Perimeter Solutions SA (PRM) Faces Mixed Financial Outcomes in Q4 and Full-Year 2023 Results

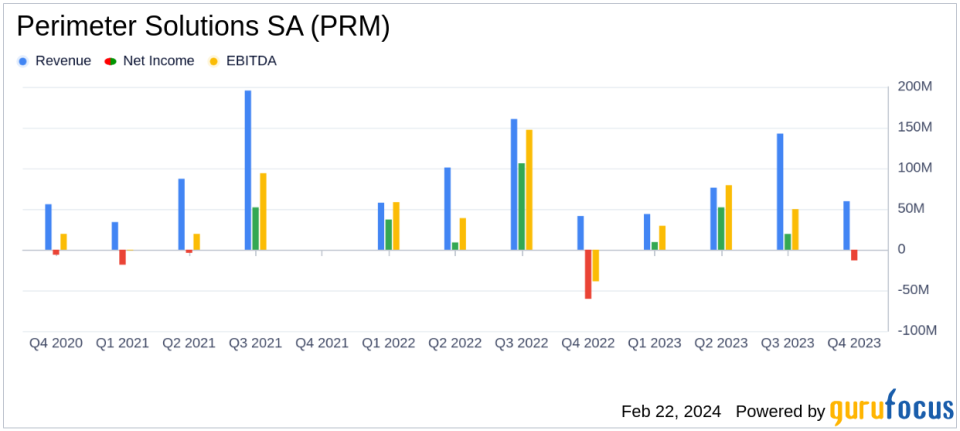

Net Sales: Full-year net sales declined by 11% to $322.1 million, while Q4 saw a 44% increase to $59.5 million.

Net Income: Full-year net income decreased to $67.5 million, with Q4 posting a net loss of $13.2 million.

Adjusted EBITDA: Full-year adjusted EBITDA fell 23% to $96.8 million, but Q4 adjusted EBITDA surged 433% to $11.2 million.

Share Repurchase: PRM repurchased 6.3 million shares in Q4 and authorized a new $100M repurchase program.

Segment Performance: Fire Safety sales remained stable, while Specialty Products sales decreased significantly.

On February 22, 2024, Perimeter Solutions SA (NYSE:PRM), a global leader in firefighting products and specialty chemicals, disclosed its financial results for the fourth quarter and full-year 2023 through its 8-K filing. The company, which operates primarily in the United States, has two business segments: Fire Safety and Specialty Products.

Financial Performance Overview

Perimeter Solutions reported a full-year net sales decrease of 11% to $322.1 million compared to the previous year. The Fire Safety segment's sales were nearly flat at $225.6 million, despite a significant reduction in U.S. acres burned, demonstrating the segment's resilience. However, the Specialty Products segment experienced a 28% decrease in sales to $96.6 million, largely due to inventory destocking activities throughout the year.

Net income for the year fell to $67.5 million, or $0.41 per diluted share, down from $91.8 million, or $0.52 per diluted share in the previous year. Adjusted EBITDA also saw a decline, dropping 23% to $96.8 million. Within the segments, Fire Safety Adjusted EBITDA decreased marginally by 1% to $76.2 million, while Specialty Products Adjusted EBITDA plummeted by 57% to $20.6 million.

The fourth quarter painted a different picture, with net sales increasing by 44% to $59.5 million. Fire Safety sales soared by 81% to $35.4 million, while Specialty Products sales grew by 11% to $24.1 million. Despite the sales uptick, the quarter ended with a net loss of $13.2 million, or $(0.09) per diluted share, improving from a loss of $60.4 million, or $(0.38) per diluted share, in the prior year quarter. Adjusted EBITDA for the quarter was significantly better, increasing by 433% to $11.2 million.

Strategic Share Repurchase and Financial Stability

In the fourth quarter, PRM repurchased 6.3 million shares at an average price of $4.21, reflecting the company's confidence in its financial stability and future prospects. Additionally, a new $100 million share repurchase program has been authorized, signaling a commitment to delivering value to shareholders.

Balance Sheet and Cash Flow Insights

As of December 31, 2023, Perimeter Solutions reported cash and cash equivalents of $47.3 million, a decrease from $126.8 million at the end of the previous year. The company's balance sheet remains robust with total assets of $2.3 billion and shareholders' equity of $1.15 billion.

The company's cash flows from operating activities were essentially breakeven at $193,000 for the year, a stark contrast to the $40.2 million used in the previous year. This demonstrates a significant improvement in operational cash management despite the challenging financial year.

Management Commentary

"2023 Fire Safety Revenue, Adjusted EBITDA, and Adjusted EBITDA margin roughly flat versus 2022, despite an almost 50% reduction in U.S. acres burned ex-Alaska."

"2023 Specialty Products financial results impacted by inventory destock activity throughout the year."

Conclusion and Forward Outlook

Perimeter Solutions' mixed financial results for 2023 reflect the resilience of its Fire Safety segment and the challenges faced by the Specialty Products segment. The company's strategic share repurchases and the authorization of a new repurchase program underscore its commitment to shareholder value. Investors and stakeholders will be watching closely to see how Perimeter Solutions navigates the market in 2024, balancing the need for operational efficiency with growth opportunities.

For a more detailed analysis of Perimeter Solutions SA's financial results and future outlook, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Perimeter Solutions SA for further details.

This article first appeared on GuruFocus.