Perrigo (PRGO) to Report Q3 Earnings: What's in the Cards?

Perrigo Company plc PRGO is scheduled to report third-quarter 2023 results on Nov 7, before the opening bell. In the last reported quarter, the company posted an earnings surprise of 16.67%.

Let’s see how things have shaped up for this announcement.

Factors at Play

During the third quarter, the performance of Perrigo’s Consumer Self Care Americas (“CSCA”) and Consumer Self Care International (“CSCI”) segments is expected to have been aided by products added through its HRA Pharma acquisition. Significant sales growth of new products is likely to have boosted sales in the soon-to-be-reported quarter. Currency movements and loss of sales following the divestiture of Latin American businesses are likely to have affected the company’s ex-U.S. sales.

The Zacks Consensus Estimate and our model estimate for CSCA sales stand at $776 million and $774 million, respectively. For sales in the CSCI segment, the Zacks Consensus Estimate and our model estimate are both pegged at $419 million.

Higher demand for infant formula in the United States is also likely to have boosted the top line in the to-be-reported quarter.

Perrigo reported higher net price realization for its products through strategic price increases in recent quarters. The improving price trend will likely be reflected in third-quarter sales, benefiting the top line.

We expect macroeconomic factors like cost headwinds (including the higher cost of goods sold), the rising cost of capital and supply chain disruptionsin certain parts of the world amid the Russia-Ukraine and Israel-Hamas wars to have dented operating margins.

Investors are likely to ask questions about potential product launches this year. We also expect management to provide an update on the expected impact of macroeconomic pressures in 2023.

Earnings Surprise History

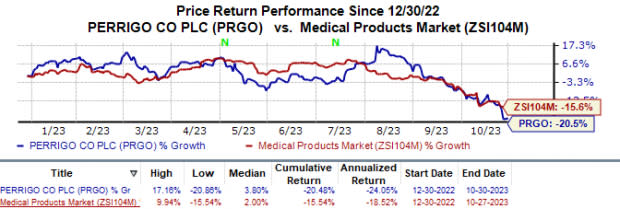

Perrigo’s shares have lost 20.5% year to date compared with the industry’s 15.5% fall.

Image Source: Zacks Investment Research

Perrigo’s earnings performance has been decent over the trailing four quarters. The company’s earnings beat estimates in three of the last four quarters and missed the mark on one occasion, registering an earnings surprise of 3.95% on average.

Perrigo Company plc Price and EPS Surprise

Perrigo Company plc price-eps-surprise | Perrigo Company plc Quote

Earnings Whispers

Our proven model does not predict an earnings beat for Perrigo this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. That is not thecase here, as you will see below. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

Earnings ESP: Perrigo has an Earnings ESP of 0.00% as both the Most Accurate Estimate and Zacks Consensus Estimate are pegged at 65 cents.

Zacks Rank: Perrigo currently carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Stocks to Consider

Here are a few stocks worth considering from the healthcare space, as our model shows that these have the right combination of elements to beat on earnings this reporting cycle.

Dynavax Technologies DVAX has an Earnings ESP of +700.00% and a Zacks Rank #1.

In the year so far, Dynavax’s stock has gained 35.9%. Dynavax’s earnings beat estimates in two of the last four quarters while missing the mark on other two occasions, witnessing an average earnings surprise of 25.78%. Dynavaxis scheduled to release second-quarter results on Nov 2, after market close.

Ligand Pharmaceuticals LGND has an Earnings ESP of +2.94% and a Zacks Rank #1.

Ligand Pharmaceuticals’ stock has lost 23.9% in the year-to-date period. LGND beat earnings estimates in three of the last four quarters while missing the mark on one occasion. Ligand has delivered an earnings surprise of 52.47% on average. Ligand is scheduled to report its Q3 earnings on Nov 8, after the closing bell.

Acadia Pharmaceuticals ACAD has an Earnings ESP of +6.76% and a Zacks Rank #2.

Shares of Acadia Pharmaceuticals have gained 39.6% in the year-to-date period. Earnings of ACAD beat estimates in two of the last four quarters while missing the mark on other two occasions, witnessing an average earnings surprise of 20.33%. Acadia is scheduled to release third-quarter results on Nov 2, after market closes.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dynavax Technologies Corporation (DVAX) : Free Stock Analysis Report

Perrigo Company plc (PRGO) : Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

ACADIA Pharmaceuticals Inc. (ACAD) : Free Stock Analysis Report