Perella Weinberg Partners Reports Modest Revenue Growth Amid Market Challenges

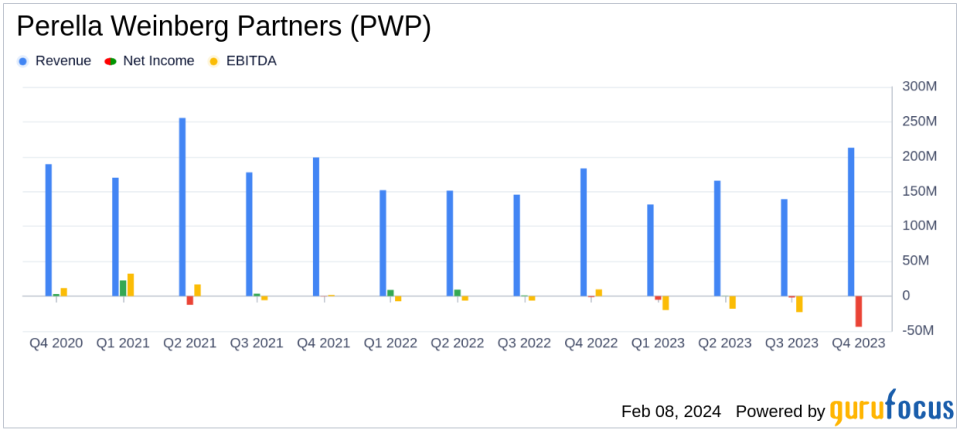

Annual Revenue: Increased to $649 million, up 3% year-over-year.

Adjusted Pre-tax Income: Reached $55 million for the full year, despite a GAAP pre-tax loss of $(113) million.

Quarterly Performance: Fourth-quarter revenues rose 16% to $213 million compared to the same period last year.

Adjusted EPS: Reported at $0.45 for the full year and $0.08 for the fourth quarter.

Capital Management: Strong liquidity with $338 million in cash and short-term investments, and no debt.

Shareholder Returns: Repurchased 4 million shares and returned $65 million to equity holders in 2023.

On February 8, 2024, Perella Weinberg Partners (NASDAQ:PWP) released its 8-K filing, detailing its financial results for the full year and fourth quarter of 2023. PWP, an independent investment banking firm known for its expertise in mergers, acquisitions, and corporate divestitures, reported a year of revenue growth and strategic talent investments despite a challenging market environment.

Fiscal Year 2023 Highlights

For the full year, PWP's revenues increased by 3% to $649 million, driven by a robust mergers and acquisitions market. Adjusted pre-tax income stood at $55 million, contrasting with a GAAP pre-tax loss of $(113) million, which included business realignment costs and other non-recurring expenses. The firm's adjusted EPS was $0.45, while the GAAP diluted EPS was $(1.33).

The fourth quarter saw a notable 16% increase in revenues to $213 million compared to the same quarter in the previous year. This growth was attributed to significant restructuring fees and increased mergers and acquisitions activity. Adjusted pre-tax income for the quarter was $11 million, with a GAAP pre-tax loss of $(44) million. Adjusted EPS for the quarter was reported at $0.08, and GAAP diluted EPS at $(0.49).

Strategic Talent Investment and Capital Management

PWP continued to expand its client coverage footprint and accelerate growth by adding seven partners and seven managing directors in 2023. The firm's balance sheet remained robust with $338 million in cash and short-term investments, and no outstanding debt. PWP also demonstrated its commitment to shareholder returns by repurchasing 4 million shares and equivalents and returning a total of $65 million to equity holders throughout the year. A quarterly dividend of $0.07 per share was declared, reflecting the firm's stable financial position.

Operational and Financial Challenges

Despite the revenue growth, PWP faced increased operating expenses, with GAAP total compensation and benefits reaching $608.9 million for the year, up from $545.5 million in the prior year. Adjusted total compensation and benefits also rose to $454.6 million due to a higher compensation margin on increased revenues. Non-compensation expenses saw a rise, primarily due to legal spend, travel, technology investments, and higher rent and occupancy costs related to office renovations and relocations.

CEO Andrew Bednar commented on the results, stating, "We are pleased with our 2023 financial performance, having delivered year-over-year revenue growth in challenging market conditions, demonstrating that we are a trusted and valued partner to our clients in any environment." This sentiment underscores the firm's resilience and adaptability in the face of market volatility.

Looking Ahead

Entering 2024, PWP is poised with positive momentum, as evidenced by a growing transaction backlog and its leading role in recently announced transactions. The firm's strategic investments in talent and prudent capital management, coupled with its strong advisory capabilities, position it well to navigate the complexities of the capital markets and continue delivering value to its clients and shareholders.

For more detailed financial information and the full earnings release, please refer to the 8-K filing.

Explore the complete 8-K earnings release (here) from Perella Weinberg Partners for further details.

This article first appeared on GuruFocus.