Perrigo (PRGO) Beats on Q2 Earnings & Sales, Reiterates '23 View

Perrigo Company plc PRGO reported adjusted earnings of 63 cents per share in second-quarter 2023, beating the Zacks Consensus Estimate of 54 cents. Earnings were up 46.5% year over year. The upside can be attributed to favorable discrete tax benefits from the resolution of various tax matters and lower operating expenses incurred by the company during the quarter.

Net sales increased 6.4% year over year to $1.19 billion, surpassing the Zacks Consensus Estimate of $1.18 billion. Excluding the negative currency impact, sales rose 6.6%. The upside was driven by strategic pricing actions undertaken by management during the quarter, sales from the newly-acquired HRA Pharma and the acquisition of the U.S. & Canadian Good Start infant formula brand. Unfavorable currency movements partially offset these. Organic net sales (excluding the effects of acquisitions and divestitures and the impact of currency) were up 0.8% year over year.

Shares of Perrigo were up 1.3% in pre-market trading on Aug 8, likely due to the better-than-expected earnings results. In the year so far, the stock has gained 8.0% compared with the industry’s 0.5% growth.

Image Source: Zacks Investment Research

Segment Discussion

Perrigo reports its results under the following segments — Consumer Self Care Americas (“CSCA”) and Consumer Self Care International (“CSCI”). Per management, the company gained market share in both business segments during the quarter compared with the year-ago period’s levels.

CSCA: The segment’s net sales in the second quarter of 2023 came in at $750.8 million, up 3.1% year over year, driven by acquisitions and strategic price increases. However, this upside was partially offset by purposeful SKU prioritization actions to enhance margins as part of the company's Supply Chain Reinvention Program undertaken last year.

CSCI: The segment reported net sales of $442.4 million, up 12.4% from the year-ago period’s levels. At constant-currency (cc) rates, sales were up 12.8% year over year. Organically, sales increased 7.1%. Segment revenues benefited from the higher sales of HRA Pharma brands and strategic pricing actions. An unfavorable currency movement negatively impacted sales.

2023 Guidance

Perrigo reiterated its financial guidance for 2023. Management expects to report net sales growth in the range of 7-11%. Adjusted earnings per share are expected to be between $2.50 and $2.70. The adjusted tax rate is expected to be around 19.5%, while the company expects to record interest expenses of about $180 million.

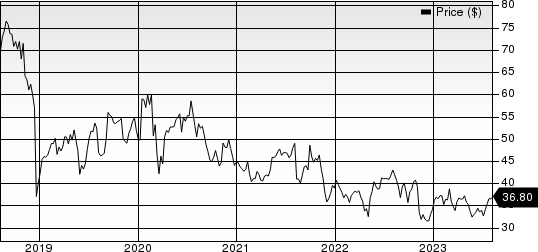

Perrigo Company plc Price

Perrigo Company plc price | Perrigo Company plc Quote

Zacks Rank & Stocks to Consider

Perrigo currently has a Zacks Rank #3 (Hold). Some better-ranked stocks in the overall healthcare sector include Caribou Biosciences CRBU, Johnson & Johnson JNJ and Novo Nordisk NVO, carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Caribou Biosciences’ loss estimates for 2023 have narrowed from $1.91 to $1.63 per share in the past 30 days. During the same period, the loss estimates per share for 2024 have narrowed from $2.60 to $1.72. Year to date, Caribou Biosciences’ stock has risen 4.8%.

Caribou Biosciences beat earnings estimates in three of the last four quarters while missing the mark on one occasion. On average, the company’s earnings witnessed a negative earnings surprise of 1.36%. In the last reported quarter, CRBU delivered an earnings surprise of 4.17%.

In the past 30 days, estimates for J&J’s 2023 earnings per share have increased from $10.66 to $10.74. During the same period, the earnings estimates per share for 2024 have risen from $11.01 to $11.29. Shares of J&J are down 2.0% in the year-to-date period.

Earnings of J&J beat estimates in each of the last four quarters, witnessing an average earnings surprise of 5.58%. In the last reported quarter, J&J’s earnings beat estimates by 7.28%.

In the past 30 days, the estimates for Novo Nordisk’s 2023 and 2024 EPS have increased from $5.07 to $5.27 and $5.95 to $6.10, respectively. Shares of Novo Nordisk are up 19.2% in the year-to-date period.

Earnings of Novo Nordisk beat estimates in two of the last four quarters, met the mark on one occasion and missed the mark on another. On an average, the company witnessed an average earnings surprise of 0.35%. In the last reported quarter, Novo Nordisk’s earnings met our estimates.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Novo Nordisk A/S (NVO) : Free Stock Analysis Report

Perrigo Company plc (PRGO) : Free Stock Analysis Report

Caribou Biosciences, Inc. (CRBU) : Free Stock Analysis Report