PepsiCo (PEP) Rallies on Q2 Earnings Beat & Raised 2023 View

PepsiCo, Inc. PEP has reported robust second-quarter 2023 results, wherein revenues and earnings surpassed the Zacks Consensus Estimate. The top and bottom lines also improved year over year. The strong results reflect gains from strength and resilience in its diversified portfolio, modernized supply chain, improved digital capabilities, flexible go-to-market distribution systems, and robust consumer demand trends.

The company also gained from the resilience and strength in the global beverage and convenient food businesses. Driven by the strong results and business momentum, the company has raised its view for 2023.

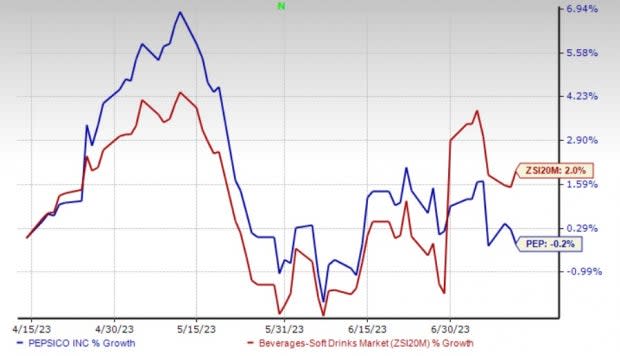

PEP shares jumped 2.5% in the pre-market session following the earnings release on Jul 13, owing to the upbeat second-quarter performance and raised view. Shares of the Zacks Rank #3 (Hold) company have declined 0.2% in the past three months against the industry’s 2% growth.

Image Source: Zacks Investment Research

Quarter in Detail

PepsiCo’s second-quarter core EPS of $2.09 beat the Zacks Consensus Estimate of $1.95 and increased 12.4% year over year. In constant currency, core earnings were up 15% from the year-ago period, backed by the mitigation of inflationary pressures through cost-management and revenue-management initiatives. The company’s reported EPS of $1.99 improved 93% year over year in the quarter. Adverse currency rates impacted EPS by 2% in the quarter.

Net revenues of $22,322 million improved 10.4% year over year and surpassed the Zacks Consensus Estimate of $21,609 million. Revenues benefited from a robust price/mix in the reported quarter. Unit volume declined 3% year over year for the convenient food business and 1% year over year for the beverage business. Foreign currency impacted revenues by 2.5%.

PepsiCo, Inc. Price, Consensus and EPS Surprise

PepsiCo, Inc. price-consensus-eps-surprise-chart | PepsiCo, Inc. Quote

On an organic basis, revenues grew 13% year over year, driven by broad-based growth across categories and geographies. This marked the seventh straight quarter of double-digit organic revenue growth for the company. The consolidated organic volume was down 2.5%, while effective net pricing improved 15% in the second quarter. Pricing gains were driven by strong realized prices across all segments.

Our model had predicted organic revenue growth of 8.9% for the second quarter, with an 11.8% gain from price/mix and a 2.9% decline in volume.

Improvements across categories resulted from accelerated growth in the global beverage and convenient food businesses, reflecting strength in its diversified portfolio. On a year-over-year basis, organic revenues grew 11% for the global beverage business and 15% for the convenient food business. Region-wise, organic revenues improved 11% and 15%, respectively, in North America and International businesses.

On a consolidated basis, the reported gross profit increased 12.9% year over year to $12,201 million. The core gross profit rose 13% year over year to $12,202 million. The reported gross margin expanded 121 basis points (bps), while the core gross margin expanded 132 bps.

The reported operating income of $3,569 million rose 76.2% year over year. The core operating income rose 13% year over year to $3,859 million and the core constant-currency operating income improved 15%. The reported operating margin expanded 613 bps from the year-ago quarter. Meanwhile, the core operating margin expanded 44 bps due to ongoing holistic cost-management initiatives, offset by a double-digit increase in advertising and marketing expenses.

Segmental Details

The company witnessed revenue growth across all segments, except for AMESA. Organic revenues improved for all segments.

Revenues, on a reported basis, improved 14% in FLNA, 10% in PBNA, 18% in Latin America, 13% in Europe, and 1% each in QFNA and APAC. However, revenues declined 8% in AMESA in the second quarter. Organic revenues increased 14% for FLNA, 2% for QFNA, 10% for PBNA, 13% for Latin America, 19% for Europe, 18% for AMESA and 7% for APAC.

Operating profit (on a reported basis) increased 14% for FLNA, 11% for PBNA, 41% for Latin America and 8% for APAC. However, it declined 5% for QFNA and 14% for AMESA.

Financials

The company ended second-quarter 2023 with cash and cash equivalents of $6,116 million, long-term debt of $36,008 million, and shareholders’ equity (excluding non-controlling interest) of $17,825 million.

Net cash provided by operating activities was $2,019 million as of Jun 17, 2023, compared with $1,881 million as of Jun 11, 2022.

Outlook

PepsiCo raised its revenue and earnings guidance for 2023. The company expects organic revenue growth of 10% for 2023 compared with the 8% rise mentioned earlier. It anticipates core constant-currency earnings per share growth of 12% from the year-ago period’s reported figure versus 9% growth stated earlier.

PEP expects currency headwinds to hurt revenues and core earnings per share by 2 percentage points in 2023, based on the current rates. The company expects a core effective tax rate of 20% for 2023.

Based on the above assumption, PepsiCo expects core earnings per share of $7.47 for 2023 compared with the $7.27 per share mentioned earlier. This suggests a 10% increase from the core EPS of $6.79 reported in 2022 compared with 7% growth expected earlier.

PepsiCo has been committed to rewarding shareholders through dividends and share buybacks. It expects to return a value worth $7.7 billion in 2023, including $6.7 billion of dividends. Additionally, the company plans to repurchase shares worth $1.0 billion in 2023.

Don’t Miss These Better-Ranked Stocks

We highlighted some better-ranked stocks from the beverages space, namely The Duckhorn Portfolio NAPA, Molson Coors TAP and Coca-Cola FEMSA KOF.

Duckhorn currently sports a Zacks Rank #1 (Strong Buy). NAPA has a trailing four-quarter earnings surprise of 14.2%, on average. Shares of NAPA have declined 14.7% in the past three months. You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Duckhorn’s current financial-year sales and earnings suggests growth of 8.3% and 4.8%, respectively, from the year-ago period's reported figures. NAPA has an expected EPS growth rate of 6.6% for three-five years.

Molson Coors currently carries a Zacks Rank #2 (Buy). The company has an expected EPS growth rate of 4.3% for three to five years. Shares of TAP have rallied 17.7% in the past three months.

The Zacks Consensus Estimate for Molson Coors’ sales and earnings per share for the current financial year suggests growth of 5.3% and 10.2%, respectively, from the year-ago period’s reported figures. TAP has a trailing four-quarter earnings surprise of 32.1%, on average.

Coca-Cola FEMSA has a trailing four-quarter earnings surprise of 33.8%, on average. It currently carries a Zacks Rank #2. Shares of KOF have declined 1% in the past three months.

The Zacks Consensus Estimate for Coca-Cola FEMSA’s current financial-year sales and earnings suggests growth of 19.5% and 14.6%, respectively, from the year-ago period's reported figures. KOF has an expected EPS growth rate of 13.5% for three to five years.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PepsiCo, Inc. (PEP) : Free Stock Analysis Report

Molson Coors Beverage Company (TAP) : Free Stock Analysis Report

Coca Cola Femsa S.A.B. de C.V. (KOF) : Free Stock Analysis Report

The Duckhorn Portfolio, Inc. (NAPA) : Free Stock Analysis Report