Petco's (NASDAQ:WOOF) Q4: Beats On Revenue But

Pet-focused retailer Petco (NASDAQ:WOOF) announced better-than-expected results in Q4 FY2023, with revenue up 6.1% year on year to $1.67 billion. On the other hand, next quarter's revenue guidance of $1.5 billion was less impressive, coming in 3.3% below analysts' estimates. It made a non-GAAP profit of $0.02 per share, down from its profit of $0.20 per share in the same quarter last year.

Is now the time to buy Petco? Find out by accessing our full research report, it's free.

Petco (WOOF) Q4 FY2023 Highlights:

Revenue: $1.67 billion vs analyst estimates of $1.63 billion (2.6% beat)

EPS (non-GAAP): $0.02 vs analyst expectations of $0.02 (roughly in line)

Revenue Guidance for Q1 2024 is $1.5 billion at the midpoint, below analyst estimates of $1.55 billion

EPS (non-GAAP) Guidance for Q1 2024 is -$0.06 at the midpoint, below analyst estimates of -$0.02

Gross Margin (GAAP): 36.2%, down from 39.3% in the same quarter last year

Free Cash Flow was -$2.04 million, down from $70.59 million in the same quarter last year

Same-Store Sales were down 0.9% year on year (beat vs. expectations of down 2.1% year on year)

Market Capitalization: $687.3 million

Historically known for its window displays of pets for sale or adoption, Petco (NASDAQ:WOOF) is a specialty retailer of pet food and supplies as well as a provider of services such as wellness checks and grooming.

Specialty Retail

Some retailers try to sell everything under the sun, while others—appropriately called Specialty Retailers—focus on selling a narrow category and aiming to be exceptional at it. Whether it’s eyeglasses, sporting goods, or beauty and cosmetics, these stores win with depth of product in their category as well as in-store expertise and guidance for shoppers who need it. E-commerce competition exists and waning retail foot traffic impacts these retailers, but the magnitude of the headwinds depends on what they sell and what extra value they provide in their stores.

Sales Growth

Petco is larger than most consumer retail companies and benefits from economies of scale, giving it an edge over its competitors.

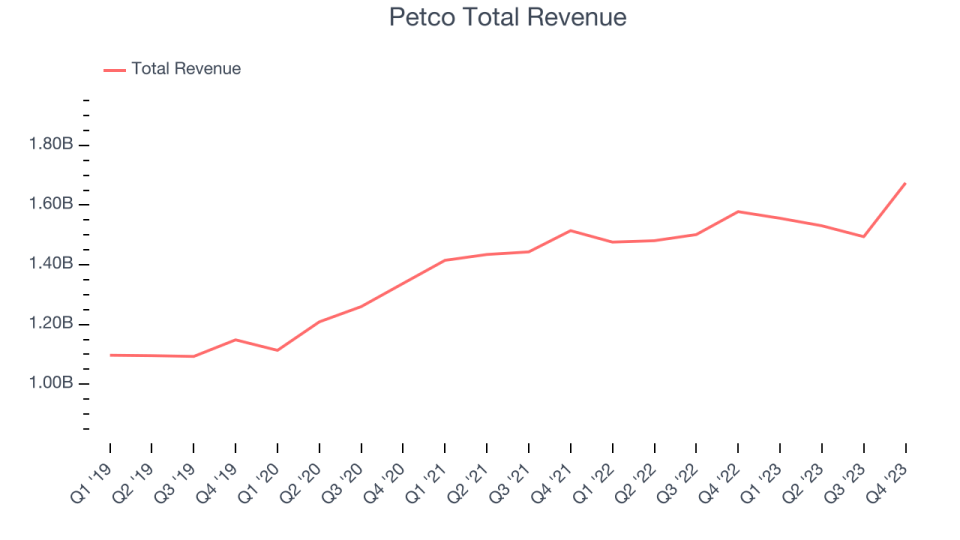

As you can see below, the company's annualized revenue growth rate of 9% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was mediocre despite closing stores, implying that growth was driven by higher sales at existing, established stores.

This quarter, Petco reported solid year-on-year revenue growth of 6.1%, and its $1.67 billion in revenue outperformed Wall Street's estimates by 2.6%. The company is guiding for a 3.6% year-on-year revenue decline next quarter to $1.5 billion, a reversal from the 5.4% year-on-year increase it recorded in the same quarter last year. Looking ahead, Wall Street expects revenue to decline 1% over the next 12 months, a deceleration from this quarter.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Same-Store Sales

Petco's demand within its existing stores has generally risen over the last two years but lagged behind the broader consumer retail sector. On average, the company's same-store sales have grown by 3.2% year on year. Given its declining store count over the same period, this performance stems from higher e-commerce sales or increased foot traffic at existing stores, which is sometimes a side effect of reducing the total number of stores.

In the latest quarter, Petco's year on year same-store sales were flat. By the company's standards, this growth was a meaningful deceleration from the 5.3% year-on-year increase it posted 12 months ago. We'll be watching Petco closely to see if it can reaccelerate growth.

Key Takeaways from Petco's Q4 Results

We enjoyed seeing Petco exceed analysts' revenue expectations this quarter. On the other hand, its earnings forecast for next quarter missed analysts' expectations and its revenue guidance for next quarter missed Wall Street's estimates. Overall, this was a mixed quarter for Petco. The stock is up 3.9% after reporting and currently trades at $2.66 per share.

So should you invest in Petco right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.