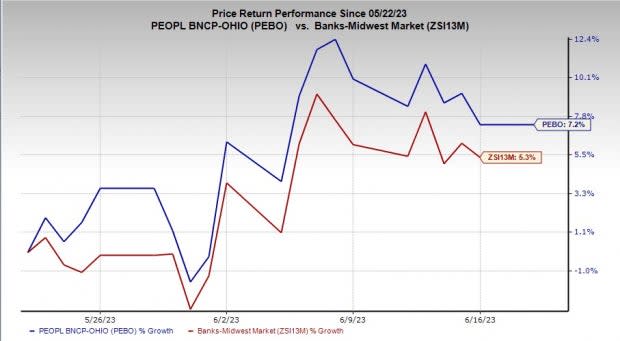

Hence, despite near-term headwinds like rising non-interest expenses, PEBO stock is fundamentally solid. In the past 30 days, shares of Peoples Bancorp have gained 7.2% compared with the industry’s rise of 5.3%.

Image Source: Zacks Investment Research

So, income investors should watch this Zacks Rank #3 (Hold) stock, as it will help generate robust returns over time. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Finance Stocks With Solid Dividends

A couple of other finance stocks like Ares Capital Corporation ARCC and Invesco Ltd. IVZ are worth a look as these too have robust dividend yields.

Considering the last day’s closing price, Ares Capital’s dividend yield currently stands at 10%. Over the past six months, shares of ARCC have gained 3.7%.

Based on the last day’s closing price, Invesco’s dividend yield currently stands at 5%. Over the past six months, shares of IVZ have lost 6.7%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Invesco Ltd. (IVZ) : Free Stock Analysis Report

Ares Capital Corporation (ARCC) : Free Stock Analysis Report

Peoples Bancorp Inc. (PEBO) : Free Stock Analysis Report