Petrobras (PBR) Stock Climbs 8.5% Following Q2 Earnings Beat

The stock of Brazil's state-run energy giant Petroleo Brasileiro S.A., or Petrobras PBR has gained around 8.5% since its second-quarter earnings announcement on Aug 5. Apart from top and bottom-line beats, investors were encouraged by its sharp debt reduction and turnaround from the year-ago loss.

What Did Petrobras’ Earnings Unveil?

Petrobras announced second-quarter earnings per ADS of $1.18, beating the Zacks Consensus Estimate of 92 cents and turning around from the year-ago loss of 38 cents. The outperformance can be attributed to the rally in oil prices, strong downstream results and favorable currency effects.

Recurring net income, which strips one-time items, came in at $7,717 million against a loss of $2,536 million a year earlier. Petrobras’ adjusted EBITDA rose to $11,750 million from $4,785 million a year ago.

Petrobras, whose board approved early distribution of dividends, reported revenues of $20,982 million that overshot the Zacks Consensus Estimate of $19,169 and skyrocketed from the year-earlier sales of $9,481 million.

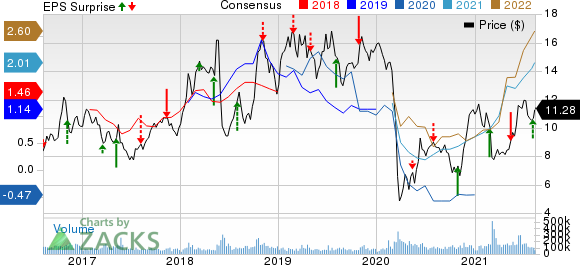

Petroleo Brasileiro S.A. Petrobras Price, Consensus and EPS Surprise

Petroleo Brasileiro S.A. Petrobras price-consensus-eps-surprise-chart | Petroleo Brasileiro S.A. Petrobras Quote

Coming back to earnings, let's take a deeper look at the recent performances of Petrobras’ two main segments: Upstream (Exploration & Production) and Downstream (or Refining, Transportation and Marketing).

Upstream: The Rio de Janeiro-headquartered company’s average oil and gas production during the second quarter reached 2,796 thousand barrels of oil equivalent per day (MBOE/d) — some 80% liquids — edging down from 2,802 MBOE/d in the same period of 2020. Compared with the year-ago quarter, Brazilian oil and natural gas production — constituting 98.5% of the overall output — remained essentially flat at 2,754 MBOE/d. The impact of the continued ramp-up of the P-68 platforms was offset by scheduled stoppages of the P-58 (Jubarte field).

In the April to June period, the average sales price of oil in Brazil soared 173.4% from the year-earlier period to $65.57 per barrel. The sharp increase in crude prices had a positive effect on the upstream segment’s earnings.

Overall, the segment’s revenues improved to $13,509 million in the quarter under review from $5,165 million in the year-ago period. As far as the bottom line is concerned, despite a slight uptick in pre-salt lifting costs (which rose 1.2% from the second quarter of 2020 to $4.22 per barrel), the upstream unit recorded a net income of $4,948 million jumping from the second-quarter 2020 profit of $1,187 million.

Downstream (or Refining, Transportation and Marketing): Revenues from the segment totaled $19,007 million, more than doubling from the year-ago figure of $8,261 million. Petrobras' downstream income of $1,673 million turned around from the year-ago loss of $566 million, primarily due to strong domestic fuel margins.

Costs

During the period, Petrobras’ sales, general and administrative expenses totaled $1,346 million, down 12.4% from the year-ago period. Selling expenses also declined from $1,246 million to $1,086 million. But rise in exploration costs, research and development expenses, together with $109 million in other expenses (compared to other income of $499 million a year ago) meant that total operating expenses rose to $1,929 million from $1,416 million in the second quarter of 2020. Nevertheless, the company’s operating income of $8,895 million was up significantly from $2,001 in the year-ago period on 121.3% higher sales revenues.

Financial Position

During the three months ended Jun 30, 2021, Petrobras’ capital investments and expenditures totaled $2,364 million, compared with $1,937 million in the prior-year quarter.

Importantly, the company generated positive free cash flow for the 25th consecutive quarter, with the metric coming at $9,329 million, surging from $3,012 million recorded in last year’s corresponding period.

At the end of the second quarter, Petrobras had a net debt of $53,262 million, decreasing from $71,222 million a year ago and $58,424 million as of Mar 31, 2021. The company ended the quarter with cash and cash equivalents of $9,822 million.

Meanwhile, Petrobras’ net-debt-to-trailing-12-months EBITDA ratio improved to 1.49 from 2.34 in the previous year.

Zacks Rank & Stock Pick

Petrobras currently carries a Zacks Rank #1 (Strong Buy).

You can see the complete list of today’s Zacks #1 Rank stocks here.

Apart from Petrobras, investors interested in the energy sector might look at Ovintiv OVV, EOG Resources EOG and APA Corporation APA, each presently flaunting a Zacks Rank of 1.

Ovintiv has an expected earnings growth rate of 1,177.14% for the current year.

EOG Resources has an expected earnings growth rate of 397.95% for the current year.

APA has an expected earnings growth rate of 389.81% for the current year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Petroleo Brasileiro S.A. Petrobras (PBR) : Free Stock Analysis Report

APA Corporation (APA) : Free Stock Analysis Report

EOG Resources, Inc. (EOG) : Free Stock Analysis Report

Ovintiv Inc. (OVV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research