PetroChina (PTR) 1H Earnings Surge on Soaring Fuel Prices

PetroChina Company Limited PTR reported first-half 2022 earnings of RMB 82,391 million or RMB 0.45 per diluted share, up from RMB 53,037 million or RMB 0.29 per diluted share a year earlier.

One of China’s big three oil giants, PetroChina, saw its earnings buoy on surging energy prices and strong fuel demand.

Further, China’s dominant oil and gas producer’s total revenues for the first six months of the year rose 34.9% from the 2021 level to RMB 1,614,621 million.

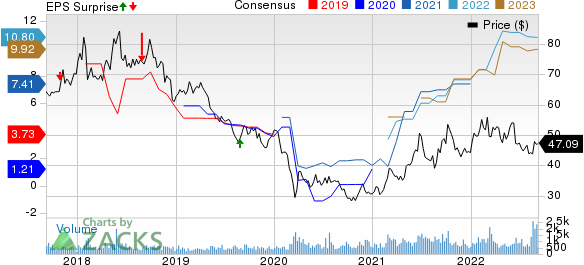

PetroChina Company Limited Price, Consensus and EPS Surprise

PetroChina Company Limited price-consensus-eps-surprise-chart | PetroChina Company Limited Quote

Segment Performance

Upstream: PetroChina posted higher upstream (or Exploration and Production) output during the six months ended Jun 30, 2022. Crude oil output — accounting for more than 53% of the total — rose 2% from the year-ago period to 451.9 million barrels. This was supported by the marketable natural gas output, which was up by 4.4% to 2,358.2 billion cubic feet.

As a result, PetroChina’s total production of oil and natural gas increased 3.1% year over year to 845 million barrels of oil equivalent. Of the total, domestic output contributed 763.4 million barrels of oil equivalent (up 3.9% year over year), or approximately 90%. While PTR’s production grew, it experienced 9.6% higher oil and gas lifting cost from the same period of last year.

The upstream segment posted an operating income of RMB 82,455 million, which soared from the year-ago profit of RMB 30,870 million. Apart from volume gains, this was due to a steep rise in oil prices. The average realized crude price during the first half of 2022 was $94.65 per barrel, 59.2% more than the year-ago period.

Downstream: The Beijing-based company’s Refining and Chemicals business recorded an operating profit of RMB 24,061 million compared to the year-earlier income of RMB 22,185 million. The improvement in the downstream division was due to higher product prices, wider refining margins and the increased output of high-value materials.

PetroChina’s refinery division processed 597.5 million barrels of crude oil during the six-month period, down 1.4% from 2021. The company produced 5,889 thousand tons of synthetic resin in the period (up 16.1% year over year), besides manufacturing 3,763 thousand tons of ethylene (up 23.7%). PTR also produced 51,510 thousand tons of gasoline, diesel and kerosene during the period compared with 54,906 thousand tons a year earlier.

Natural Gas Sales: An increase in natural gas purchase price and pipeline asset restructuring dented the Chinese behemoth’s segment earnings. These factors were partly offset by higher volume and increased realizations. Overall, the segment’s income fell to RMB 13,649 million in the period under review, from the year-earlier profit of RMB 36,888 million.

Marketing: In marketing operations, the state-owned Group sold 71,433 thousand tons of gasoline, diesel and kerosene during the half-year period, down 11.1% year over year. The lower volumes were more than offset by higher refined products’ prices, incremental international sales and a reduction in unit marketing costs. Consequently, PetroChina’s Marketing segment recorded a profit of RMB 8,522 million compared to the prior-year earnings of RMB 6,640 million.

Liquidity & Capital Expenditure

As of Jun 30, the Group’s cash balance was RMB 221,155 million and long-term debt amounted to RMB 238,728 million. PetroChina’s debt-to-capital ratio was 13.8%. Meanwhile, cash flow from operating activities was RMB 196,061 million (up 69%). Capital expenditure for the six months reached RMB 92,312 million, 25% more than the year-ago level.

Zacks Rank & Energy Picks

PetroChina currently carries a Zacks Rank #4 (Sell).

Some better-ranked players in the Energy sector are Murphy USA MUSA, PBF Energy PBF and Earthstone Energy ESTE, each carrying a Zacks Rank #1 (Strong Buy) currently.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Murphy USA: Murphy USA is valued at some $6.7 billion. The Zacks Consensus Estimate for MUSA’s 2022 earnings has been revised 21.9% upward over the past 60 days.

Murphy USA, headquartered in El Dorado, AR, delivered a 40.8% beat in Q2. MUSA shares have surged 89.2% in a year.

Earthstone Energy: ESTE beat the Zacks Consensus Estimate for earnings in each of the last four quarters. The company has a trailing four-quarter earnings surprise of roughly 27%, on average.

Earthstone Energy is valued at around $2.1 billion. ESTE has seen its shares gain 67% in a year.

PBF Energy: PBF Energy is valued at some $4.1 billion. The Zacks Consensus Estimate for PBF’s 2022 earnings has been revised 91.9% upward over the past 60 days.

PBF Energy, headquartered in Parsippany, NJ, has a trailing four-quarter earnings surprise of roughly 78%, on average. PBF shares have surged 233.8% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PetroChina Company Limited (PTR) : Free Stock Analysis Report

Murphy USA Inc. (MUSA) : Free Stock Analysis Report

PBF Energy Inc. (PBF) : Free Stock Analysis Report

Earthstone Energy, Inc. (ESTE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research