Perficient Inc (PRFT) Reports Decline in Q4 and Full Year 2023 Earnings

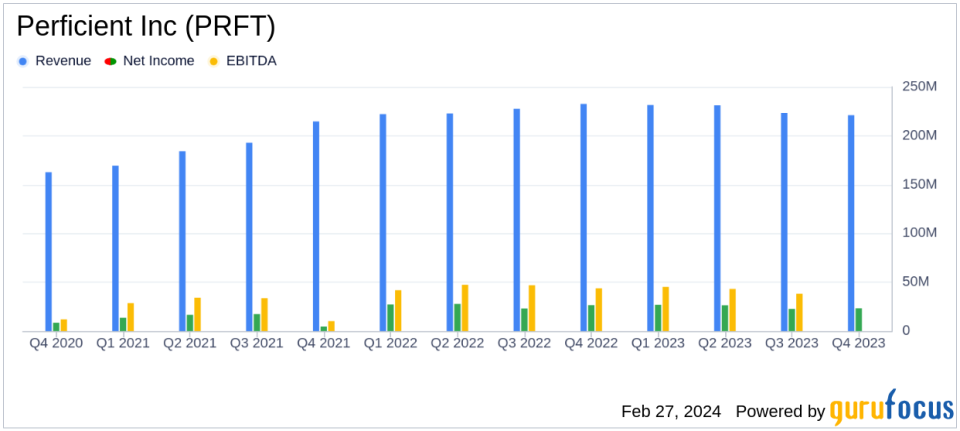

Revenue: Q4 revenue decreased by 5% to $221 million, while full-year revenue slightly increased to $907 million.

Net Income: Q4 net income fell by 12% to $23.2 million, with a full-year decrease of 5% to $98.9 million.

Earnings Per Share: GAAP EPS for Q4 decreased by 12% to $0.65, and full-year GAAP EPS decreased by 5% to $2.76.

Adjusted EBITDA: Q4 adjusted EBITDA decreased by 14% to $46.7 million, and full-year adjusted EBITDA decreased by 7% to $190.7 million.

Business Outlook: Perficient expects Q1 2024 revenue to be between $212 million and $218 million, with GAAP EPS between $0.31 and $0.35.

On February 27, 2024, Perficient Inc (NASDAQ:PRFT), a leading global digital consultancy, announced its financial results for the fourth quarter and full year ended December 31, 2023. The company, which specializes in digital experience, business optimization, and IT solutions, reported a decline in both quarterly and annual earnings despite maintaining stable revenue year-over-year. The full details of the financial results can be found in the company's 8-K filing.

Financial Performance Analysis

Perficient's Q4 revenues saw a 5% decrease to $221 million from the previous year's $233 million. The full-year revenues showed a marginal increase to $907 million from $905 million in 2022. However, net income for Q4 decreased by 12% to $23.2 million, and the full-year net income also saw a reduction of 5% to $98.9 million. This decline in profitability was reflected in the earnings per share (EPS), with Q4 GAAP EPS down by 12% to $0.65 and full-year GAAP EPS decreasing by 5% to $2.76.

The company's adjusted EBITDA, a non-GAAP measure, also experienced a downturn, with a 14% decrease in Q4 to $46.7 million and a 7% decrease for the full year to $190.7 million. These figures indicate challenges in maintaining profitability despite relatively stable revenue streams.

Strategic Developments and Outlook

Perficient's President and CEO, Tom Hogan, commented on the results, stating,

Solid fourth quarter bookings have us positioned for a return to growth, particularly in the second half of 2024."

He also highlighted the company's global expansion with the recent acquisition of SMEDIX, Inc., which strengthens Perficient's presence in Europe.

The company's outlook for the first quarter of 2024 projects revenues between $212 million and $218 million, with GAAP EPS expected to be in the range of $0.31 to $0.35. For the full year 2024, revenue guidance is set between $925 million and $965 million, with GAAP EPS guidance ranging from $2.64 to $2.77 and adjusted EPS expected to be between $4.05 and $4.20.

Balance Sheet and Cash Flow Highlights

Perficient ended the year with $128.9 million in cash, cash equivalents, and restricted cash, a significant increase from $30.1 million at the end of 2022. The balance sheet also shows a healthy position with total assets of $1.06 billion and total liabilities of $534 million as of December 31, 2023. Net cash provided by operating activities for the year was $142.9 million.

The company's financial achievements and strategic initiatives are crucial for its position in the competitive software industry. The ability to adapt to market demands and expand its global footprint while managing profitability is vital for Perficient's long-term success. Investors and stakeholders will be closely monitoring the company's performance in the coming quarters to gauge the effectiveness of its growth strategies and operational efficiency.

For a more detailed analysis of Perficient Inc (NASDAQ:PRFT)'s financial results, including income statements, balance sheets, and cash flow statements, please visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Perficient Inc for further details.

This article first appeared on GuruFocus.