Petco (WOOF) Q3 Earnings Miss Estimates, Sales Decline Y/Y

Petco Health and Wellness Company, Inc. WOOF delivered drab third-quarter fiscal 2023 results, as the top and bottom lines fell short of the Zacks Consensus Estimate. This fully integrated health and wellness company of pets registered year-over-year declines in net sales and earnings.

Petco Health and Wellness Company, Inc. Price, Consensus and EPS Surprise

Petco Health and Wellness Company, Inc. price-consensus-eps-surprise-chart | Petco Health and Wellness Company, Inc. Quote

Operational Information

Petco's fiscal third-quarter results lagged expectations, prompting a strategic response to address the challenging consumer environment. The company is taking several key actions to improve business performance.

This includes introducing the largest national cat and dog food value brands to appeal to a broader range of pet parents, while aiming to boost profits over time. Additionally, Petco is placing a strong emphasis on managing costs and capital more efficiently.

To further enhance its market position, the company is focusing on expanding services and omni-channel capabilities, which blend physical and digital shopping experiences. This is complemented by an industry-leading assortment of premium products and the dedication of Petco's staff. These efforts are part of a larger plan to capitalize on the long-term growth trends in the pet care category and deepen connections with pet parents, positioning Petco for success despite the current challenges.

Additionally, the company plans to present an operational reset for the business aimed at enhancing profitability and strengthening its competitive stance. This will involve providing an update on the cost action plan, which was introduced in the fiscal second quarter.

The goal of this plan is to achieve annualized gross run-rate cost savings of $150 million by the end of fiscal 2025, with these savings coming from various areas, including merchandise, supply chain, and general and administrative expenses. Furthermore, the company maintains its expectation of realizing $40 million in savings in the first year of this plan.

Image Source: Zacks Investment Research

Q3 in Detail

The Zacks Rank #5 (Strongly Sell) company posted an adjusted loss from continuing operations of 5 cents per share in the third quarter of fiscal 2023, down from adjusted earnings of 11 cents in the year-ago quarter. The metric lagged the Zacks Consensus Estimate of earnings of 2 cents per share.

Net sales of $1.49 billion dipped 0.5% year over year. Also, the top line missed the Zacks Consensus Estimate of $1.51 billion. Comparable sales remained flat year over year.

The company experienced a 1.8% year-over-year increase in its consumables business. Additionally, there was a 15% rise in the services and other business segment over the same period. However, this growth was partially counterbalanced by an 8.8% year-over-year decline in the supplies and companion animal business.

Gross profit decreased 8% year over year to $550 million. We note that the gross margin declined 300 basis points (bps) to 36.8% from the prior-year period.

Selling, general and administrative expenses increased 1.8% to $559.6 million. As a percentage of net sales, selling, general and administrative expenses deleveraged 90 bps to 37.5% in the third quarter of fiscal 2023.

Adjusted EBITDA came in at $72.2 million compared with $120.2 million in the year-ago period. We note that the adjusted EBITDA margin contracted 320 bps to 4.8% in the fiscal third quarter.

Other Financials

Petco ended the quarter with cash and cash equivalents of $139.8 million, and a total stockholders’ equity of $1.19 billion. In the third quarter of fiscal 2023, Petco made a principal payment of $15 million on its term loan. This payment brought the total principal amount paid by the company in the nine months to $75 million.

FY23 Outlook

For fiscal 2023, Petco offered its financial guidance. The company anticipates net revenue between $6.150 billion and $6.275 billion, with an adjusted EBITDA of $400 million.

Adjusted earnings per share (EPS) are expected to be 8 cents per share. Capital expenditure for the year is projected to be $215 -$225 million.

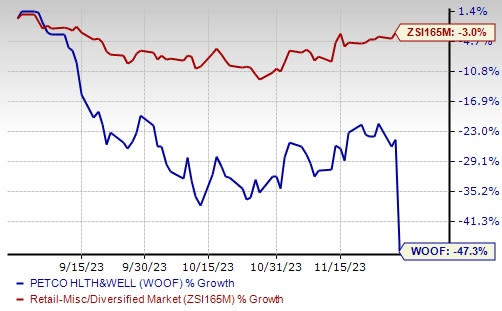

This pet wellness retailer’s shares have lost 47.3% in the past three months compared with the industry’s 3% decline.

3 Promising Stocks

A few better-ranked stocks are Ross Stores Inc. ROST, Target Corporation TGT and Ollie's Bargain Outlet Holdings OLLI.

Ross Stores is an off-price retailer of apparel and home accessories. It currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Ross Stores’ current fiscal-year sales and EPS suggests growth of 7.4% and 22.2%, respectively, from the year-ago reported figures. ROST has a trailing four-quarter earnings surprise of 7.8%, on average.

Target has evolved from just being a pure brick-and-mortar retailer to an omni-channel entity. It has a Zacks Rank #2 at present.

The Zacks Consensus Estimate for Target’s current fiscal-year earnings suggests growth of 38.5% from the year-ago reported number. TGT has a trailing four-quarter earnings surprise of 30.8%, on average.

Ollie's is a value retailer of brand-name merchandise at drastically reduced prices. It has a Zacks Rank #2 at present.

The Zacks Consensus Estimate for Ollie's current fiscal-year earnings and sales indicates growth of 68.5% and 14.2% from the year-ago period’s reported figures. OLLI has a trailing four-quarter average earnings surprise of 1.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Target Corporation (TGT) : Free Stock Analysis Report

Ross Stores, Inc. (ROST) : Free Stock Analysis Report

Petco Health and Wellness Company, Inc. (WOOF) : Free Stock Analysis Report

Ollie's Bargain Outlet Holdings, Inc. (OLLI) : Free Stock Analysis Report