Perficient's (NASDAQ:PRFT) earnings growth rate lags the 17% CAGR delivered to shareholders

Perficient, Inc. (NASDAQ:PRFT) shareholders might be concerned after seeing the share price drop 14% in the last month. But that scarcely detracts from the really solid long term returns generated by the company over five years. Indeed, the share price is up an impressive 120% in that time. We think it's more important to dwell on the long term returns than the short term returns. The more important question is whether the stock is too cheap or too expensive today.

Since the long term performance has been good but there's been a recent pullback of 4.4%, let's check if the fundamentals match the share price.

See our latest analysis for Perficient

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

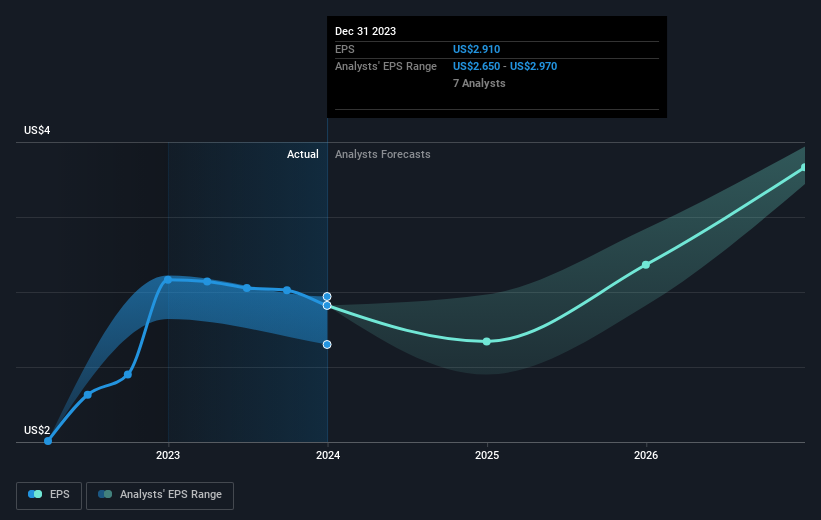

Over half a decade, Perficient managed to grow its earnings per share at 30% a year. The EPS growth is more impressive than the yearly share price gain of 17% over the same period. So one could conclude that the broader market has become more cautious towards the stock.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

Investors in Perficient had a tough year, with a total loss of 13%, against a market gain of about 30%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 17%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Perficient is showing 2 warning signs in our investment analysis , you should know about...

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.